Research Methodology on Nanocoatings Market

1. Introduction

The goal of this research project is to provide an updated review of the Global Nanocoatings Market size, growth, share, trends, analysis, and forecast. The research methodology used for this purpose is described in detail below.

2. Research Objectives

The specific objectives of this research project are as follows:

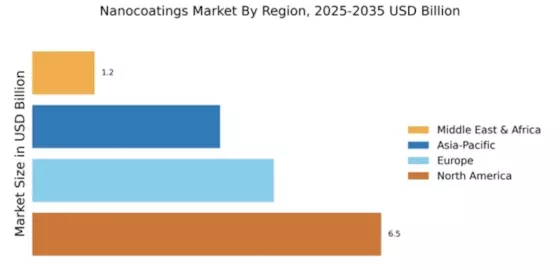

- To analyze the current size of the Global Nanocoatings Market;

- To analyze the growth trends in the Global Nanocoatings Market;

- To identify major drivers and challenges for the Global Nanocoatings Market;

- To provide an updated forecast for the Global Nanocoatings Market from 2023 to 2030.

3. Research Design

The research design used in this project is a combination of both qualitative and quantitative research methods. The sources of primary and secondary data used in this study include industry reports, market research studies, industry interviews, journalist assessments, and other corporate documents and reports.

4. Research Procedure

• Data Collection:

The primary sources of data collection include industry interviews, journalist assessments, industry reports, market research studies, corporate documents and reports. Industry experts were interviewed to acquire the latest data and insights regarding the Global Nanocoatings Market.

• Data Analysis:

The collected data is analyzed and sorted to provide the most accurate and up-to-date information. The data is analyzed using both analytical instruments (such as statistical and trend analysis) as well as qualitative data analysis (such as interviews and insights from industry experts).

• Data Interpretation:

The data is interpreted and the results are presented in a comprehensive market report.

5. Market Size Estimation

The market size for the Global Nanocoatings Market is estimated using both top-down and bottom-up approaches. The top-down approach includes analyzing the overall size of the global market and then assessing the size of the sub-segments. The bottom-up approach involves estimating the individual market shares of the different segments and then deducing the overall size of the Global Nanocoatings Market.

6. Assumptions

The following assumptions are made while estimating the market size:

- The economic conditions in the major markets of the Global Nanocoatings Market are stable and are expected to remain so in the forecast period 2023 to 2030.

- The new technologies and advancements in the Global Nanocoatings Market are likely to increase the market size during the forecast period.

7. Conclusion

This research report provides an updated review of the Global Nanocoatings Market size, growth, share, trends, analysis, and forecast. The research methodology used for this purpose is a combination of both qualitative and quantitative approaches. The market size is estimated using both top-down and bottom-up approaches. The research project also provides an overview of the major drivers and challenges for the Global Nanocoatings Market.