Top Industry Leaders in the Nutraceuticals Market

The competitive landscape of the nutraceuticals market is characterized by intense rivalry among key players, each vying for a significant share in this rapidly growing industry. Nutraceuticals, which include functional foods, dietary supplements, and herbal products with health benefits, have witnessed increased consumer awareness and demand for wellness-oriented products. The key players in this market employ diverse strategies to gain a competitive edge.

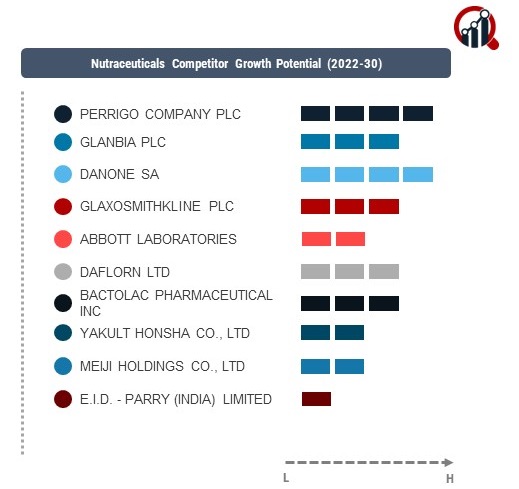

Several established companies dominate the nutraceuticals market, including

- Glanbia Plc

- Abbot Laboratories

- Perrigo Company Plc

- Danone SA

- GlaxoSmithKline Plc

- Daflorn Ltd

- Bactolac Pharmaceutical Inc

These industry giants focus on product innovation, strategic partnerships, and extensive distribution networks to maintain and expand their market presence. Strategies adopted by these players include investing heavily in research and development to introduce novel products with enhanced health benefits. Furthermore, strategic collaborations with healthcare professionals and fitness experts serve to endorse their products and strengthen their market position.

Market Share Analysis Factors:

Market share analysis is influenced by various factors, including product quality, brand reputation, pricing, and distribution channels. Established companies often leverage their financial resources to invest in robust marketing campaigns, creating brand loyalty among consumers. Pricing strategies are also crucial in determining market share, with companies adopting competitive pricing or premium pricing depending on their target audience and the perceived value of their products.

New & Emerging Companies:

New and emerging companies are making notable strides in the nutraceuticals market, challenging the dominance of established players. Start-ups like NutraBlast, NutraIngredients, and NutraCoast have gained traction by capitalizing on niche segments, emphasizing organic and natural ingredients, and leveraging e-commerce platforms for direct-to-consumer sales. These companies often focus on agility and innovation, bringing unique formulations and product offerings to cater to evolving consumer preferences.

Industry Trends:

Industry news and current investment trends indicate a growing interest in personalized nutrition and the integration of technology into nutraceutical products. Companies are increasingly exploring the use of artificial intelligence and data analytics to develop personalized dietary plans based on individual health profiles. Investment trends also reveal a heightened focus on sustainable and eco-friendly packaging, aligning with the growing consumer consciousness towards environmental responsibility.

Competitive Scenario:

The overall competitive scenario in the nutraceuticals market remains dynamic, with mergers and acquisitions playing a pivotal role. Strategic alliances allow companies to strengthen their product portfolios, access new markets, and consolidate their market share. Recent instances include Nestlé's acquisition of Atrium Innovations and Danone's partnership with Mengniu Dairy Company to expand their presence in the Chinese market.

Recent Development

Significant developments have shaped the nutraceuticals market. The industry has witnessed a surge in demand for immunity-boosting products, driven by the global health crisis. Companies responded by introducing new formulations enriched with vitamins, minerals, and herbal extracts known for their immune-boosting properties. Additionally, there has been an increased emphasis on mental wellness, leading to the development of nutraceuticals designed to support cognitive health and alleviate stress.

Investment trends in 2023 highlight a focus on sustainable sourcing and production practices. Companies are investing in supply chain transparency and ethical sourcing of ingredients to meet the growing consumer demand for responsibly produced nutraceuticals. This trend is not only driven by consumer preferences but also by regulatory pressures and the need for companies to align with global sustainability goals.