Growth in Automotive Sector

The automotive sector is a significant driver for the Mixed Xylene Market, as mixed xylene is utilized in the production of fuels and lubricants. With the automotive industry projected to grow at a compound annual growth rate of around 4% through 2025, the demand for mixed xylene is expected to follow suit. This growth is attributed to the increasing production of vehicles and the rising need for high-performance fuels. Additionally, the shift towards more efficient and cleaner fuel formulations may further enhance the role of mixed xylene in automotive applications, thereby solidifying its importance in the market.

Increased Use in Adhesives and Sealants

The Mixed Xylene Market is also benefiting from the rising use of mixed xylene in adhesives and sealants. These products are crucial in various applications, including construction, automotive, and consumer goods. The adhesives and sealants market is projected to grow at a steady pace, driven by the demand for durable and high-performance bonding solutions. In 2023, the adhesives segment accounted for around 15% of mixed xylene usage, indicating a solid market foothold. As industries continue to seek innovative bonding solutions, the Mixed Xylene Market is expected to experience increased demand, potentially leading to new product developments and applications.

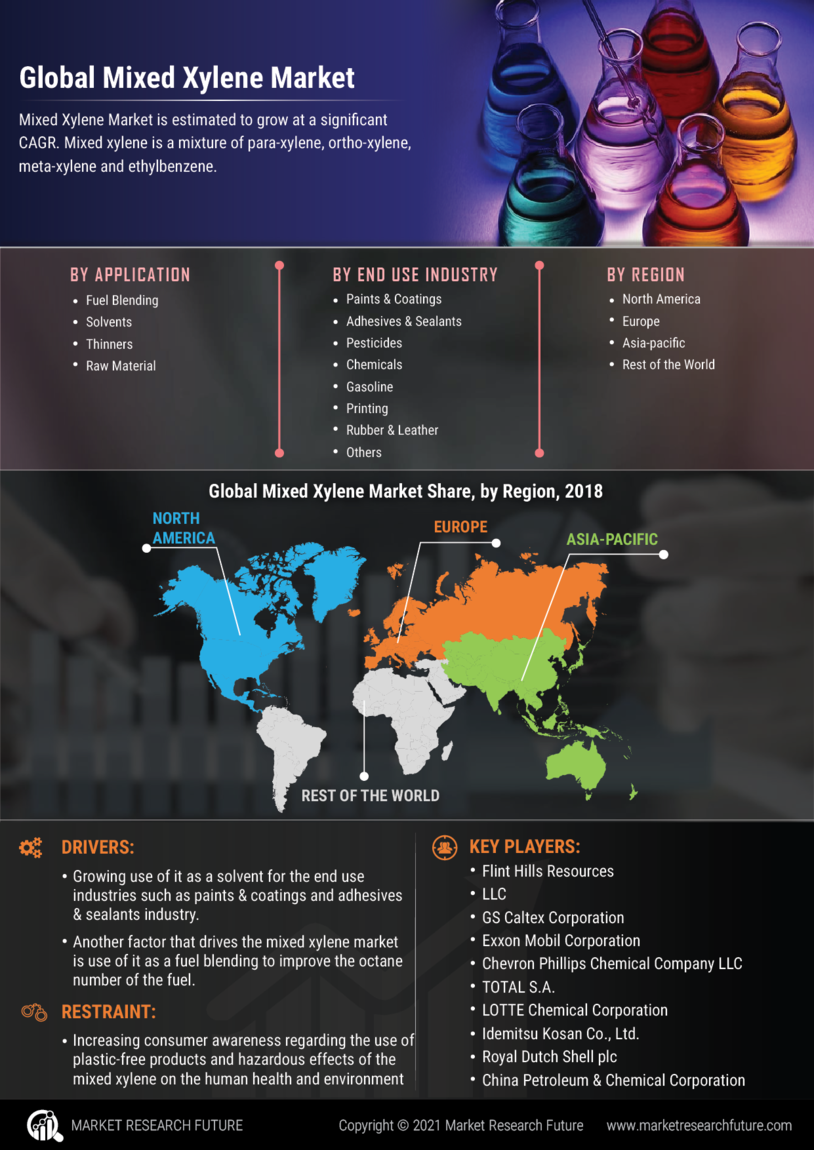

Rising Demand in Chemical Manufacturing

The Mixed Xylene Market is experiencing a notable increase in demand due to its essential role in chemical manufacturing. Mixed xylene serves as a key solvent and intermediate in the production of various chemicals, including plastics and synthetic fibers. As industries expand and innovate, the need for high-quality solvents is likely to rise. In 2023, the chemical manufacturing sector accounted for approximately 30% of the total mixed xylene consumption, indicating a robust market presence. This trend suggests that as production capacities increase, the Mixed Xylene Market will continue to benefit from sustained demand, potentially leading to further investments in production facilities.

Expansion of Paints and Coatings Industry

The paints and coatings industry is another critical driver for the Mixed Xylene Market. Mixed xylene is widely used as a solvent in the formulation of paints, varnishes, and coatings, which are essential for various applications, including construction and automotive refinishing. The Mixed Xylene Market is anticipated to grow significantly, driven by urbanization and infrastructure development. In 2023, this sector represented approximately 25% of mixed xylene consumption, highlighting its relevance. As demand for high-quality finishes and protective coatings increases, the Mixed Xylene Market is likely to see a corresponding rise in consumption, further bolstering market dynamics.

Regulatory Support for Petrochemical Industry

Regulatory frameworks supporting the petrochemical industry are likely to influence the Mixed Xylene Market positively. Governments are increasingly recognizing the importance of petrochemicals in economic development and are implementing policies that promote growth and sustainability. This regulatory support may lead to enhanced investment in mixed xylene production facilities and technologies. Furthermore, as environmental regulations evolve, the industry may adapt by developing more sustainable practices, which could open new avenues for mixed xylene applications. The interplay between regulation and market dynamics suggests that the Mixed Xylene Market could see a favorable environment for growth in the coming years.