Mining Drill Bits Size

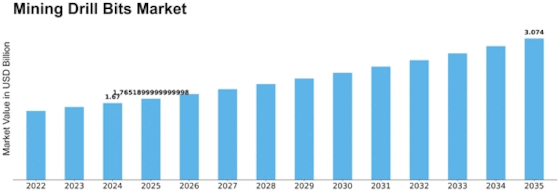

Mining Drill Bits Market Growth Projections and Opportunities

The mining drill bits market is influenced by several key market factors that drive its growth, dynamics, and competitive landscape. One of the primary factors impacting this market is the overall demand for minerals and metals. As industries such as construction, manufacturing, and infrastructure development continue to expand globally, there is a constant need for raw materials like coal, iron ore, copper, and gold. This sustained demand drives the need for mining operations, consequently fueling the demand for drill bits used in exploration and extraction processes.

Moreover, technological advancements play a significant role in shaping the mining drill bits market. Innovations in materials science, engineering designs, and manufacturing processes have led to the development of more durable, efficient, and versatile drill bits. Manufacturers are continuously investing in research and development to enhance the performance and longevity of their products, thereby catering to the evolving needs of mining companies for higher productivity and cost-efficiency.

Another crucial market factor is the exploration and exploitation of unconventional energy sources such as shale gas and oil sands. These resources require specialized drilling techniques and equipment, including drill bits designed to withstand the challenges posed by abrasive formations and extreme drilling conditions. The increasing focus on tapping into unconventional reserves has created opportunities for drill bit manufacturers to develop specialized products tailored to the unique requirements of these applications.

Furthermore, environmental regulations and sustainability concerns are shaping the mining industry and, consequently, the demand for drill bits. Governments worldwide are imposing stricter environmental standards to mitigate the impact of mining activities on ecosystems and local communities. This has led to a growing emphasis on sustainable mining practices, including the use of technologies that minimize environmental footprint and reduce waste generation. As a result, there is a rising demand for eco-friendly drill bits made from recyclable materials and designed for efficient resource utilization.

Additionally, economic factors such as commodity prices and market volatility significantly influence the mining drill bits market. Fluctuations in commodity prices can directly impact mining profitability and investment decisions, affecting the demand for drilling equipment and consumables like drill bits. Moreover, geopolitical factors, trade policies, and macroeconomic trends can create uncertainties in the market, influencing capital expenditure by mining companies and, consequently, the demand for drill bits.

Market competition is another key factor driving the dynamics of the mining drill bits market. The industry is characterized by intense competition among manufacturers vying for market share through product differentiation, pricing strategies, and technological innovation. Established players often leverage their brand reputation and global distribution networks to maintain a competitive edge, while new entrants focus on niche segments or disruptive technologies to gain a foothold in the market.

Lastly, the geographical distribution of mining activities and infrastructure development projects also shapes the demand for drill bits regionally. Emerging economies with rapidly growing industrial sectors, such as China, India, and Brazil, represent significant growth opportunities for drill bit manufacturers due to the increasing investment in infrastructure and urbanization projects. Conversely, mature markets like North America and Europe exhibit more stable demand patterns driven by replacement and upgrade cycles in existing mining operations.

Leave a Comment