Top Industry Leaders in the Micro Server Market

Competitive Landscape of the Micro Server Market: Navigating a Dynamic Terrain

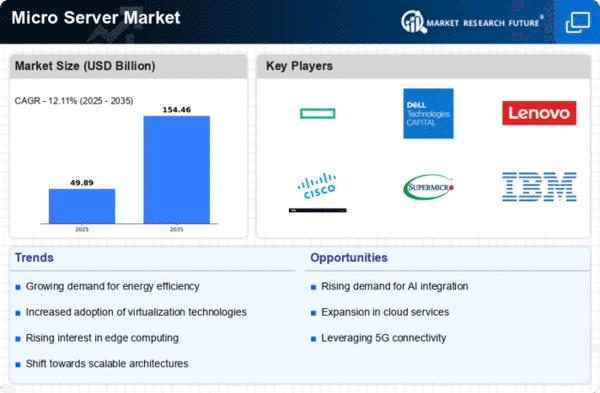

The micro server market, catering to compact, low-power computing solutions, is experiencing a surge in demand driven by the proliferation of cloud computing, Internet of Things (IoT), and edge computing applications. This dynamic landscape presents both opportunities and challenges for established players and aspiring entrants. To navigate this terrain effectively, understanding the competitive landscape is crucial.

Key Players:

-

Hewlett Packard (U.S.)

-

Dell (U.S.)

-

Fujitsu (Japan)

-

Hitachi (Japan)

-

NEC (Japan)

-

IBM (U.S.)

-

Quanta (Taiwan)

-

AMD (U.S.)

-

Tyan (Taiwan)

-

Acer Inc. (Taiwan)

-

Calxeda, Inc. (U.S.)

Factors for Market Share Analysis:

-

Product Portfolio: Offering a diverse range of micro servers catering to different performance, power consumption, and budget requirements is crucial.

-

Technological Innovation: Continuously developing energy-efficient designs, high-performance processors, and advanced cooling solutions is key to staying ahead of the curve.

-

Software and Services: Providing comprehensive software support, cloud integration, and managed services packages enhances customer value proposition.

-

Channel Partnerships: Building strong partnerships with distributors, resellers, and system integrators expands market reach and caters to diverse customer segments.

-

Sustainability: Demonstrating commitment to environmental responsibility through energy-efficient designs and responsible sourcing practices resonates with modern businesses.

New and Emerging Companies:

-

Whitebox Server Manufacturers: Companies like Mitac International Corporation and Marvell Technology Group are gaining traction by offering customizable whitebox micro server solutions at competitive prices.

-

Start-ups: Young companies like RISC-V International and Esperanto Technologies are developing innovative micro server architectures based on RISC-V processors, offering potential for increased performance and efficiency.

-

Specialized Micro Server Providers: Companies like Edge Computing Solutions and MicroMod are catering to specific niche markets like edge computing and high-performance computing, offering tailored solutions for these demanding applications.

Current Investment Trends:

-

Focus on Software and Services: Players are increasingly investing in developing software stacks and managed services to complement their hardware offerings, driving recurring revenue streams and customer lock-in.

-

Open Source and Cloud Integration: Open-source software and cloud-native architectures are gaining traction, prompting investments in compatibility and integration with these platforms.

-

Artificial Intelligence and Machine Learning: Integrating AI and ML capabilities into micro servers is a growing trend, opening up new application possibilities in areas like edge computing and smart infrastructure.

-

Sustainability Initiatives: Investments in energy-efficient designs, renewable energy sources, and responsible manufacturing practices are becoming increasingly important for attracting environmentally conscious customers.

Latest Company Updates:

-

November 15, 2023: Dell expands its microserver offerings with PowerEdge T350: Dell introduced its PowerEdge T350 microserver, designed for small businesses and branch offices. The T350 features Intel Xeon processors and a compact design.

-

December 12, 2023: HPE reports strong growth in microserver sales: Hewlett Packard Enterprise (HPE) announced a 25% year-over-year increase in microserver sales in Q3 2023, attributing it to the growing demand for edge computing solutions.

-

January 10, 2024: Intel launches new Atom processors for microservers: Intel announced its new Atom C5200 series processors, specifically designed for microservers and edge computing applications. These processors offer improved performance and power efficiency compared to previous generations.