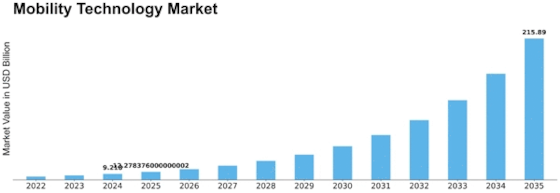

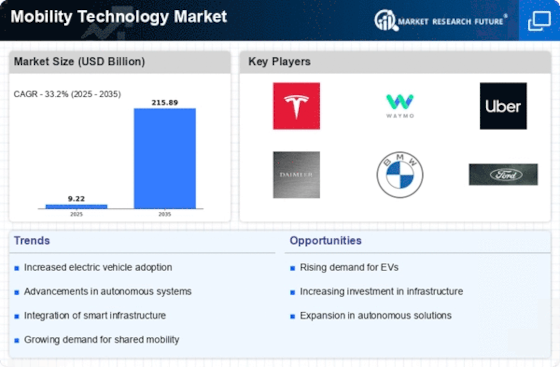

Mobility Technology Size

Mobility Technology Market Growth Projections and Opportunities

The market dynamics of the mobility technology sector have been undergoing a transformative journey, driven by a confluence of technological advancements, changing consumer preferences, and regulatory initiatives. As we delve into the intricate fabric of this market, a prominent feature is the rapid evolution of smart mobility solutions. The demand for these technologies, which encompass a spectrum from electric vehicles to intelligent transportation systems, has surged in recent years, reflecting a global shift towards sustainable and efficient transportation options.

One of the key drivers propelling the mobility technology market is the growing awareness and concern for environmental sustainability. Governments worldwide are increasingly emphasizing the need to reduce carbon emissions and combat climate change. This has led to a surge in investments and incentives for the development and adoption of electric vehicles (EVs) and other clean transportation solutions. Consequently, traditional automakers are pivoting their strategies towards electric and hybrid vehicles, and a slew of new players are entering the market with innovative electric mobility solutions.

Furthermore, the advent of autonomous vehicles has added a new dimension to the market dynamics. The race to achieve fully autonomous driving capabilities has intensified, with major players in the automotive and technology sectors investing heavily in research and development. The promise of increased safety, reduced traffic congestion, and enhanced mobility services has fueled consumer and industry enthusiasm. As a result, partnerships and collaborations between automotive manufacturers, tech companies, and mobility service providers have become commonplace, reshaping the competitive landscape.

The consumer mindset is also playing a pivotal role in shaping the mobility technology market. Urbanization trends and the rise of the sharing economy have given rise to a preference for on-demand and shared mobility services. Ride-hailing platforms, bike-sharing programs, and other shared mobility solutions are gaining popularity, particularly among younger demographics. This shift in consumer behavior is prompting traditional transportation models to adapt and integrate technology-driven solutions to stay relevant in a changing market.

Amidst these transformative forces, regulatory frameworks are exerting a significant influence on the mobility technology market. Governments worldwide are formulating policies to encourage the adoption of electric vehicles, promote sustainable transportation infrastructure, and address safety concerns related to autonomous vehicles. The regulatory landscape is evolving rapidly, and companies operating in the mobility technology sector must navigate these complexities to ensure compliance and foster innovation.

In terms of market competition, the mobility technology sector is witnessing a convergence of industries. Traditional automotive manufacturers are competing with technology giants, start-ups, and new entrants from various sectors. The battle for market share extends beyond the manufacturing of vehicles to the development of software, connectivity solutions, and mobility-as-a-service platforms. The emergence of ecosystem-driven approaches, where companies offer integrated solutions encompassing hardware, software, and services, is becoming increasingly prevalent.

In conclusion, the market dynamics of the mobility technology sector are characterized by a dynamic interplay of technological innovation, shifting consumer preferences, regulatory influences, and intense competition. The trajectory of this market reflects a future where sustainable, connected, and autonomous mobility solutions will play a central role in shaping the way people and goods move. As the industry continues to evolve, stakeholders must remain agile, adaptive, and collaborative to navigate the complexities and capitalize on the myriad opportunities that this transformative era presents.

Leave a Comment