Top Industry Leaders in the Naval Combat Systems Market

The Naval Combat Systems market is a critical sector within the defense industry, characterized by intense competition, technological advancements, and strategic maneuvers among key players striving for dominance. These systems are pivotal for naval operations, encompassing radar systems, sonar technology, weapons guidance systems, command and control systems, and more, enhancing a navy's combat readiness and capabilities. The market has seen substantial growth owing to increased naval modernization programs and the need for advanced systems to counter evolving threats in maritime domains.

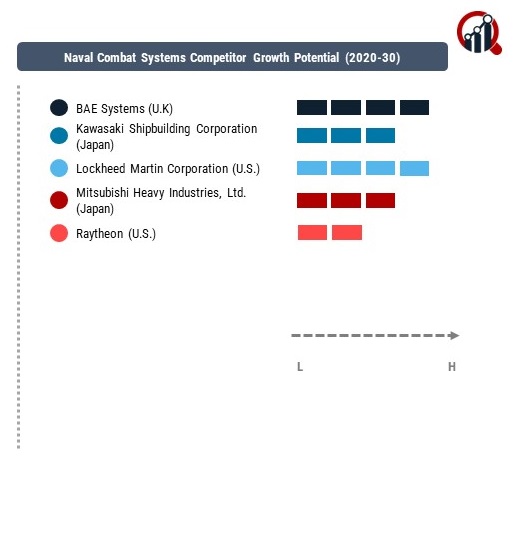

Competitive Landscape

- BAE Systems (U.K)

- Kawasaki Shipbuilding Corporation (Japan)

- Lockheed Martin Corporation (U.S.)

- Mitsubishi Heavy Industries, Ltd. (Japan)

- Raytheon (U.S.)

Strategies adopted by these key players revolve around technological innovation, strategic partnerships, and diversification of offerings. Continuous research and development efforts drive innovation, focusing on advancements in sensor technology, integration of artificial intelligence and machine learning, and enhancing interoperability among different naval systems. Collaborations and partnerships with other defense contractors, technology firms, and government agencies are common to leverage complementary capabilities, broaden market reach, and offer comprehensive integrated solutions.

Market share analysis in the Naval Combat Systems sector considers factors such as technological superiority, reliability, interoperability, lifecycle costs, and adaptability to various naval platforms and operational environments. Companies excelling in providing modular, scalable, and interoperable systems that offer enhanced performance while adhering to stringent naval standards gain a competitive edge. Additionally, the ability to provide comprehensive and cost-effective lifecycle support, including maintenance, upgrades, and training services, plays a significant role in market leadership.

The landscape also sees the emergence of new and agile companies aiming to penetrate the market. Emerging players like Navantia, Saab AB, and Atlas Elektronik GmbH specialize in specific segments, offering niche expertise or advanced technologies in areas such as unmanned systems, autonomous navigation, or specialized weapons systems. These newcomers bring innovative solutions, driving competition and fostering innovation within the Naval Combat Systems market.

Industry news reflects the market's dynamism, with frequent announcements of significant contracts, technological advancements, and collaborations. Developments in unmanned maritime systems, next-generation sensor technologies, cybersecurity for naval systems, and the integration of artificial intelligence into combat systems are notable trends in the sector. Additionally, news about government procurement programs, international collaborations, and advancements in naval warfare capabilities significantly impact market dynamics.

Current company investment trends in the Naval Combat Systems market highlight substantial allocations to research and development, technological advancements, and strategic acquisitions or partnerships. Key players invest significantly in R&D to maintain technological superiority, continually improving system capabilities, reducing size and weight, enhancing energy efficiency, and addressing cybersecurity concerns. Strategic investments in acquiring smaller firms with specialized capabilities or forming alliances with complementary technology providers remain prevalent strategies to expand market presence and diversify product portfolios.

Overall, the competitive scenario in the Naval Combat Systems market is marked by fierce competition among established players, the emergence of innovative startups, continuous technological advancements, and a persistent drive for market differentiation and expansion. The trajectory of this market is shaped by the ability of companies to stay ahead in technological innovation, align with evolving naval requirements, comply with stringent standards, and swiftly adapt to geopolitical changes. As navies worldwide continue to prioritize advanced combat systems for maritime security and dominance, the Naval Combat Systems market is poised for further evolution, promising a future characterized by increasingly sophisticated and adaptable naval technologies.

Recent Development:

March 2022, Damen Naval, a subsidiary of Damen Shipyards Group, chose Leonardo to supply and install its OTO 127/64 lightweight (LW) Vulcano defense systems onto the four F126 frigates of the German Navy.

January 2022, the Philippines finalized a USD 374.96 million contract with BrahMos Aerospace Private Ltd. The agreement involves delivering a shore-based anti-ship variant of the BrahMos supersonic cruise missile. The contract encompasses the supply of three missile batteries, operator and maintainer training, and an Integrated Logistics Support (ILS) package. BrahMos Aerospace will aid the Philippines in establishing bases for anti-ship missile systems and associated sensor suites and combat management systems, set to be operational from the latter part of 2023.