North America Smart Hvac Systems Size

North America Smart HVAC Systems Market Growth Projections and Opportunities

Searching...

What is the projected market valuation of the North America Smart HVAC Systems Market by 2035?

The projected market valuation for the North America Smart HVAC Systems Market is 91.44 USD Billion by 2035.

What was the market valuation of the North America Smart HVAC Systems Market in 2024?

The overall market valuation was 50.73 USD Billion in 2024.

What is the expected CAGR for the North America Smart HVAC Systems Market during the forecast period 2025 - 2035?

The expected CAGR for the North America Smart HVAC Systems Market during the forecast period 2025 - 2035 is 5.5%.

Which companies are considered key players in the North America Smart HVAC Systems Market?

Key players in the market include Carrier, Trane Technologies, Lennox International, Honeywell, Johnson Controls, Daikin North America, Mitsubishi Electric, Rheem Manufacturing, and York International.

What are the main segments of the North America Smart HVAC Systems Market?

The main segments include Single Split, Variable Refrigerant Flow (VRF) Systems, Chillers, and Others (Multi-split System) for type, and Commercial, Residential, and Industrial for application.

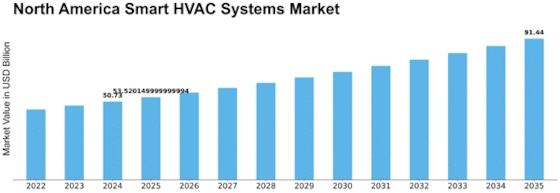

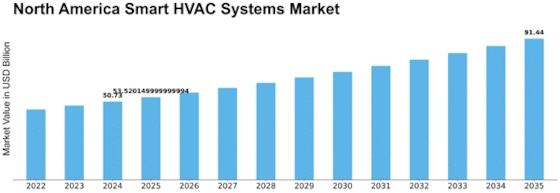

As per Market Research Future analysis, the North America Smart HVAC Systems Market was estimated at 50.73 USD Billion in 2024. The Smart HVAC Systems industry is projected to grow from 53.52 USD Billion in 2025 to 91.44 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.5% during the forecast period 2025 - 2035

The North America Smart HVAC Systems Market is poised for substantial growth driven by technological advancements and increasing demand for energy-efficient solutions.

| 2024 Market Size | 50.73 (USD Billion) |

| 2035 Market Size | 91.44 (USD Billion) |

| CAGR (2025 - 2035) | 5.5% |

| Largest Regional Market Share in 2024 | North America |

<a href="https://www.carrier.com/residential/en/ca/products/">Carrier </a>(US), Trane Technologies (US), Lennox International (US), Honeywell (US), Johnson Controls (US), Daikin North America (US), <a href="https://mitsubishielectric.in/fa/hvac/">Mitsubishi Electric</a> (JP), Rheem Manufacturing (US), York International (US)

The North America Smart HVAC Systems Market is currently experiencing a transformative phase, driven by advancements in technology and increasing consumer awareness regarding energy efficiency. The integration of smart technologies into heating, ventilation, and air conditioning systems is reshaping how residential and commercial spaces manage climate control. This evolution appears to be influenced by a growing emphasis on sustainability and the need for reduced energy consumption. As a result, manufacturers are focusing on developing innovative solutions that not only enhance comfort but also contribute to environmental conservation. Moreover, the market seems to be benefiting from the rising adoption of Internet of Things (IoT) devices, which facilitate remote monitoring and control of HVAC systems. This trend indicates a shift towards more user-friendly interfaces and automated functionalities, allowing users to optimize their energy usage effectively. Additionally, regulatory frameworks promoting energy-efficient technologies are likely to further propel market growth. Overall, the North America Smart HVAC Systems Market is poised for continued expansion as stakeholders adapt to evolving consumer preferences and technological advancements.

The incorporation of Internet of Things (IoT) technologies into HVAC systems is becoming increasingly prevalent. This trend allows for enhanced connectivity and control, enabling users to monitor and adjust their systems remotely. Such capabilities not only improve user experience but also promote energy efficiency by allowing for real-time adjustments based on occupancy and environmental conditions.

There is a notable emphasis on energy efficiency within the North America Smart HVAC Systems Market. Consumers are increasingly seeking solutions that reduce energy consumption and lower utility costs. This shift is prompting manufacturers to innovate and develop systems that meet stringent energy standards, thereby appealing to environmentally conscious consumers.

Government regulations are playing a crucial role in shaping the North America Smart HVAC Systems Market. Policies aimed at promoting sustainable practices and energy-efficient technologies are encouraging manufacturers to invest in research and development. This regulatory support is likely to foster innovation and drive the adoption of smart HVAC solutions across various sectors.

