Network Probe Size

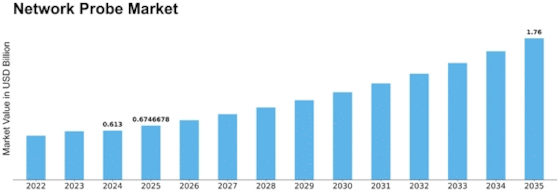

Network Probe Market Growth Projections and Opportunities

The Network Probe market develops due to several market factors. Network system complexity is a major driver of network probe sales. As companies become digital, large-scale network monitoring tools are essential. To ensure network security and reliability, companies need network probes, which gather and analyze network data. The rise of internet dangers is also boosting network probe sales. To defend against increasingly complex cyberattacks, corporations are prioritizing advanced network monitoring and protection. Network probes help find and prevent security vulnerabilities by showing network activity in real-time. Government compliance laws and legislation also boost the network probe sector. The healthcare and banking industries must monitor and protect private data under strict laws. Network probes help organizations meet these criteria by giving them full control over their networks and the ability to spot threats. Competition is a major aspect in the Network Probes industry. As more people hunt for effective network monitoring options, more vendors and service providers are offering new, creative technologies. Competition drives innovation, which led to more advanced Network Probes. Key player engagement and collaborations help industry development and technical progress. Other economic factors, such as economic stability and industry movements, may also affect network probe sales. Many firms understand how crucial network security and efficiency are to their operations. As the economy grows, companies have more money and motivation to spend in network monitoring tools, growing the demand for network probes. The adoption of new technologies and technological developments also affect the network probe industry. The growth of cloud computing, IoT, and virtualization technologies has made networks more complex. Network probes must be updated to keep up with fast technological innovation to operate in a range of network settings. Government regulations affect the network probe market. Governments and regulatory agencies set data privacy and security rules. This affects the network tracking solutions needed. Organizations buy Network Probes to comply with legislation and protect private data.

Leave a Comment