Military Helmet Size

Military Helmet Market Growth Projections and Opportunities

The Military Helmet market is subject to a myriad of factors that collectively shape its landscape and growth patterns. A primary driver for this market is the increasing focus on soldier safety and modernization of military forces worldwide. As armed forces seek to enhance the protection and survivability of their personnel, the demand for advanced military helmets has surged. These helmets are designed to offer ballistic protection, incorporate communication systems, and provide compatibility with other technologies, addressing the evolving needs of modern warfare. Such increased demand serves as a notable impulse to market growth. This, in turn, encourages manufacturers to carry out thorough research and development, irrespective of which company will finally emerge victorious. They need to roll-out innovative and high-end helmets that will satisfy the needs of the military.

Technological innovations of great importance transform the competitive-nature at the Military Helmet market. A modern military helmet will combine the development in materials, the production technique and the software. This will make it stronger, lighter and of course more resourceful in fighting the battle. Helmets are progressively furnishing with systems such as the heads-up display, communication and even, the night vision capabilities to enhance the performance of the soldiers in the battlefield. It is manufacturers who consistently spend on R&D with utmost priority to safeguard their position as the top-of-the-line club in the world of military beckets who dictate the standards for defense services world wide.

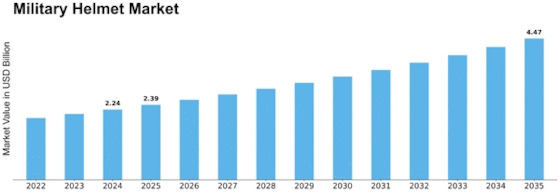

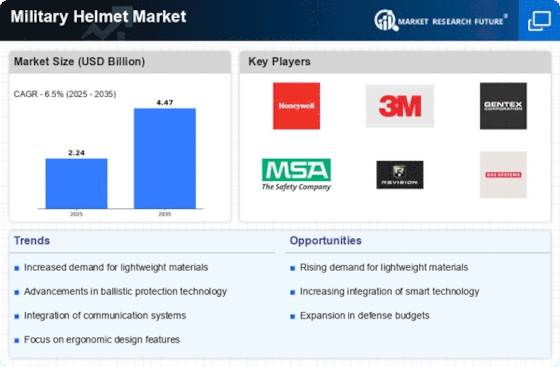

The Military helmet industry is expected to mount up to USD 3.2633 billion in 2030, which is with a compound annual growth rate (CAGR) of 6.50% from its present position upto the end of the forecast period. The market has mainly been growing as a result of the augmented defense forces’ interest in soldier capability development paradigm and an increased number of initiatives to modularize soldiers, both being the forces pushing the market development path.

The foreign political aspects of the market for Military Helmet are guided by the advancement of nations that undertake military modernization programs in a move to respond to the emerging dangers. Technology developments of conflicts and security issues in the present day requires the military forces to give allotment of high-technology protection tools say helmets. Geopolitical tensions and, in view of that, military preparation increase the demand of the market, as the armed forces are in dire need of military helmets of the modern models to protect their soldiers from the shooting and blows.

Economic considerations, too, being determining factors in the market, as the defense budget has correlation with equipment procurement by miliatary. Economic stability, government priorities in the usage of sources of supply and regional security all affect the amount of money earmarked for defense sectors together. Uncertainty in the defense market can trigger difficulties for the producers to which they should establish close ties with the global economic situation and geopolitical fluctuations to respond to the changes by customizing their strategies and the offered products.

The military helmets adoption for law enforcement and peacekeeping missions by security organizations is a swing for the market sector. Agencies involved in enforcing laws and using peacekeeping forces emphasize the need to furnish their workers with modern helmet systems. This lead to a situation where many manufacturers are now producing a range of helmets able to supply the dynamic needs of these civilian sectors, in turn making the market bigger and players more adaptive.

Consequently, the military helmets market is susceptible to multiple government and privately established regulations and compliance standards. Given the critical role of helmets in protecting the lives of military personnel, adherence to strict quality and safety standards is imperative. Manufacturers must ensure that their military helmets meet or exceed these standards to gain approvals and certifications. This regulatory landscape adds complexity to the development and marketing processes, influencing market competitiveness.

Leave a Comment