Market Growth Projections

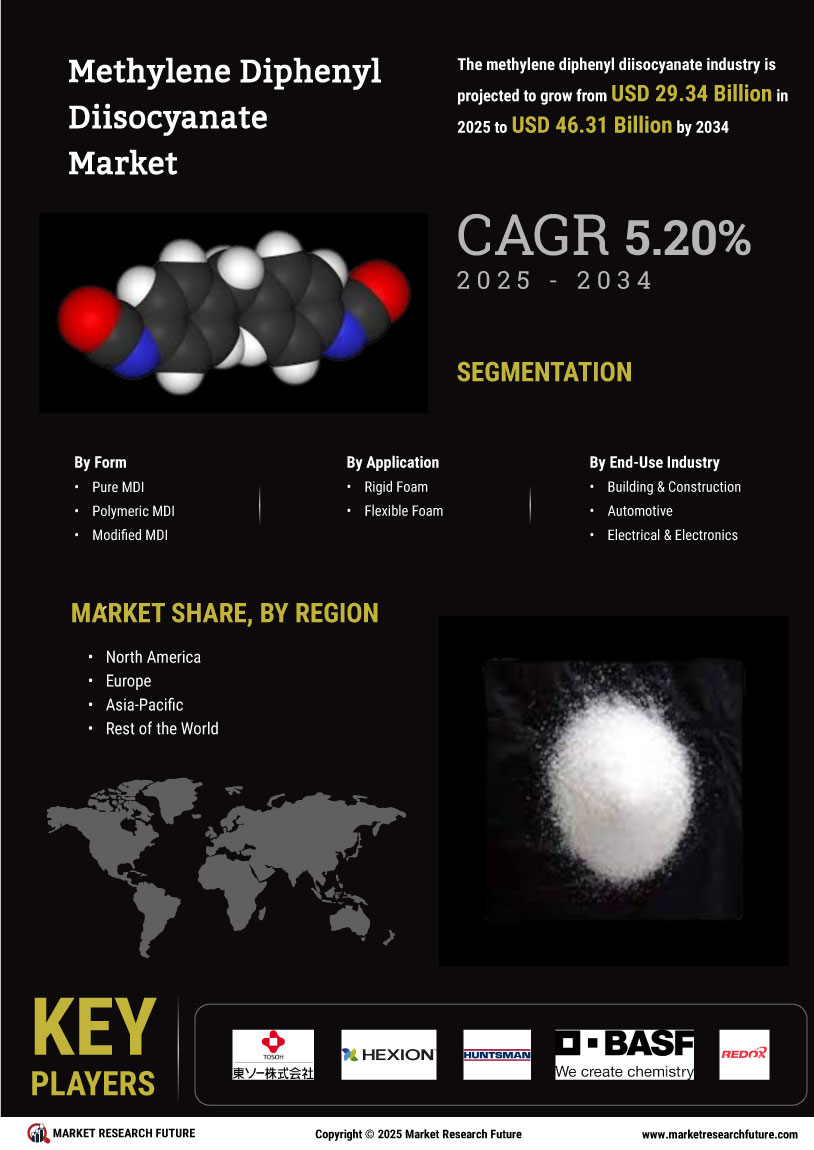

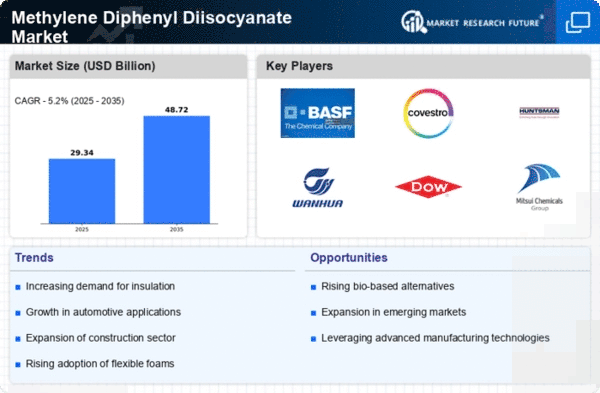

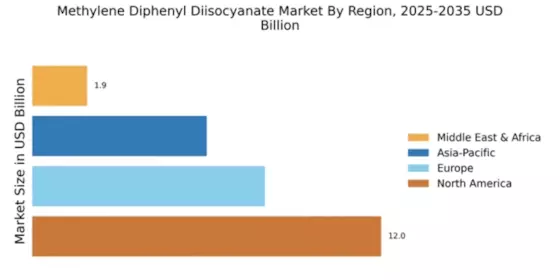

The Global Methylene Diphenyl Diisocyanate Market Industry is projected to experience substantial growth over the next decade. With a market value anticipated to reach 27.9 USD Billion by 2024 and further expand to 48.7 USD Billion by 2035, the industry is on a promising trajectory. The compound annual growth rate of 5.2% from 2025 to 2035 indicates a robust demand across various sectors. This growth is driven by factors such as increased urbanization, technological advancements, and a growing focus on sustainability, positioning the market favorably for future developments.

Expansion of End-Use Industries

The expansion of various end-use industries, including furniture, textiles, and electronics, is a crucial driver for the Global Methylene Diphenyl Diisocyanate Market Industry. The versatility of Methylene Diphenyl Diisocyanate Market allows it to be utilized in a wide range of applications, from cushioning materials in furniture to coatings in electronics. As these industries continue to grow and innovate, the demand for high-performance materials is likely to increase. This broad applicability suggests a sustained upward trajectory for the market, as manufacturers seek to leverage the unique properties of Methylene Diphenyl Diisocyanate Market in their products.

Growth in Automotive Applications

The automotive industry is another pivotal driver for the Global Methylene Diphenyl Diisocyanate Market Industry. The material is utilized in manufacturing lightweight and durable components, which are essential for enhancing fuel efficiency and performance in vehicles. As manufacturers strive to meet stringent environmental regulations and consumer demand for fuel-efficient vehicles, the adoption of Methylene Diphenyl Diisocyanate Market-based products is likely to rise. This trend is anticipated to bolster the market, with a projected compound annual growth rate of 5.2% from 2025 to 2035, indicating a robust future for this segment.

