Advancements in 5G Technology

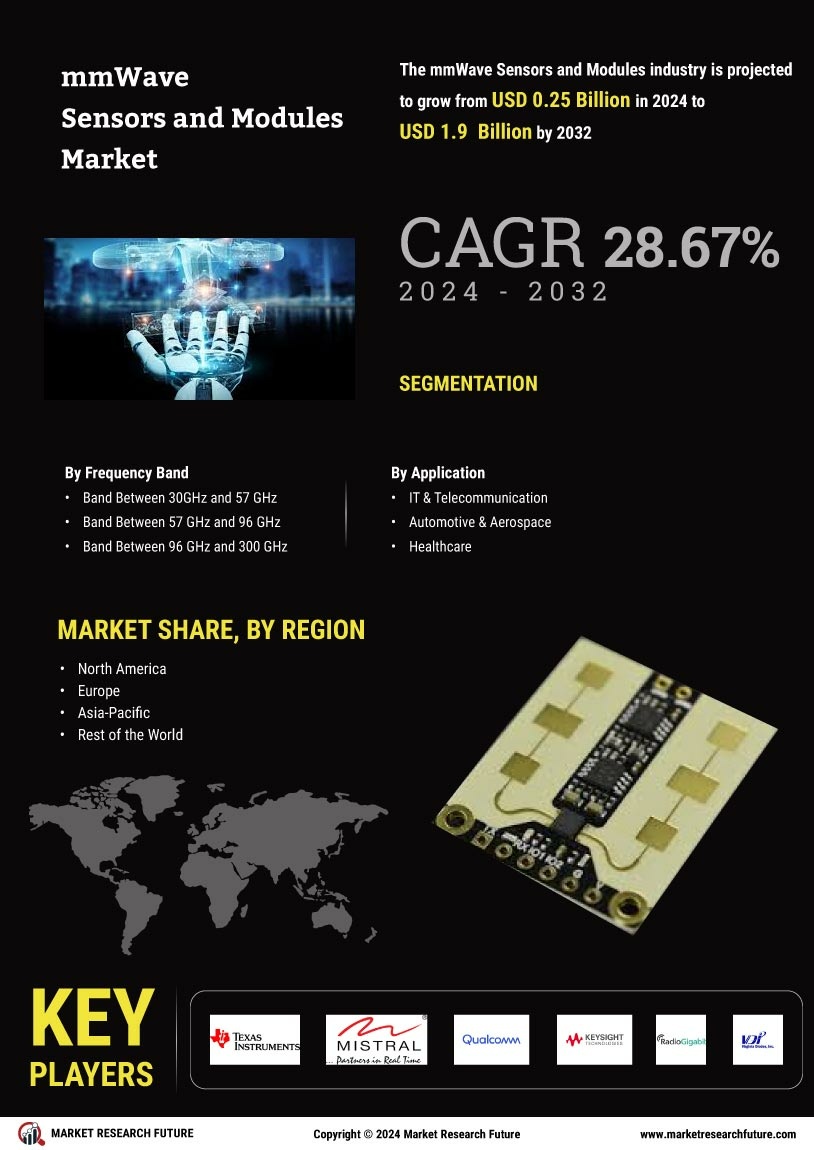

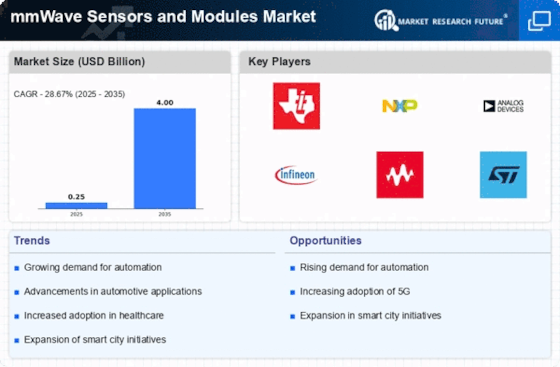

The rollout of 5G technology is significantly influencing the mmWave Sensors and Modules Market. With its promise of ultra-fast data speeds and low latency, 5G is expected to revolutionize various sectors, including telecommunications, automotive, and healthcare. mmWave sensors play a crucial role in enabling the high-frequency bands utilized by 5G networks, thus enhancing overall network performance. As 5G infrastructure continues to expand, the demand for mmWave modules is anticipated to grow correspondingly. Industry analysts project that the 5G market could reach a valuation of over 700 billion dollars by 2026, underscoring the potential for mmWave technologies to thrive in this evolving landscape.

Rising Demand for Smart Devices

The increasing proliferation of smart devices is a pivotal driver for the mmWave Sensors and Modules Market. As consumers and businesses alike seek enhanced connectivity and functionality, the demand for high-speed data transmission has surged. mmWave sensors, known for their ability to operate at high frequencies, facilitate faster data rates and improved performance in various applications, including smart homes and industrial automation. According to recent estimates, the market for smart devices is projected to reach several billion units by 2026, thereby propelling the need for advanced mmWave technologies. This trend indicates a robust growth trajectory for the mmWave Sensors and Modules Market, as manufacturers strive to meet the evolving demands of consumers and enterprises.

Emergence of Autonomous Vehicles

The advent of autonomous vehicles is poised to be a transformative force within the mmWave Sensors and Modules Market. These vehicles rely heavily on advanced sensing technologies to navigate and operate safely in complex environments. mmWave sensors provide critical data for object detection, distance measurement, and environmental mapping, making them indispensable for the development of self-driving cars. As automotive manufacturers invest heavily in research and development to bring autonomous vehicles to market, the demand for mmWave modules is expected to rise significantly. This trend suggests a promising future for the mmWave Sensors and Modules Market, as it aligns with the broader shift towards automation in transportation.

Increased Focus on Safety and Security

The heightened emphasis on safety and security measures across various industries is driving the mmWave Sensors and Modules Market. mmWave sensors are increasingly utilized in security applications, such as surveillance systems and intrusion detection, due to their ability to provide precise and reliable data. The automotive sector, in particular, is adopting mmWave technology for advanced driver-assistance systems (ADAS), which enhance vehicle safety through features like collision avoidance and adaptive cruise control. As regulatory standards for safety continue to tighten, the demand for mmWave sensors is likely to escalate, further propelling the growth of the mmWave Sensors and Modules Market.

Growing Applications in Industrial Automation

The increasing adoption of industrial automation technologies is a key driver for the mmWave Sensors and Modules Market. Industries are increasingly integrating mmWave sensors into their operations to enhance efficiency, reduce costs, and improve safety. These sensors facilitate real-time monitoring and control of manufacturing processes, enabling predictive maintenance and minimizing downtime. As industries strive for greater operational excellence, the demand for mmWave modules is likely to grow. Market Research Future indicates that the industrial automation sector is expected to witness substantial growth, potentially exceeding 300 billion dollars by 2026, thereby providing a fertile ground for the mmWave Sensors and Modules Market to flourish.