Market Trends

Key Emerging Trends in the Oil & Gas Engineering Services Market

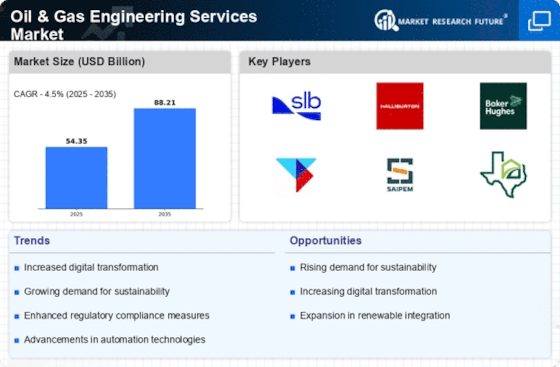

The oil and gas Engineering Services market is presenting excellent trends that replicate the dynamic nature of the industry. As of the modern checks, numerous elements are shaping the panorama of this sector. One prominent trend is the increasing recognition of sustainability and environmental concerns. With a worldwide push closer to purifying energy sources, oil and gasoline organizations are investing in engineering offerings that facilitate the development and integration of extra eco-friendly technologies. This includes the adoption of renewable energy solutions, carbon seizes and storage technology, and the optimization of existing procedures to minimize environmental impact. Furthermore, the market is witnessing a shift towards modular and scalable answers. In response to the volatility in oil prices and marketplace uncertainties, organizations are more and more adopting flexible engineering solutions that may be tailored to convert necessities without difficulty. Modular designs allow faster undertaking implementation, lessen production time, and provide a greater cost-effective technique. This trend is specifically relevant in the modern economic climate, where the potential to adjust to marketplace dynamics quickly is important for the survival and achievement of oil and gas projects. Collaboration and partnerships are also becoming necessary to the Oil and gas Engineering Services market. As tasks become more complicated and multidisciplinary, collaboration between engineering corporations, technology companies, and oil and fuel groups is important for successful mission execution. This fashion fosters innovation, knowledge sharing, and the pooling of know-how, which is important for the development of extra robust and comprehensive engineering answers. Moreover, geopolitical factors continue to influence marketplace trends inside the Oil and gas Engineering Services region. The industry is touchy with geopolitical activities, regulatory adjustments, and worldwide monetary conditions. Companies are closely monitoring geopolitical developments to count on capability influences on supply chains, assignment timelines, and funding choices. In the end, the Oil and gas Engineering Services market is evolving in response to a confluence of things. The enterprise is navigating the challenges posed by means of environmental issues, virtual transformation, modular solutions, collaborative efforts, and geopolitical impacts. As the sector continues to evolve to these tendencies, it is poised for a more resilient and sustainable future. Companies that include innovation, flexibility, and collaboration are probable to thrive in this dynamic and ever-changing landscape.

Leave a Comment