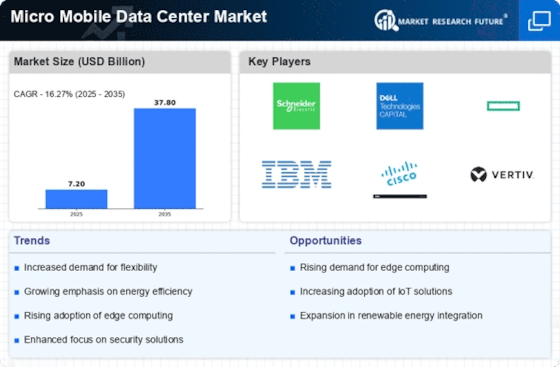

Top Industry Leaders in the Micro Mobile Data Center Market

Competitive Landscape of Micro Mobile Data Center Market: A Thriving Frontier

The micro mobile data center market is experiencing explosive growth, fueled by the burgeoning demand for edge computing, cloud adoption, and digital transformation across industries. These compact, self-contained units, housing computing, storage, and networking capabilities, offer agility, scalability, and rapid deployment options, making them ideal for edge deployments. Navigating this dynamic landscape necessitates an understanding of the key players, their strategies, and the factors shaping market share dynamics.

Key Players:

-

Schneider Electric SE (France)

-

Canovate Group (Turkey)

-

Elliptical Mobile Solutions (U.S.)

-

Huawei Technologies Co. Ltd. (China)

-

Panduit Corp (U.S.)

-

Rittal (Germany)

-

Wave-2-Wave Solution Corporation (U.S.)

-

Zellabox (Australia)

-

Dell Inc. (U.S.)

-

Silicon Graphics, Inc. (U.S.)

Market Share Analysis:

-

Technology & Features: Advanced cooling technologies, energy efficiency, containerization, and remote management capabilities are critical differentiators. Players like Vertiv and Schneider Electric focus on energy-efficient designs, while Vapor IO emphasizes liquid cooling for high-density applications.

-

Vertical Specialization: Targeting specific industry needs with tailored solutions is crucial. Dell EMC offers healthcare-specific MDCs, while Ericsson partners with industrial automation players for customized edge solutions.

-

Pricing & Service Model: Cost-effectiveness, flexible financing options, and subscription-based models are key to attracting budget-conscious customers. Startups like EdgeMicro offer pay-as-you-go models, while established players like HPE provide managed service options.

-

Partnerships & Ecosystem: Building strong partnerships with technology providers, system integrators, and consulting firms expands reach and offers comprehensive solutions. Cisco collaborates with network operators and cloud providers, while Dell EMC partners with software vendors to enhance MDC functionality.

New & Emerging Companies:

-

Cloud Service Providers (CSPs): Amazon Web Services (AWS) and Microsoft Azure are entering the market with offerings like AWS Outposts and Azure Stack Edge, blurring the lines between cloud and edge computing.

-

Modular Construction Companies: Manufacturers like Flex and Quanta Computer are leveraging their expertise in modular solutions to develop prefabricated MDCs, further streamlining deployment.

-

Sustainable Technology Players: Companies like Equinor and Bloom Energy are developing micro data centers powered by renewable energy sources, catering to eco-conscious customers.

Current Investment Trends:

-

Automation & AI: Players are investing heavily in automation and AI-powered management tools for remote monitoring, predictive maintenance, and self-healing capabilities.

-

Cybersecurity: With increased attack surfaces at the edge, cybersecurity solutions integrated into MDCs are a major focus. Companies like Vertiv are offering advanced security features to protect edge deployments.

-

Software-Defined Infrastructure (SDI): The integration of SDI tools to enable software-driven control and orchestration of MDC infrastructure is gaining traction. Startups like Vapor IO are leading the charge in this area.

Latest Company Updates:

-

Oct 26, 2023: Dell Technologies unveils its new Micro Data Center portfolio, featuring modular and pre-configured solutions for edge deployments.

-

Nov 15, 2023: Huawei announces its next-generation micro data center, offering improved performance and efficiency for edge applications.

-

Dec 05, 2023: Colt Technology Services partners with Vertiv to offer managed micro data center solutions for enterprises.

-

Jan 10, 2024: Emerson Network Power launches its new Emerson Liebert APM Micro Data Center, designed for harsh environments and remote locations.