Growing Aging Population

The growing aging population represents a significant driver for the Global Medically Prescribed Apps Market Industry. As the global demographic landscape shifts, older adults are increasingly seeking solutions to manage their health conditions effectively. Medically prescribed apps Market cater to this demographic by offering features such as medication reminders, appointment scheduling, and health monitoring. This trend is particularly relevant as the aging population is more likely to experience chronic diseases, necessitating ongoing management. The demand for user-friendly and accessible health solutions is expected to drive market growth, aligning with the overall expansion of the healthcare technology sector.

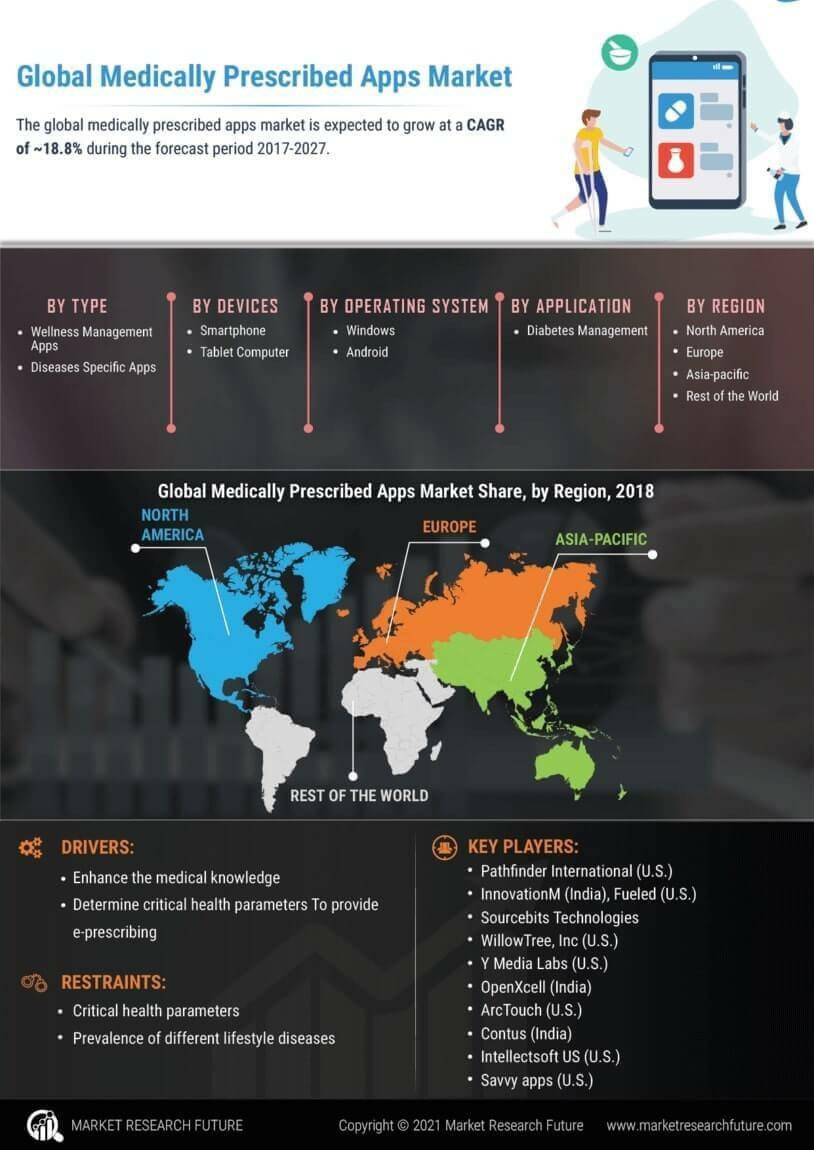

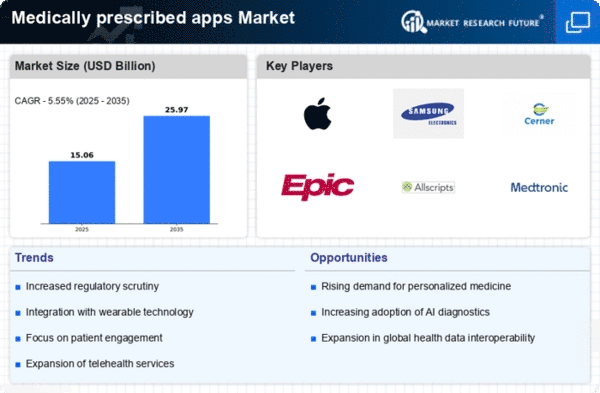

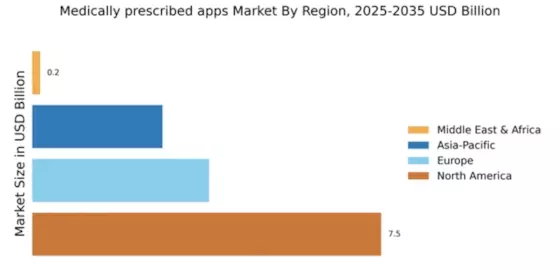

Market Growth Projections

The Global Medically Prescribed Apps Market Industry is projected to experience substantial growth in the coming years. With a market value expected to reach 15.2 USD Billion in 2024 and potentially soar to 87.2 USD Billion by 2035, the industry is on a robust growth trajectory. This growth is underpinned by a compound annual growth rate (CAGR) of 17.2% from 2025 to 2035. Such projections indicate a strong demand for innovative healthcare solutions that enhance patient engagement and improve health outcomes. The convergence of technology and healthcare is likely to play a pivotal role in shaping the future landscape of this market.

Increased Focus on Mental Health

The Global Medically Prescribed Apps Market Industry is witnessing an increased focus on mental health, driving the development and adoption of apps designed to support mental well-being. With rising awareness of mental health issues, healthcare providers are increasingly prescribing apps that offer therapeutic exercises, mood tracking, and teletherapy options. This trend is particularly relevant as mental health conditions become more prevalent globally. The incorporation of evidence-based practices into these apps enhances their credibility and effectiveness, thereby attracting more users. As a result, the market is poised for significant growth, aligning with the overall expansion of the healthcare technology sector.