Rising Demand in Construction Sector

The Global Methylene Diphenyl Diisocyanate Market Industry is experiencing a surge in demand driven by the construction sector. Methylene Diphenyl Diisocyanate Market is a key component in the production of polyurethane foams, which are extensively used in insulation materials and construction applications. As urbanization continues to escalate, particularly in developing regions, the need for energy-efficient building materials is paramount. This trend is expected to contribute significantly to the market's growth, with projections indicating that the market could reach 27.9 USD Billion by 2024, reflecting the increasing reliance on advanced materials in construction.

Technological Advancements in Production

Technological innovations in the production of Methylene Diphenyl Diisocyanate Market are poised to enhance efficiency and reduce costs within the Global Methylene Diphenyl Diisocyanate Market Industry. Advances in chemical processing techniques and the development of more sustainable production methods are likely to improve yield and lower environmental impact. These innovations not only cater to regulatory demands but also align with the growing consumer preference for eco-friendly products. As a result, manufacturers may experience increased competitiveness and profitability, further driving market growth in the coming years.

Increasing Awareness of Energy Efficiency

The Global Methylene Diphenyl Diisocyanate Market Industry is benefiting from a heightened awareness of energy efficiency among consumers and businesses alike. Methylene Diphenyl Diisocyanate Market-based products, particularly in insulation applications, contribute significantly to energy conservation in buildings and industrial processes. As governments worldwide implement stricter energy efficiency regulations, the demand for such materials is expected to rise. This trend is likely to propel the market towards an estimated value of 48.7 USD Billion by 2035, reflecting the growing emphasis on sustainability and energy-efficient solutions across various sectors.