Growing Demand in Automotive Sector

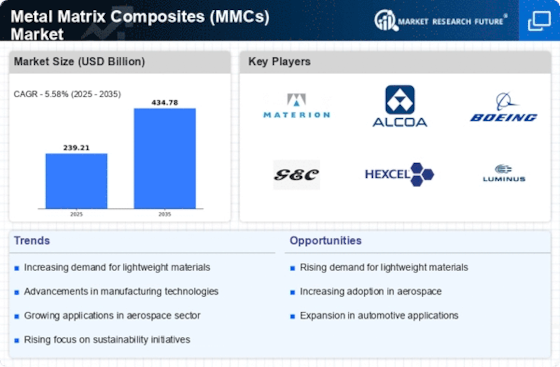

The automotive industry is increasingly adopting Metal Matrix Composites (MMCs) due to their lightweight and high-strength properties. This shift is driven by the need for fuel efficiency and reduced emissions, as manufacturers seek to comply with stringent regulations. MMCs offer superior performance in critical components such as engine parts and structural elements, which enhances vehicle performance. The Metal Matrix Composites (MMCs) Market is projected to witness substantial growth, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This trend indicates a robust demand for advanced materials that can withstand high temperatures and mechanical stress, further solidifying the role of MMCs in automotive applications.

Rising Demand for Lightweight Materials

The increasing emphasis on lightweight materials across various industries is a key driver for the Metal Matrix Composites (MMCs) Market. As industries strive to enhance energy efficiency and performance, MMCs are becoming a preferred choice due to their excellent strength-to-weight ratio. This trend is particularly evident in sectors such as aerospace and defense, where reducing weight can lead to significant fuel savings and improved operational efficiency. The market for MMCs is anticipated to expand as more companies recognize the benefits of incorporating these materials into their designs. Analysts predict that the demand for lightweight materials will continue to rise, further propelling the growth of the MMCs market.

Technological Advancements in Manufacturing

Recent technological advancements in manufacturing processes are significantly impacting the Metal Matrix Composites (MMCs) Market. Innovations such as powder metallurgy and advanced casting techniques have improved the production efficiency and quality of MMCs. These advancements allow for the creation of complex geometries and enhanced material properties, making MMCs more accessible for various applications. The market is likely to benefit from these developments, as they reduce production costs and time, thereby attracting more industries to consider MMCs for their projects. Furthermore, the integration of automation and smart manufacturing technologies is expected to streamline operations, leading to increased adoption of MMCs across multiple sectors.

Growing Environmental Concerns and Regulations

Environmental concerns and regulatory pressures are increasingly influencing the Metal Matrix Composites (MMCs) Market. As industries face stricter regulations regarding emissions and waste management, there is a growing need for sustainable materials that can meet these requirements. MMCs, known for their durability and recyclability, are becoming an attractive option for manufacturers looking to reduce their environmental footprint. This shift towards sustainability is likely to drive demand for MMCs, as companies seek to comply with regulations while also appealing to environmentally conscious consumers. The market is expected to grow as more industries recognize the potential of MMCs in achieving their sustainability goals.

Increased Investment in Research and Development

Investment in research and development is playing a crucial role in advancing the Metal Matrix Composites (MMCs) Market. Companies are allocating significant resources to explore new formulations and applications of MMCs, which is expected to lead to innovative products and solutions. This focus on R&D is likely to enhance the performance characteristics of MMCs, making them suitable for a broader range of applications. Furthermore, collaborations between academic institutions and industry players are fostering knowledge exchange and accelerating the development of next-generation MMCs. As a result, the market is poised for growth, driven by continuous innovation and the introduction of novel materials.