Integration with Wearable Technology

The integration of medically prescribed apps with wearable technology is a pivotal driver in the Global Medically Prescribed Apps Market Industry. Wearables such as smartwatches and fitness trackers provide real-time health data, which can be seamlessly synced with prescribed apps. This synergy enhances the ability of healthcare providers to monitor patients' health metrics effectively. For example, a patient using a glucose monitoring device can have their data automatically uploaded to a diabetes management app, allowing for timely interventions. This integration not only improves patient engagement but also supports the anticipated market growth, potentially reaching 87.2 USD Billion by 2035.

Rising Demand for Remote Patient Monitoring

The Global Medically Prescribed Apps Market Industry experiences a notable surge in demand for remote patient monitoring solutions. As healthcare systems increasingly prioritize patient-centered care, these apps facilitate continuous health tracking and management. For instance, patients with chronic conditions can utilize apps to monitor vital signs and medication adherence, thereby enhancing their overall health outcomes. This trend is reflected in the projected market growth, with the industry expected to reach 15.2 USD Billion in 2024. The convenience and accessibility offered by these apps are likely to drive further adoption, contributing to a robust CAGR of 17.2% from 2025 to 2035.

Regulatory Support and Reimbursement Policies

Regulatory support and favorable reimbursement policies are crucial factors propelling the Global Medically Prescribed Apps Market Industry. Governments and health authorities are increasingly recognizing the value of digital health solutions, leading to the establishment of guidelines that facilitate app development and deployment. For instance, some countries have implemented reimbursement frameworks for prescribed health apps, encouraging healthcare providers to integrate these solutions into their practice. This regulatory backing not only enhances the credibility of medically prescribed apps but also incentivizes their adoption among patients and providers alike. Such developments are likely to contribute to the market's projected growth trajectory.