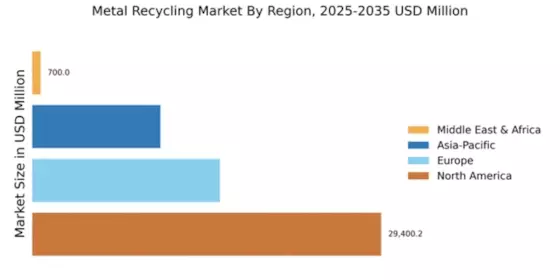

North America : Market Leader in Recycling

North America is poised to maintain its leadership in the metal recycling market, holding a significant share of 29400.2 million in 2024. The region's growth is driven by stringent environmental regulations, increasing demand for recycled metals, and advancements in recycling technologies. The push for sustainability and circular economy practices further catalyzes market expansion, making it a focal point for investment and innovation. The United States stands out as the leading country, with major players like Nucor Corporation and Commercial Metals Company driving competition. The presence of established firms such as Sims Metal Management and Steel Dynamics, Inc. enhances the competitive landscape. The region's robust infrastructure and regulatory support create a conducive environment for growth, ensuring North America remains at the forefront of the global metal recycling industry.

Europe : Sustainable Recycling Initiatives

Europe is experiencing a surge in the metal recycling market, with a market size of 15800.15 million in 2024. The region's growth is fueled by ambitious sustainability goals, regulatory frameworks promoting recycling, and increasing consumer awareness about environmental issues. The European Union's Circular Economy Action Plan is a key driver, encouraging member states to enhance recycling rates and reduce waste. Leading countries like Germany and the UK are at the forefront of this transformation, with key players such as European Metal Recycling and HMS Group leading the charge. The competitive landscape is characterized by innovation and collaboration among firms to meet regulatory standards. The focus on sustainable practices and resource efficiency positions Europe as a pivotal region in The Metal Recycling.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is witnessing rapid growth in the metal recycling market, with a market size of 10800.0 million in 2024. The region's expansion is driven by urbanization, industrialization, and increasing demand for metals in various sectors. Governments are implementing policies to promote recycling and reduce environmental impact, which is further propelling market growth. The rising awareness of sustainability among consumers is also a significant factor. Countries like China and India are leading the charge, with numerous local and international players entering the market. The competitive landscape is evolving, with companies focusing on technological advancements and efficient recycling processes. The presence of key players such as Davidson Metals and Ferrous Processing and Trading enhances the region's market dynamics, making Asia-Pacific a vital area for future growth in metal recycling.

Middle East and Africa : Untapped Recycling Opportunities

The Middle East and Africa region is gradually emerging in the metal recycling market, with a market size of 700.05 million in 2024. The growth is primarily driven by increasing industrial activities and a rising focus on sustainable practices. Governments are beginning to recognize the importance of recycling in waste management and resource conservation, leading to the development of supportive policies and initiatives. Countries like South Africa and the UAE are taking the lead in establishing recycling frameworks, with local companies starting to invest in recycling technologies. The competitive landscape is still developing, but the presence of firms focused on innovation and sustainability is growing. As awareness increases, the region is expected to see significant advancements in metal recycling practices, positioning it as a future player in the global market.