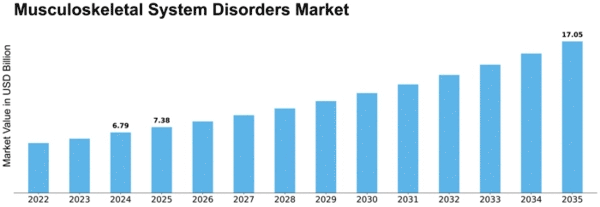

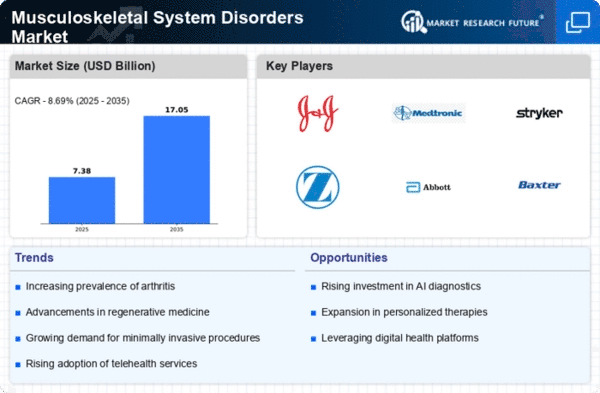

Musculoskeletal System Disorders Size

Musculoskeletal System Disorders Market Growth Projections and Opportunities

The market for musculoskeletal system disorder treatments is significantly influenced by the rising prevalence of these disorders, particularly among the aging population. As people age, the likelihood of developing conditions such as osteoarthritis, rheumatoid arthritis, and osteoporosis increases, driving the demand for effective therapies.

Innovations in medical technology paved way for the market topography. With regard to that, advances in diagnostics equipment and imaging technologies as well minimally transferred surgeries are those factors which facilitate quicker diagnoses and higher effectiveness of treatment results. Such innovations are appealing to the providers of healthcare together with patients, promoting market development respectively. Research and development activities persist in the pharmaceutical sector leading to widening of treatment alternatives for musculoskeletal disorders. The availability of new drugs, biologics and targeted therapies presents the patients with more options ultimately benefiting research driven pharmaceutical companies to compete in this market evolution. Market availability of musculoskeletal disorders state directly depends on the development level of healthcare infrastructure in different regions. In areas that have well developed health systems, adoption would be higher for advanced treatments and surgical interventions; further differences in access to medicare also bring variations into the market. What takes the form of global economic conditions impact on musculoskeletal disorder market. A stable economic environment can lead to increased healthcare spending, thus making it possible for the highly innovative methods being incorporated. On the other hand, economic recession might restrict healthcare budgets which in turn influence patient affordability and market dynamics. Empowerment of patient on musculoskeletal disorders and treatment options is a major market accelerator. Educational approaches as well an awareness campaigns leads to the early detection and proactive approach. They affect patient preferences, demands for certain treatments etc The scope of insurance coverage in musculoskeletal disorder treatments deeply impacts the market trends. Therefore, all-inclusive medical insurance that includes diagnostics, therapies and surgeries which means better access to more treatments will lead to an improved picture for market growth. Changing the lifestyle such as sedentary habits and poor quality of food added to increase musculoskeletal disorders. The market responds to these, lifestyle trends with preventive approach both medic as well medical non-medic insights complemented by the rehabilitation services and lifestyle interventions. The market also responds to strict drug approval regulations, medical device rules as well prescriptions. Conformity to regulatory standards ensures the safety and effectiveness of musculoskeletal disorder treatments; efficient market entry procedure benefits high-performing innovative therapies. Alliances between drug-manufacturing companies, healthcare professionals and health research organizations are helpful in the knowledge transfer as well bedrive innovation. The adoption of partnerships can be seen as a great contributor to the development into effective integrated care pathway and encourage provision of sustainable holistic solutions in musculoskeletal disorder management.

The musculoskeletal disorder market is expanding in emerging economies due to improving healthcare infrastructure, rising disposable incomes, and increasing awareness. These markets present significant growth opportunities for companies entering with cost-effective and innovative solutions. Increasing emphasis on patient-centered care and improving quality of life shapes the musculoskeletal disorder market. Therapies that not only address symptoms but also enhance overall well-being gain traction, influencing treatment preferences and market trends.

Leave a Comment