Regulatory Support

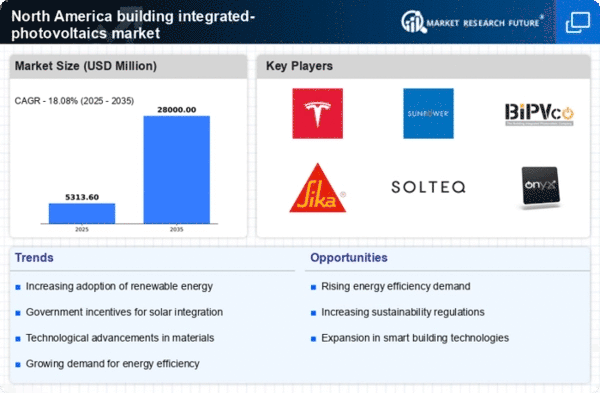

Regulatory frameworks in North America are increasingly favoring renewable energy solutions, which is beneficial for the building integrated-photovoltaics market. Various states have implemented policies that promote the adoption of solar technologies, including tax credits, rebates, and renewable portfolio standards. For instance, California has set ambitious goals to achieve 100% clean energy by 2045, which encourages the integration of solar systems in new constructions. This regulatory support not only enhances the market's growth potential but also fosters innovation within the building integrated-photovoltaics market. As regulations evolve, they are likely to create a more favorable environment for solar energy adoption, further driving demand for integrated photovoltaic solutions.

Rising Energy Costs

The escalating costs of traditional energy sources are driving interest in the building integrated-photovoltaics market. As energy prices continue to rise, homeowners and businesses are increasingly seeking alternative energy solutions. The integration of photovoltaic systems into building designs offers a dual benefit: reducing reliance on grid electricity and lowering energy bills. In North America, energy costs have seen an increase of approximately 15% over the past five years, prompting a shift towards renewable energy sources. This trend is likely to continue, as consumers become more aware of the long-term savings associated with solar energy. The building integrated-photovoltaics market stands to benefit significantly from this shift, as more stakeholders recognize the financial advantages of investing in solar technology.

Architectural Innovation

The trend towards innovative architectural designs is significantly impacting the building integrated-photovoltaics market. Architects and builders are increasingly incorporating solar technologies into their designs, creating aesthetically pleasing structures that also generate energy. This integration is not merely functional; it enhances the overall value of properties. In North America, the demand for sustainable building practices has surged, with a reported 30% increase in projects that utilize solar technology in their designs. This architectural shift is likely to continue, as more developers recognize the benefits of integrating photovoltaic systems into their projects. The building integrated-photovoltaics market is poised to thrive as these innovative designs become more mainstream.

Technological Integration

The advancement of technology in the solar energy sector is a key driver for the building integrated-photovoltaics market. Innovations in photovoltaic materials and systems have led to more efficient and cost-effective solutions. For instance, the development of thin-film solar cells and building-integrated photovoltaics (BIPV) has made it easier to incorporate solar technology into building designs without compromising aesthetics. In North America, the efficiency of solar panels has improved by approximately 20% over the last decade, making them more appealing to consumers and builders alike. This technological integration is likely to continue, further enhancing the building integrated-photovoltaics market as new solutions emerge that meet the evolving needs of the market.

Consumer Awareness and Demand

There is a growing awareness among consumers regarding the benefits of renewable energy, which is positively influencing the building integrated-photovoltaics market. As more individuals become educated about the environmental and economic advantages of solar energy, demand for integrated photovoltaic solutions is expected to rise. Surveys indicate that approximately 70% of North American homeowners are considering solar energy as a viable option for their energy needs. This heightened consumer interest is likely to drive investments in the building integrated-photovoltaics market, as manufacturers and developers respond to the increasing demand for sustainable energy solutions. The shift in consumer preferences is a crucial driver for market growth.