Market Analysis

In-depth Analysis of Next-Generation Memory Market Industry Landscape

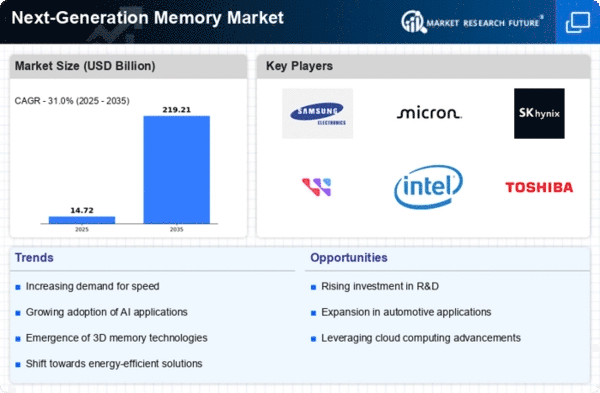

The dynamics of the Next-Generation Memory Market are shaped by a myriad of factors, influencing its growth, trends, and overall trajectory. One fundamental driver of market dynamics is the relentless pursuit of higher performance. As computing demands become more sophisticated and applications more complex, there is a continuous need for memory solutions that can keep pace. Such drivers as increasing data access speed and lower latency prop up market growth. In addition, these trends improve general operations and accommodate emerging technologies, for example, artificial intelligence, machine learning, and high performance computing.

Furthermore, as data-driven applications change over time, these technologies that led to the market dynamics in the first place. The explosion of data analytics with big data, IoT, and 5G creates for once digital data a new dimension. It is this flood of data creation and usage that sets off a chain reaction of demand for memory solutions that can efficiently handle vast database sets and process them quickly. The Next-Generation Memory Industry occupies a major place among manufacturers for it is addressing these issues staying on point with solutions where data access and storage become smooth, consequentially affecting market's movement.

Energy efficiency, as the other factor driving the development of Next Generation Memory Market, plays a major role there. Now that technology has become part of everyday life, measures for energy consumption and environmental sustainability are receiving more attention. 3rd generation memory technologies are the giving advantage of energy efficiency and thus are fast taking place not only by manufacturers but also by the end users. With the consumer preference for greener products inclined towards energy saving and ecological memory solutions, the market dynamics are altering in line with the wider global push for sustainable technology.

Also, the most vital factor in the market condition is the competition that is dominant in the process. The market is defined by a huge competition that includes semiconductor manufacturers, high-tech corporations and entrepreneurs as leaders, who are trying to stay ahead of all competitors. Local, national and global research and development initiatives, strategic businesses partnerships and mergers and acquisitions determine the structure of this market. The firms want to take advantage of the really latest technology while staying one step ahead of its competitor to secure the market share; thus lead them to innovations and advancements in the similar sector.

In addition to dynamics of the marketplace, the economics of the system regarding the adoption of the advanced memory technologies are a major consideration. However, the fact that they provide more product capabilities than ever while the initial startup, and production costs may become the most challenging barriers for these technologies to be disseminated on a large scale. The evolution of market dynamics may be seen as the market matures and economics of scale take place. The impact of cost dynamics will enable next-generation memory solutions and affect the market for these products holistically.

In addition, the regulation and standard guidelines contribute to the market conditions. Compliance with industry standards and regulations is essential for market acceptance and interoperability. Changes in standards or the introduction of new regulations can have a profound impact on the market, influencing product development and adoption strategies for industry players.

Leave a Comment