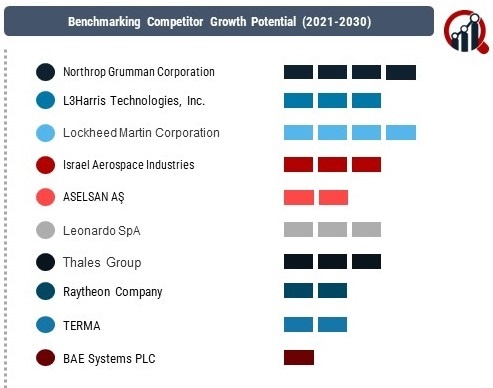

Top Industry Leaders in the Military Radar Systems Market

Key Players Military Radar Systems Market Dominance:

Northrop Grumman Corporation (US),

L3Harris Technologies, Inc. (US),

Lockheed Martin Corporation (US),

Israel Aerospace Industries (Israel),

ASELSAN AŞ (Turkey),

Leonardo SpA (Italy),

Thales Group (France),

Raytheon Company (US),

TERMA (Denmark),

BAE Systems PLC (UK),

SAAB AB (Sweden),

HENSOLDT (Germany).

Strategies Adopted by Market Leaders: Market leaders deploy a mix of strategies to sustain and enhance their positions. Continuous investment in research and development (R&D) is a common thread, with a focus on next-gen radar technologies. Lockheed Martin, for example, emphasizes innovation through partnerships with academic institutions and collaborations with technology startups. Additionally, strategic mergers and acquisitions remain pivotal, with Northrop Grumman's acquisition of Orbital ATK being a recent example, bolstering its radar capabilities.

Factors for Market Share Analysis: Several factors contribute to the market share dynamics. Technological innovation is a key differentiator, and companies investing in the development of multifunctional and electronically scanned array (ESA) radars often gain a competitive edge. Geographical presence also plays a crucial role, with companies strategically expanding their footprints to cater to regional defense needs. Government contracts and alliances are instrumental, shaping market share through major defense procurement programs.

New and Emerging Companies: While established players dominate, the military radar systems market also sees the emergence of new and innovative companies. Aselsan A.S., a Turkish defense company, has gained recognition for its radar solutions. Their product line includes ground-based and naval radars, showcasing the growing influence of non-traditional players in the market. Additionally, start-ups like RADA Electronic Industries are making waves with compact, mobile radar systems, disrupting traditional market dynamics.

Industry News and Technological Advancements: The industry is abuzz with constant technological advancements and strategic developments. The adoption of gallium nitride (GaN) technology is a notable trend, enhancing radar performance with higher power densities and efficiency. News of successful radar field tests, such as the integration of AESA radar on fighter jets, further exemplifies the industry's commitment to pushing technological boundaries. Collaborations between defense contractors and technology firms also mark a trend, as seen in the integration of artificial intelligence and machine learning into radar systems.

Current Company Investment Trends: Investment trends in the military radar systems market reflect the industry's commitment to innovation and adaptation. Companies are allocating significant budgets to R&D to stay ahead in the technological curve. Funding partnerships with government agencies are common, facilitating the development of advanced radar solutions. Moreover, investments in cybersecurity measures for radar systems are gaining traction, addressing the rising concern of cyber threats compromising national defense infrastructure.

Overall Competitive Scenario: The overall competitive scenario in the military radar systems market is characterized by a delicate balance between traditional heavyweights and emerging players. Established companies strive to maintain technological superiority and global reach, while newer entrants disrupt the market with niche solutions and agile approaches. The industry's responsiveness to geopolitical developments and defense policy changes further adds complexity to the competitive landscape. As defense budgets fluctuate and nations prioritize different aspects of their defense capabilities, the competition within the military radar systems market is expected to remain fierce, fostering innovation and ensuring the continual evolution of this critical sector.

Recent News :

Raytheon, for instance, is renowned for its cutting-edge radars like the AN/SPY-6, while Lockheed Martin's AN/TPQ-53 has gained acclaim for its advanced counterfire target acquisition capabilities.

Raytheon Technologies:

January 6, 2024: Received a $160 million contract from the U.S. Navy to deliver advanced Dual-band Radars for warships, enhancing detection and tracking capabilities against air and surface threats.

October 26, 2023: Successfully tested its SPY-6(V)3 Enterprise Air Surveillance Radar on board the USS John F. Kennedy aircraft carrier, marking a significant milestone in next-generation naval radar technology.

Lockheed Martin:

December 12, 2023: Awarded a full-rate production contract for its AN/TPQ-53 radar systems by the U.S. Army, solidifying its position as a major supplier of ground-based air defense radars.

September 20, 2023: Unveiled its new Long Range Precision Radar (LRPR), designed for early warning and tracking of hypersonic and other advanced threats, showcasing its focus on counteracting emerging technologies.

Thales Group:

November 8, 2023: Secured a contract with the French Ministry of Defense to provide its Groundmaster 400 radars for air defense purposes, demonstrating its dominance in European radar systems.

June 14, 2023: Partnered with Airbus to develop a new multi-function radar for future European combat aircraft, highlighting collaboration in next-generation air warfare technology.