Research Methodology on Narrowband IOT Market

1. Introduction:

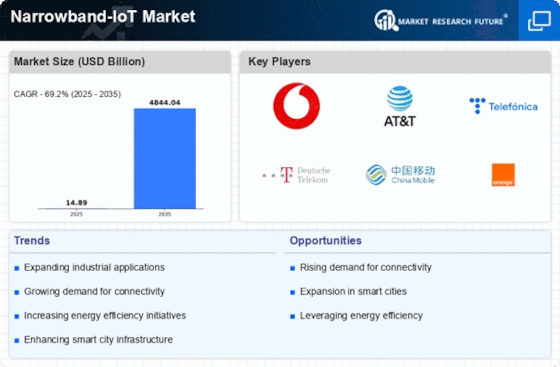

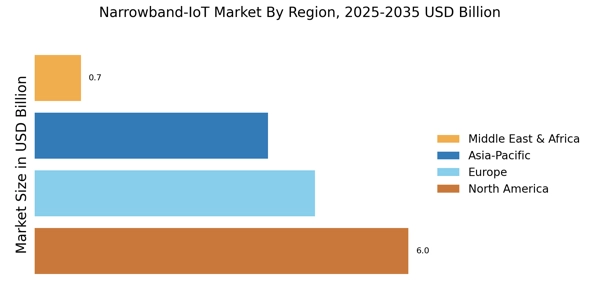

In this project, an effort is made to explore the market trends of the global Narrowband Internet of Things (NB-IoT) industry. The report summarizes current literature, potential market opportunities and potential risk factors related to the industry. The overall objective of the research project is to provide an in-depth analysis of the contemporary state of the global NB-IoT market and to make effective forecasts for the industry in the coming years.

2. Research Approach:

To achieve the desired results, a combination of both primary and secondary research approaches is used. Primary research methods include interviews with industry experts, professionals, and stakeholders. This information is used to validate research assumptions and to provide qualitative data for the report. Secondary research methods include analysis of existing published literature, such as market reports, articles, data, and industry reports, as well as extensive usage of qualitative tools and data sources such as market databases.

3. Target Population:

The target population for the research project includes both key players in the NB-IoT industry and those who are indirectly affected by the industry. Examples of key players include NB-IoT industry stakeholders, experts and professionals, industry analysts, and the NB-IoT user base.

4. Sampling Technique:

Non-probability sampling is used to select the participants in the research project. This type of sampling technique allows bias in the selection of participants, which is beneficial for our research project. For example, the selection of specific industry experts with unique insights on the global NB-IoT market, as well as existing data analysts, can provide the researcher with more targeted insight into the industry.

5. Data Collection:

Data for the project is collected from both primary and secondary sources. The primary data is collected through semi-structured interviews with industry experts and stakeholders from the NB-IoT market. The information gathered from these interviews is then validated through secondary research sources such as market reports, journal articles, and industry data. All information gathered from both sources will then be processed and analyzed in order to conclude the current state of the global NB-IoT industry.

6. Data Analysis:

The data collected for the research project is analyzed using a combination of both quantitative and qualitative techniques. The quantitative data is analyzed using methods such as descriptive and inferential statistics, while the qualitative data are analyzed using techniques such as content analysis. All data is then used to develop conclusions and forecasts for the global NB-IoT market.

7. Hypothesis Development:

The research project begins by developing a set of hypothesis statements which is tested against the data collected during the research project. The hypothesis statements are used to identify any trends or patterns that may be present in the data collected. This is then used to conclude the state of the global NB-IoT market.

8. Ethical Considerations:

In order to ensure the project is conducted ethically and acceptably, it is important to consider the various ethical issues associated with the research. These issues include the involvement of human subjects in the research, the protection of any sensitive data, and the fair representation of the results. It is expected that the research team will adhere to the relevant ethical standards when conducting the research.

9. Conclusion:

This research report provides a comprehensive examination of the global NB-IoT industry. A combination of both primary and secondary research methods is used to collect and analyze data from both industry stakeholders and users. The data that is collected is then processed and analyzed to draw conclusions and make effective forecasts for the industry in the coming years. Through this research project, a better understanding of the market trends and dynamics of the global NB-IoT market can be attained.