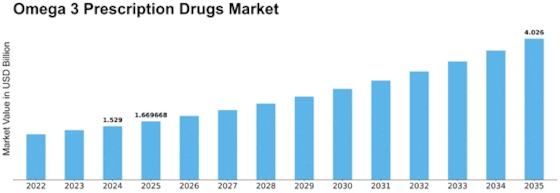

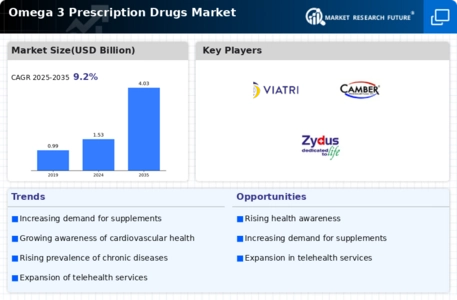

Omega 3 Prescription Drugs Size

Omega 3 Prescription Drugs Market Growth Projections and Opportunities

The Pharmaceutical Omega-3 Prescription Drugs Market has a great role in the healthcare industry where it provides prescription medicines utilizing omega-3 fatty acids. Omega-3 fatty acids are contained in fish oil and some marine sources and have been known to have cardiovascular potential as well as anti-inflammatory benefits. The market has experienced tremendous growth due to increase in knowledge of the health gains related with having omega-3 fatty acids included in prescription drugs for different diseases.

One of the major drivers behind the expansion of this market is that there is now a better appreciation of how omega-3 acids can benefit health: Several clinical studies suggest that regular intake could reduce triacylglycerol levels, reduce inflammation, and support overall heart function. In response, pharmaceutical companies have produced omegas rich drugs which help cardiovascular issues such as hypertriglyceridemia by providing patients with new choices on how they can manage their risks.

The needs for novel and easily administrable dosage forms led to the provision of pharmaceutical grade preparations containing omega 3 drugs. These prescribed agents provide an assured amount of administered pure essential fats according to regulatory standards. Availability of these pharmaceutical grade omega 3 drugs enables healthcare professionals make dependable prescriptions for those patients with specific cardiovascular requirements.

Geographically, Pharmaceutical Omega-3 Prescription Drugs Market showcases growth within regions highly burdened with cardiovascular diseases and actively involved in preventive care. North America, Europe, and Asia Pacific are major players within this market due to well-established pharmaceuticals industries presence robust healthcare facilities as well as increased awareness on need for omega 3 fatty acid consumption towards heart health.

A significant trend observed within this market is diversification into non-cardiac indications: Some research suggests possible therapeutic applications involving mental health or cognitive functioning while others address joint pain or chronic inflammatory conditions. Therefore, drugmakers develop medications involving omega-three fatty acids specifically targeting depression disorders like rheumatoid arthritis or even Crohn’s disease thereby expanding its intervention range.

The competitive landscape of the Pharmaceutical Omega-3 Prescription Drugs Market is characterized by the presence of pharmaceutical companies that are involved in research and development activities aimed at coming up with effective and well tolerated omega-3 formulations. These firms often perform clinical trials to ascertain safety as well as efficacy of their omega-3 prescription drugs used for a particular disease. Interactions with healthcare practitioners, academicians, amongst others continue to explore into the use of omega-3 fatty acids in medicine.

Leave a Comment