Market Trends

Key Emerging Trends in the Medical Vending Machines Market

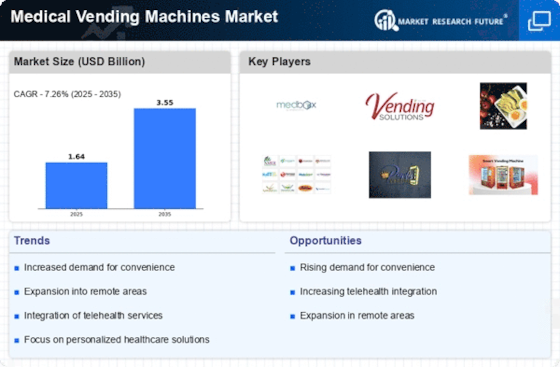

Companies are strategically transforming the Medical Vending Machines Market to gain market share in the unique convergence of healthcare and automation. Technical innovation and personalization are key strategies in this market. To meet the growing need for efficient and accessible healthcare, corporations invest heavily in medical vending machine research and development. These machines dispense over-the-counter drugs and medical supplies. By meeting the changing needs of consumers and healthcare professionals for convenient and automated access to important medical supplies, organizations strive to stand out and gain market share by offering unique and customizable vending solutions.

Medical Vending Machines Market share is shaped by strategic alliances. Companies partner with hospitals, pharmacies, and healthcare facilities since medical vending machines are used in many contexts. These agreements integrate vending machines into healthcare workflows, expanding their reach and use. Companies lead by delivering a wide range of vending solutions to meet the needs of healthcare providers and institutions by using their experience and resources.

Pricing and accessibility strategies are crucial to Medical Vending Machines Market share positioning. Quality vending solutions and accessibility to a variety of healthcare settings are balanced by companies. Some corporations use flexible pricing, leasing, or revenue-sharing agreements to help healthcare providers meet financial restrictions. Companies trying to gain market share and meet the financial needs of varied healthcare institutions must balance affordability and perceived value of automated medical dispensing.

Marketing and education are key to increasing Medical Vending Machines Market share. To promote their vending solutions to healthcare administrators, facility managers, and the public, companies spend much on marketing. Targeted promotions, educational resources, and healthcare conferences build brand trust and credibility. Optimizing distribution networks makes medical vending machines available in hospitals, clinics, and pharmacies. Strategic alliances with healthcare groups and key decision-makers boost market share and expand access to innovative medical vending solutions.

In the Medical Vending Machines Market, customization and product diversity are becoming important. Companies may offer vending machines that can be customized or loaded with a variety of medical supplies to meet the different demands of healthcare consumers. Customizable interfaces, modular designs, and the capacity to dispense several healthcare items let healthcare practitioners and customers fulfill their specific demands. This modification improves medical vending machines' usability and a company's reputation as a provider of flexible and patient-centric automated solutions."

Leave a Comment