Molded Fiber Egg Carton Size

Molded Fiber Egg Carton Market Growth Projections and Opportunities

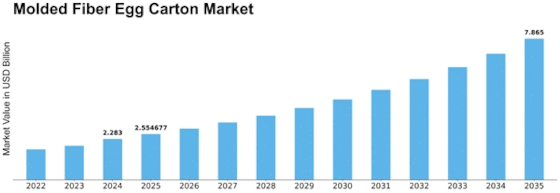

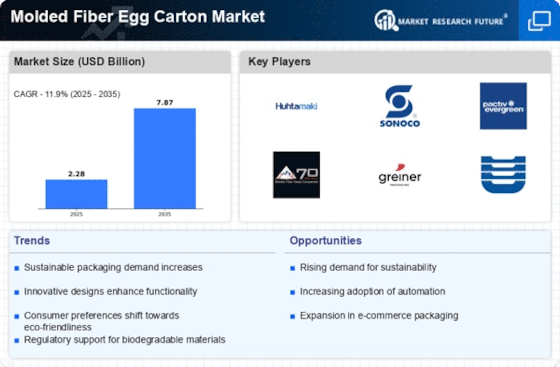

Molded Fiber Egg Carton Market Size was valued at USD 1.7 Billion in 2022. The Molded fiber egg carton industry is projected to grow from USD 2.04 Billion in 2023 to USD 8.77 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 11.90%

The molded fiber egg carton market is shaped by various market factors that influence its growth, development, and competitiveness within the packaging industry. Sustainability is a prominent factor influencing the market dynamics of molded fiber egg cartons. With a growing emphasis on environmental conservation, consumers and businesses are increasingly seeking eco-friendly packaging solutions. Molded fiber egg cartons, made from recycled paper and cardboard, align with this sustainability trend. The use of renewable and recycled materials in the manufacturing process appeals to environmentally conscious consumers, and businesses often choose molded fiber egg cartons as part of their commitment to reducing environmental impact.

Economic factors also play a crucial role in the molded fiber egg carton market. Economic growth, consumer spending patterns, and agricultural activities impact the demand for egg packaging. As economies thrive, there tends to be an increase in egg production and consumption, leading to a higher demand for packaging solutions such as molded fiber egg cartons. Conversely, economic downturns may result in reduced egg production and consumption, affecting the market negatively. Understanding the economic landscape is essential for stakeholders in the molded fiber egg carton industry to adapt to market fluctuations.

The regulatory environment significantly influences the molded fiber egg carton market. Food safety regulations, recycling mandates, and restrictions on single-use plastics contribute to the shaping of the industry. Molded fiber egg cartons are often favored for their biodegradability and compliance with recycling regulations. Government initiatives and policies promoting sustainable packaging further drive the adoption of molded fiber egg cartons. Manufacturers and users of these cartons must stay informed about evolving regulations to ensure compliance and adapt their practices accordingly.

Technological advancements in the manufacturing process are key market factors for molded fiber egg cartons. Innovations in molding techniques, equipment, and materials contribute to improved product quality, efficiency, and cost-effectiveness. Manufacturers that invest in advanced technologies can enhance their production capabilities, creating a competitive advantage in the market. Additionally, the incorporation of technological advancements allows for customization in the design and printing of molded fiber egg cartons, meeting branding and marketing requirements for businesses.

Consumer preferences and perceptions also impact the molded fiber egg carton market. As consumers become more conscious of their choices, there is a growing preference for packaging that aligns with their values, such as environmental sustainability. The aesthetic appeal and functional design of molded fiber egg cartons, including features like easy handling and stackability, contribute to consumer satisfaction. Brand loyalty and positive consumer experiences further influence purchasing decisions, prompting businesses to prioritize the quality and design of their egg packaging.

Market competition is shaped by factors such as pricing, distribution channels, and brand reputation within the molded fiber egg carton market. Pricing strategies that consider production costs, raw material prices, and market demand influence a company's competitiveness. Effective distribution networks and partnerships with retailers contribute to market reach and accessibility. Brand reputation for reliability, quality, and sustainability is a key factor in attracting and retaining customers. Manufacturers and distributors must navigate these competitive factors strategically to establish a strong market presence.

Leave a Comment