Medicinal Mushroom Size

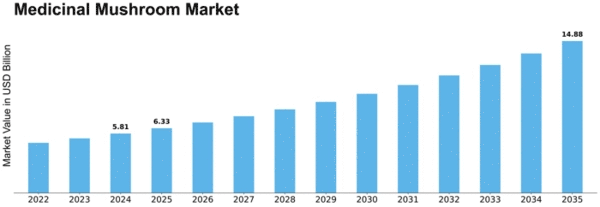

Medicinal Mushroom Market Growth Projections and Opportunities

The Medicinal Mushroom market is influenced by several factors, which in combination foster the growth and maturity of this sector. One of the factors that propel this market is rising awareness regarding health benefits from consumption of medicinal mushrooms. Customers are moving towards natural and holistic ways of being comfortable. Medicinal mushrooms have become a functional food through its properties allowing to strengthen the immune system and antioxidant activity. This need has been exacerbated further by the observed rising pattern of alternative medicine and herbal therapy. The Medicinal Mushroom market is greatly influenced by geographical factors. Various types of medicinal mushrooms grow well in certain climate zones and specific regions for different species. For instance, some mushrooms originate from Asian countries such as China and Japan while others are native to North America or Europe. Geography of these mushrooms’ distribution affects the world supply chain and market dynamics. More importantly, the climate and environmental surroundings can greatly affect mushroom variety availability or cultivation. Economic factors also influence the Medicinal Mushroom market. Cultivation, processing, and distribution cost determines the price of medicinal mushroom products. The macro environment consists of economic stability in the major producing countries, currency exchange rates and trade policy issues that can influence the overall market structure. The availability of medicinal mushrooms to a larger consumer base is largely influenced by economic factors. Consumer preferences and dynamics also drive the medicinal mushroom market. Given the growing awareness of potential health benefits through mushrooms, an increased demand for a range of products that are based on these fungi has been observed with supplements, teas, extracts, and powders. The rise of natural and organic products is another factor that has led to the increasing demand for medicinal mushrooms because many people view them as a natural alternative source of wellness. Major market drivers include technological innovations in agricultural and extraction procedures. The advancement of mushroom farming technologies, including controlled environment agriculture and mycelium fermentation promotes efficiency in production quality. The extraction techniques that do not destroy the bioactive components in mushrooms help with ensuring quality medicinal products made from such fungi. Technology is very central to meeting the increasing need for accurate and quality mushroom supplements. There are regulatory implications in the Medicinal Mushroom market. With growing demand for these products, regulatory agencies are developing regulations on product safety and quality as well as accurate labelling. Adhering to these rules is vital for the players of the market so that they can cultivate trust in consumers and preserve credibility within medicinal mushrooms. The standardization of production processes and quality control methods also seem to play an ever-growing role in fulfilment of these regulatory needs. One of the emerging factors that affect Medicinal Mushroom market is environmental sustainability. Consumers are more environmentally aware of the impacts that agricultural practices have. Agroforestry and organic farming as sustainable agriculture, which is gaining popularity. Moreover, the mushrooms’ ability to help in ecological rehabilitation like mycoremediation is matched with environmentally concerned customers.

Leave a Comment