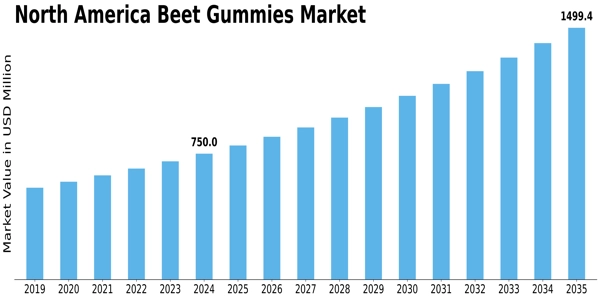

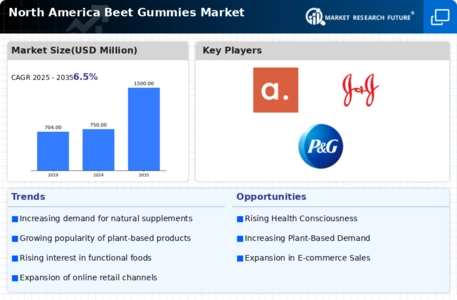

North America Beet Gummies Size

North America Beet Gummies Market Growth Projections and Opportunities

The North American beet gummies market is influenced by various factors that collectively shape its supply, demand, and overall dynamics. One of the primary factors driving this market is the increasing consumer interest in natural and healthy food options. Beet gummies, made from beetroot extract, are gaining popularity due to their perceived health benefits, including being a good source of vitamins, minerals, and antioxidants. As consumers become more health-conscious and seek out alternatives to traditional sweets and snacks, the demand for beet gummies continues to rise, driving growth in the market.

Government regulations and policies also play a significant role in shaping the North American beet gummies market. Regulatory standards regarding food safety, labeling requirements, and ingredient specifications impact the manufacturing, marketing, and sale of beet gummy products. Additionally, regulations related to organic certification, non-GMO labeling, and health claims influence consumer trust and purchasing decisions, further shaping market dynamics for beet gummies.

Market demand for North American beet gummies is influenced by factors such as consumer preferences, dietary trends, and lifestyle choices. As more consumers adopt plant-based diets, seek out vegan-friendly options, or look for gluten-free alternatives, the demand for beet gummies as a natural and nutritious snack option increases. Additionally, factors such as flavor variety, packaging design, and marketing campaigns can influence consumer perceptions and purchasing behavior within the beet gummies market.

Technological advancements and innovations in product formulation, manufacturing processes, and packaging technologies also play a crucial role in shaping the North American beet gummies market. Improved extraction methods, flavoring techniques, and texture modifiers enable manufacturers to create high-quality beet gummy products that meet consumer preferences for taste, texture, and appearance. Similarly, advancements in packaging materials and designs enhance product freshness, shelf life, and convenience, driving consumer appeal and market competitiveness for beet gummy brands.

Economic factors such as disposable income levels, consumer spending habits, and price sensitivity impact the North American beet gummies market. While beet gummies may be perceived as a premium product compared to traditional candies, their pricing relative to other health snacks or confectionery options can influence consumer affordability and purchasing decisions. Economic downturns or fluctuations in consumer confidence may affect sales of beet gummies, particularly among price-sensitive demographics.

Market competition is another significant factor shaping the North American beet gummies market. As consumer demand for healthy snacks and natural food products grows, more companies are entering the market, leading to increased competition for market share. Brand differentiation, product innovation, distribution strategies, and marketing efforts all play a role in determining the success of beet gummy brands in a competitive market environment. Additionally, partnerships, collaborations, and acquisitions may occur as companies seek to expand their product portfolios and capture market opportunities within the beet gummies segment.

Consumer education and awareness about the nutritional benefits and uses of beet gummies also influence market dynamics. Educational initiatives by manufacturers, health professionals, and influencers help to highlight the health properties of beetroot and promote the consumption of beet gummies as part of a balanced diet. As consumers become more informed about the nutritional value, taste, and texture of beet gummies, demand for these products is expected to continue growing, driving further expansion of the North American beet gummies market.

Leave a Comment