Top Industry Leaders in the Mid Wave Infrared MWIR Sensors Market

A Competitive Landscape of Mid-Wave Infrared (MWIR) Sensor Market:

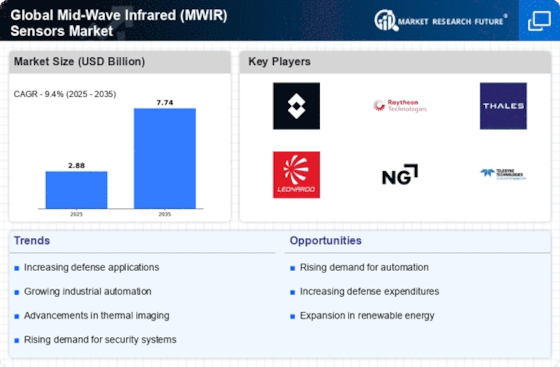

The global MWIR sensor market growth is fueled by the versatility and unmatched capabilities of MWIR technology in diverse applications, spanning defense, aerospace, industrial, and even commercial sectors. Navigating this dynamic landscape requires a keen understanding of the competitive terrain, the strategies employed by key players, and the factors influencing market share.

Some of the Mid Wave Infrared MWIR Sensors companies listed below:

- SemiConductor Devices

- Teledyne FLIR LLC

- Lynred

- Leonardo S.p.A.

- GSTIR

- Silent Sentinel

- Ascendent Technology Group

- Excelitas Technologies Corp.

- Opto Engineering

- New Infrared Technologies (NIT)

Strategies adopted by key players:

The competitive landscape is fiercely contested, with players adopting diverse strategies to gain an edge. Here are some key tactics:

- Product Differentiation: Companies invest in developing unique features and functionalities to stand out from the crowd. This could involve advancements in resolution, sensitivity, operating temperature, or integration with other technologies like AI or machine learning.

- Vertical Specialization: Focusing on specific application segments like automotive night vision, medical diagnostics, or gas leak detection allows for deeper market penetration and tailored solutions.

- Cost Optimization: Balancing high performance with affordability is crucial, especially for commercial applications. New materials, efficient cooling technologies, and streamlined manufacturing processes are key aspects of cost reduction strategies.

- M&A and Partnerships: Strategic acquisitions and collaborations can expand market reach, access new technologies, and strengthen existing product lines. This is particularly relevant for smaller players seeking to compete with established giants.

Factors Shaping Market Share:

Understanding the factors influencing market share is critical for both established and emerging players. These include:

- Technological Advancements: Continuous innovation in materials, detector design, and signal processing algorithms dictates the performance and capabilities of MWIR sensors, directly impacting market share.

- Government Spending: Defense and aerospace applications drive a significant portion of the MWIR market. Fluctuations in government spending on these sectors can significantly impact market dynamics.

- Regulatory Landscape: Stringent regulations regarding export controls and intellectual property can pose challenges for certain players and restrict market access.

- Regional Demand: The demand for MWIR sensors varies significantly across different regions, with Asia Pacific and North America currently leading the charge. Understanding regional trends and tailoring offerings accordingly is crucial for success.

Latest Company Updates:

On Sep. 07, 2023, At SEMICON Taiwan 2023, IGO Photonics featured in Poland's national pavilion co-organized by the Polish Development Fund, Polish Investment and Trade Agency, Industrial Development Agency, and Łukasiewicz Research Network. In 2022, the company launched its office in Taiwan, marking its first foothold in the Asian market.

Thanks to its earlier investments, VIGO's offerings now include indium arsenide antimonide (InAsAb)-based MWIR and LWIR detectors, indium arsenide (InAs), and indium gallium arsenide (InGaAs)-based SWIR detectors. VIGO aims to gain a leading position on the PIC for the MWIR market while acquiring a significant share of the SWIR-based PIC market.

On Dec. 13, 2022, Clear Align LLC, an electro-optics specialist, introduced the VZ 1200 series of MWIR multimodal wide area surveillance systems for long-range persistent surveillance applications like perimeter security and border control. These thermal/ cooled MWIR cameras are for day or nighttime surveillance and offer 26 to 42 % longer range than their nearest competitors.

The VZ 1200 MWIR long-range camera system integrates a 1200-millimeter MWIR spectral range camera monitoring electrical transmission towers as far as 38 miles. Also available for performance imagery are systems with 900- and 600-millimeter standard and high-definition cooled MWIR sensor technology.

On Apr. 02, 2023, Leonardo DRS announced receiving a $94.8 million contract from the Army Contracting Command at Aberdeen Proving Ground, Md., for a series of Weapons Sights-Sniper Improved Night/Day Observation Device (INOD) Block III system. The Leonardo DRS Electro-Optical Infrared Systems segment suits the requirement of the U.S. Army for a thermal weapon sight for special operations soldiers.

Leonardo DRS to build mercury cadmium telluride infrared thermal weapon sight for special forces snipers. The INOD employs a mercury cadmium telluride passive micro-cooled mid-wave infrared (MWIR) sensor providing a quality 640-by-480-pixel resolution that is usable with day scope magnifications from 5x to more than 25x to match or exceed current sniper weapons systems capabilities. INOD is ruggedized for use with all Special Forces and U.S. Army sniper weapons -- particularly for long-range target detection and identification.