Top Industry Leaders in the Military Protective Eyewear Market

Key Players

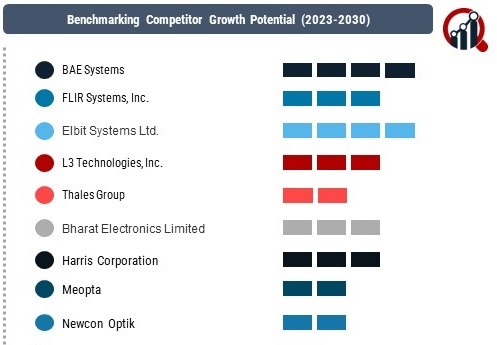

BAE Systems.

FLIR Systems, Inc.

Elbit Systems Ltd.

L3 Technologies, Inc.

Thales Group

Bharat Electronics Limited (BEL)

Harris Corporation

Meopta

Newcon Optik

the safety and effectiveness of military personnel in diverse operational environments.

Strategies Adopted In a market where precision and protection are paramount, key players employ strategic approaches to maintain a competitive edge. Technological innovation is a cornerstone strategy, with companies investing heavily in advanced materials and lens technologies to enhance protection without compromising visibility. Oakley, renowned for its cutting-edge eyewear technologies, frequently introduces lenses with enhanced contrast and anti-fog coatings, catering to the diverse needs of military professionals.

Strategic partnerships and collaborations are also common in this sector, with companies often joining forces with defense contractors or military branches to ensure their products meet stringent standards. Revision Military, for instance, collaborates closely with defense agencies to develop eyewear solutions that integrate seamlessly with other protective gear, reflecting a commitment to holistic protection strategies.

Factors for Market Share Analysis Several factors contribute to the analysis of market share in the Military Protective Eyewear Market. The adherence to and certification under stringent ballistic standards, such as the Ballistic Eyewear Standard (MIL-PRF-31013) and the Occupational and Educational Personal Eye and Face Protection Devices Standard (ANSI Z87.1), are key indicators of a company's commitment to quality and compliance. The ability to provide a diverse range of eyewear solutions, including ballistic goggles, sunglasses, and prescription eyewear, also plays a crucial role in market share considerations.

Established relationships with defense agencies and military branches are significant market share factors. Companies with long-standing contracts or preferred supplier status are better positioned to maintain and expand their market share. Additionally, a proactive approach to addressing emerging threats and adapting eyewear solutions accordingly demonstrates a company's agility and foresight, influencing its standing in the competitive landscape.

New and Emerging Companies While established players dominate the Military Protective Eyewear Market, new and emerging companies are making notable strides in introducing innovative solutions. Venture capitalists and startups are exploring niche segments within the market, focusing on specialized eyewear for specific military roles or introducing novel materials and manufacturing techniques.

One such emerging player is Noisefighters, a company gaining recognition for its advanced ear protection solutions. While not a traditional eyewear manufacturer, their integration of innovative technologies showcases the potential for newcomers to disrupt the market by addressing unmet needs in peripheral areas of military protection. As technology continues to advance, opportunities for new entrants to introduce disruptive solutions in the military eyewear space are likely to increase.

Industry News Staying abreast of industry news is essential in understanding the rapidly evolving dynamics of the Military Protective Eyewear Market. Recent developments include advancements in augmented reality (AR) and heads-up display (HUD) technologies integrated into eyewear, providing military personnel with real-time information and enhancing situational awareness. Companies like BAE Systems are at the forefront of these innovations, showcasing the convergence of cutting-edge technologies with protective eyewear.

The market has also witnessed developments in smart eyewear with communication capabilities, enabling seamless coordination among military units. These advancements reflect a broader trend in the defense industry toward integrating digital technologies into traditional equipment, underscoring the need for protective eyewear to go beyond basic ballistic protection.

Current Company Investment Trends Investment trends in the Military Protective Eyewear Market reveal a focus on research and development to meet evolving military requirements. Companies are allocating resources to enhance the durability, clarity, and adaptability of protective eyewear. Research initiatives often target advancements in lens materials, such as high-index plastics and photochromic technologies, to improve optical performance in varying light conditions.

The integration of smart technologies is a prominent investment trend, with companies exploring ways to incorporate heads-up displays, communication systems, and even biometric sensors into eyewear. This aligns with the broader trend of developing interconnected systems that enhance the capabilities of military personnel on the field. Investments in manufacturing processes, including 3D printing and advanced materials like graphene, also showcase a commitment to staying at the forefront of technological innovation.

Overall Competitive Scenario In conclusion, the competitive landscape of the Military Protective Eyewear Market is shaped by established industry leaders that prioritize innovation, quality, and compliance with stringent standards. These key players leverage technological advancements, strategic collaborations, and a diverse product portfolio to maintain dominance. Market share analysis considers factors such as adherence to ballistic standards, relationships with defense agencies, and responsiveness to emerging threats.

Emerging companies, though fewer in number, contribute to the market's dynamism by introducing niche solutions and leveraging cutting-edge technologies. Industry news reflects the integration of augmented reality, heads-up displays, and smart technologies into protective eyewear, showcasing the market's evolution toward more sophisticated and interconnected solutions.

Current investment trends emphasize research and development, with a focus on advanced materials, smart technologies, and manufacturing processes. As the Military Protective Eyewear Market continues to evolve, companies that can balance technological innovation with strategic partnerships and a commitment to meeting the specific needs of military professionals are poised to shape the future of this critical sector.

Recent News Top of Form

Revision Military

Launched the SawFly™ goggle system, featuring modular ballistic lenses and customizable headstraps for optimal fit and performance in diverse operational environments.

Partnered with a research institute to develop next-generation helmet-mounted displays (HMDs) for enhanced situational awareness and information overlay on the battlefield.

Oakley SI

Secured a multi-million dollar contract with the U.S. Army to supply their SI ballistic sunglasses, showcasing their lightweight and comfortable designs for everyday troop protection.

Unveiled a prototype ballistic visor with augmented reality capabilities, potentially transforming soldier vision and battlefield decision-making.

ESS (Eye Safety Systems)

Introduced the Crosshairs™ ballistic goggles, boasting improved peripheral vision and compatibility with night vision devices, catering to special operations and close-quarters combat needs.

Collaborated with a textile company to develop fog-resistant and anti-scratch coatings for their lenses, ensuring optimal clarity and performance in all weather conditions.

Bolle Safety

Expanded their line of ballistic eyewear with prescription lens options, catering to soldiers with vision correction needs without compromising ballistic protection.

Focuses on sustainable practices by utilizing recycled materials and eco-friendly manufacturing processes in their protective eyewear production.