The Mobile Wallet Market is currently experiencing a transformative phase, characterized by rapid technological advancements and shifting consumer preferences. As digital payment solutions gain traction, the integration of mobile wallets into everyday transactions appears to be becoming increasingly prevalent. This trend is driven by the growing demand for convenience, security, and efficiency in financial transactions. Moreover, the proliferation of smartphones and internet connectivity has facilitated the widespread adoption of mobile wallets, enabling users to make payments seamlessly and securely. As a result, various sectors, including retail, transportation, and hospitality, are increasingly embracing mobile wallet solutions to enhance customer experiences and streamline operations. This report presents the most comprehensive wallet growth trends analysis, covering market size, technology adoption, and regional dynamics through 2035.

Strategic mobile wallet marketing initiatives, including cashback offers and loyalty integrations, are helping providers expand user adoption. The ewallet market is expanding rapidly as consumers shift toward secure, cashless, and mobile-first payment solutions. The broader wallet market is being reshaped by the increasing adoption of mobile and digital payment platforms. Innovation across the wallets market continues to enhance user convenience and transaction security. The digital wallet market serves as a foundational segment supporting the growth of mobile wallet platforms globally. Growth in the e wallet market is supported by rising demand for contactless payments and peer-to-peer transfer solutions.

In addition to technological innovations, regulatory frameworks are evolving to support the growth of the Mobile Wallet Market. Governments and financial institutions are recognizing the potential of digital payment systems to foster financial inclusion and stimulate economic growth. This regulatory support may lead to increased trust among consumers, further propelling the adoption of mobile wallets. Furthermore, partnerships between financial service providers and technology companies are likely to create new opportunities for innovation and expansion within the market. Overall, the Mobile Wallet Market appears poised for continued growth, driven by a combination of consumer demand, technological advancements, and supportive regulatory environments. The e-wallet market is expected to witness sustained growth due to enhanced security features and expanding merchant acceptance. The global digital wallet market is witnessing strong growth as mobile payments become an integral part of daily financial transactions.

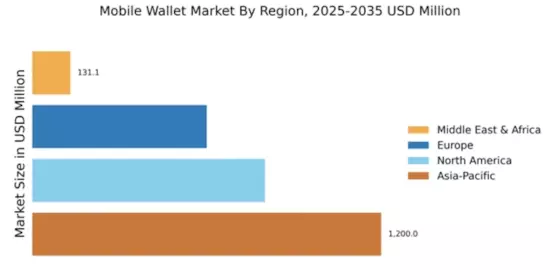

The global mobile wallet market is projected to expand significantly through 2035, supported by increasing smartphone penetration and digital payment adoption. Google continues to strengthen its position, with increasing Google Wallet market share driven by Android integration and expanding merchant partnerships. The latest wallet trends include biometric authentication, blockchain-based payments, and integration with loyalty programs. The mobile wallet industry is undergoing rapid transformation due to technological innovation and evolving consumer payment preferences. This mobile wallet research provides in-depth insights into market trends, growth drivers, and competitive strategies.

Increased Adoption of Contactless Payments

The Mobile Wallet Market is witnessing a notable rise in the adoption of contactless payment methods. This trend reflects a growing consumer preference for quick and efficient transactions, allowing users to make payments with minimal physical interaction. As merchants increasingly support contactless technology, the convenience offered by mobile wallets is likely to enhance user experience.

Integration of Loyalty Programs

Another emerging trend within the Mobile Wallet Market is the integration of loyalty programs into mobile wallet applications. This development appears to encourage customer retention and engagement, as users can easily access rewards and discounts through their mobile wallets. Such integration may also provide businesses with valuable insights into consumer behavior.

Enhanced Security Features

The Mobile Wallet Market is also seeing advancements in security features, which are crucial for building consumer trust. Innovations such as biometric authentication and encryption technologies are becoming more prevalent, addressing concerns related to fraud and data breaches. As security measures improve, consumers may feel more confident in utilizing mobile wallets for their transactions.