Rising energy costs are a significant driver for the North America Smart HVAC Systems Market. As energy prices continue to escalate, consumers and businesses are increasingly seeking solutions that can mitigate these expenses. Smart HVAC systems, with their ability to optimize energy consumption and provide real-time data analytics, offer a compelling solution to this challenge. Market analysis indicates that the implementation of smart HVAC technologies can lead to substantial reductions in energy bills, often by 20% or more. This financial incentive is prompting both residential and commercial sectors to invest in smart HVAC solutions, thereby accelerating market growth.

The North America Smart HVAC Systems Market is witnessing an increased focus on sustainability, driven by both consumer preferences and regulatory frameworks. As environmental concerns gain prominence, there is a growing demand for energy-efficient and eco-friendly HVAC solutions. This shift is supported by various government initiatives aimed at reducing carbon footprints and promoting renewable energy sources. For instance, the U.S. Department of Energy has set ambitious targets for energy efficiency in buildings, which directly influences the HVAC market. Consequently, manufacturers are innovating to develop systems that not only comply with these regulations but also appeal to environmentally conscious consumers.

The North America Smart HVAC Systems Market is experiencing a notable surge in demand for smart home solutions. As consumers increasingly seek convenience and control over their living environments, smart HVAC systems are becoming integral to modern homes. This trend is driven by the proliferation of smart devices and the growing awareness of energy management. According to recent data, the smart home market is projected to reach USD 174 billion by 2025, indicating a robust growth trajectory. This demand is further fueled by the desire for enhanced comfort, security, and energy efficiency, positioning smart HVAC systems as a pivotal component in the evolving landscape of home automation.

The growing awareness of indoor air quality (IAQ) is emerging as a crucial driver in the North America Smart HVAC Systems Market. Consumers are becoming more cognizant of the health implications associated with poor air quality, leading to an increased demand for HVAC systems that can effectively monitor and improve IAQ. Smart HVAC systems equipped with advanced filtration and ventilation technologies are well-positioned to address these concerns. Data suggests that improved IAQ can enhance productivity and overall well-being, making these systems attractive to both homeowners and businesses. As awareness continues to rise, the market for smart HVAC solutions is likely to expand further.

Technological advancements are significantly shaping the North America Smart HVAC Systems Market. Innovations such as machine learning, artificial intelligence, and advanced sensors are enhancing the functionality and efficiency of HVAC systems. These technologies enable predictive maintenance, real-time monitoring, and automated adjustments based on user preferences and environmental conditions. The integration of these advanced features not only improves energy efficiency but also reduces operational costs. Market data suggests that the adoption of smart HVAC technologies could lead to energy savings of up to 30%, making them an attractive option for both residential and commercial applications.

In the North America Smart HVAC Systems Market, the segment is largely dominated by Variable Refrigerant Flow (VRF) Systems, which have carved a substantial share due to their energy efficiency and flexibility. Following closely are chillers, which also hold a significant portion of the market. Other segments such as Single Split and Multi-split systems contribute to the overall mix but are overshadowed by the prominence of VRF Systems and <a href="https://www.marketresearchfuture.com/reports/chillers-market-11556">chillers</a>.

VRF Systems (Dominant) vs. Chillers (Emerging)

Variable Refrigerant Flow (VRF) Systems are known for their ability to concurrently provide both heating and cooling, making them highly adaptable for varying climatic conditions typical in North America. Their efficient use of refrigerants allows significant energy savings, which appeals to eco-conscious consumers. On the other hand, Chillers are rapidly gaining popularity as an emerging technology, thanks to advancements that improve their efficiency and cooling capabilities. As sustainability becomes a focal point in building design, chillers are adapting quickly, making them a vital contender in the market. The competition between these two segments is shaping the technological advancements in <a href="https://www.marketresearchfuture.com/reports/smart-hvac-controls-market-22293">smart HVAC controls solutions</a>.

In the North America Smart HVAC Systems Market, the application segment is primarily divided into Commercial, Residential, and Industrial categories. The Commercial segment dominates the market, capturing the largest share due to significant investments in smart technologies for large buildings and office spaces. On the other hand, the Residential segment is experiencing rapid growth, driven by increasing consumer preferences for energy efficiency and smart home integrations. The Industrial segment, while vital, operates on a smaller market scale compared to its counterparts, focusing on specialized systems tailored for manufacturing environments.

Application: Commercial (Dominant) vs. Residential (Emerging)

The Commercial HVAC systems segment is characterized by its extensive usage in office buildings, shopping malls, and institutional facilities, where the demand for advanced climate control and energy management is paramount. This dominance is attributed to the substantial investments from businesses aiming to enhance operational efficiency and reduce energy costs. Conversely, the Residential segment, emerging as a key player, has been gaining traction through the growing adoption of smart home technologies. Homeowners are increasingly seeking systems that provide not only comfort but also significant energy savings and automation features, thereby making Residential HVAC systems a focal point for innovation in the market.

