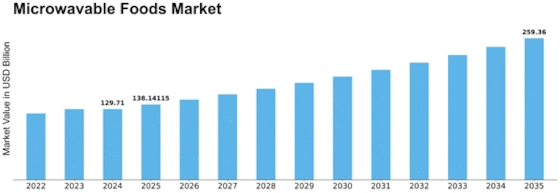

Microwavable Foods Size

Microwavable Foods Market Growth Projections and Opportunities

The Microwavable Foods Market is influenced by various market factors that shape its dynamics and growth trajectory. One crucial factor is the increasing pace of modern lifestyles, where consumers seek convenient and time-saving meal solutions. The hectic schedules of individuals and families have led to a rising demand for quick and easy-to-prepare meals, making microwavable foods a convenient choice. This trend is particularly evident in urban areas where time constraints often limit the preparation of elaborate meals.

Another significant market factor is the growing awareness of health and wellness among consumers. With an increasing focus on maintaining a balanced lifestyle, there is a rising demand for microwavable food options that align with health-conscious choices. Market players have responded by introducing healthier alternatives, such as organic, low-sodium, and preservative-free microwavable meals, catering to the evolving preferences of health-conscious consumers.

The global shift towards urbanization is also impacting the microwavable foods market. As more people migrate to urban areas in search of better economic opportunities, the demand for convenient and ready-to-eat meals has surged. Urbanization is often accompanied by smaller living spaces and busier lifestyles, further fueling the need for quick and hassle-free meal options that microwavable foods offer.

Moreover, the influence of technology on the market cannot be ignored. Advancements in food processing and packaging technologies have played a pivotal role in enhancing the quality, taste, and shelf life of microwavable foods. Innovative packaging solutions, including microwave-safe materials and technologies that retain the freshness of the food, have contributed to the market's growth. Additionally, the development of microwaveable packaging that allows for even cooking and heating has improved the overall consumer experience.

Economic factors also contribute to the market dynamics of microwavable foods. The affordability and cost-effectiveness of these products make them an attractive option for a wide range of consumers, including students, working professionals, and families on a budget. The competitive pricing of microwavable meals compared to dining out or ordering takeout further enhances their market appeal, especially during economic uncertainties.

Furthermore, the influence of cultural shifts and changing dietary preferences impacts the market for microwavable foods. As globalization continues to connect diverse cultures, consumers are exposed to a variety of cuisines, leading to a demand for convenient options that reflect this cultural diversity. Manufacturers are responding by introducing a range of international flavors and cuisines in microwavable formats, catering to the multicultural palate of consumers.

Environmental sustainability is emerging as a critical factor influencing the microwavable foods market. As consumers become more environmentally conscious, there is a growing demand for sustainable and eco-friendly packaging options. Market players are responding by exploring and adopting packaging solutions that minimize environmental impact, such as recyclable and biodegradable materials, to align with the values of environmentally conscious consumers.

Leave a Comment