The North American Smart HVAC Systems market is primarily driven by increasing energy efficiency regulations and a growing demand for sustainable solutions. The U.S. holds the largest market share at approximately 70%, followed by Canada at around 20%. Regulatory initiatives, such as the Energy Policy Act, are catalyzing the adoption of smart technologies, enhancing energy savings and reducing carbon footprints. Leading countries in this region include the United States and Canada, with major players like Carrier, Trane Technologies, and Honeywell dominating the landscape. The competitive environment is characterized by continuous innovation and strategic partnerships among key players. The presence of advanced manufacturing capabilities and a strong focus on R&D further bolster the market, ensuring a robust growth trajectory for smart HVAC systems.

Europe is witnessing a significant shift towards smart HVAC systems, driven by stringent environmental regulations and a commitment to reducing greenhouse gas emissions. The European market is characterized by a strong emphasis on energy efficiency, with countries like Germany and France leading the charge. Germany holds approximately 30% of the market share, while France accounts for around 25%. The EU's Green Deal is a pivotal regulatory catalyst promoting the adoption of smart technologies. Key players in the European market include Daikin and Mitsubishi Electric, which are focusing on innovative solutions to meet the growing demand. The competitive landscape is marked by collaborations and technological advancements aimed at enhancing system efficiency. As the region moves towards a more sustainable future, the integration of IoT and AI in HVAC systems is becoming increasingly prevalent, positioning Europe as a leader in smart HVAC innovation.

The Asia-Pacific region is experiencing rapid growth in the smart HVAC systems market, fueled by urbanization and rising disposable incomes. Countries like China and India are at the forefront, with China holding approximately 40% of the market share, followed by India at around 15%. Government initiatives aimed at improving energy efficiency and reducing emissions are significant drivers of this growth, with policies supporting the adoption of smart technologies. The competitive landscape in Asia-Pacific is evolving, with key players such as Daikin and Mitsubishi Electric expanding their presence. Local manufacturers are also emerging, contributing to a dynamic market environment. The increasing focus on smart city initiatives and sustainable building practices is further propelling the demand for advanced HVAC solutions, making this region a critical player in the global market.

The Middle East and Africa region presents untapped potential for smart HVAC systems, driven by rapid urbanization and infrastructural development. Countries like the UAE and South Africa are leading the market, with the UAE holding approximately 25% of the market share. The region's growing focus on energy efficiency and sustainability is prompting investments in smart technologies, supported by government initiatives aimed at reducing energy consumption. The competitive landscape is characterized by a mix of international and local players, with companies like Johnson Controls and Honeywell establishing a strong foothold. The increasing demand for energy-efficient solutions in commercial and residential sectors is driving innovation and market growth. As the region continues to develop, the adoption of smart HVAC systems is expected to rise significantly, creating new opportunities for stakeholders.

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the smart HVAC systems market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, smart HVAC systems industry must offer cost-effective items.

The North America Smart HVAC Systems Market is projected to grow at a 5.5% CAGR from 2024 to 2035, driven by technological advancements, energy efficiency demands, and regulatory support.

New opportunities lie in:

By 2035, the market is expected to be robust, driven by innovation and sustainability initiatives.

| MARKET SIZE 2024 | 50.73(USD Billion) |

| MARKET SIZE 2025 | 53.52(USD Billion) |

| MARKET SIZE 2035 | 91.44(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 5.5% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2019 - 2024 |

| Market Forecast Units | USD Billion |

| Key Companies Profiled | Carrier (US), Trane Technologies (US), Lennox International (US), Honeywell (US), Johnson Controls (US), Daikin North America (US), Mitsubishi Electric (JP), Rheem Manufacturing (US), York International (US) |

| Segments Covered | Type, Application |

| Key Market Opportunities | Integration of artificial intelligence for enhanced energy efficiency in the North America Smart HVAC Systems Market. |

| Key Market Dynamics | Rising consumer demand for energy-efficient solutions drives innovation in North America Smart HVAC Systems market. |

| Countries Covered | North America, Europe, APAC, South America, MEA |

What is the projected market valuation of the North America Smart HVAC Systems Market by 2035?

The projected market valuation for the North America Smart HVAC Systems Market is 91.44 USD Billion by 2035.

What was the market valuation of the North America Smart HVAC Systems Market in 2024?

The overall market valuation was 50.73 USD Billion in 2024.

What is the expected CAGR for the North America Smart HVAC Systems Market during the forecast period 2025 - 2035?

The expected CAGR for the North America Smart HVAC Systems Market during the forecast period 2025 - 2035 is 5.5%.

Which companies are considered key players in the North America Smart HVAC Systems Market?

Key players in the market include Carrier, Trane Technologies, Lennox International, Honeywell, Johnson Controls, Daikin North America, Mitsubishi Electric, Rheem Manufacturing, and York International.

What are the main segments of the North America Smart HVAC Systems Market?

The main segments include Single Split, Variable Refrigerant Flow (VRF) Systems, Chillers, and Others (Multi-split System) for type, and Commercial, Residential, and Industrial for application.

Kindly complete the form below to receive a free sample of this Report

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”

Leave a Comment