- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

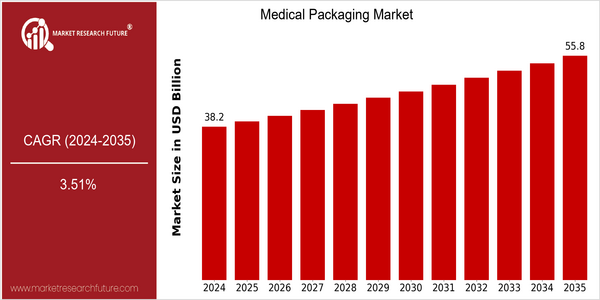

| Year | Value |

|---|---|

| 2024 | USD 38.16 Billion |

| 2035 | USD 55.77 Billion |

| CAGR (2025-2035) | 3.51 % |

Note – Market size depicts the revenue generated over the financial year

The market for medical packaging is growing steadily, and the current value of the market is expected to reach $ 38.16 billion in 2024 and $ 55.77 billion in 2035. The average annual growth rate from 2025 to 2035 is 3.17%. The main reasons for the increase in the size of the market are: the increase in the demand for medical care, the increase in chronic diseases, and the emphasis on patient safety and compliance. The development of smart packaging and sustainable materials is also expected to drive the growth of the market, as they are expected to increase product integrity and reduce the impact on the environment. The major players in the field of medical packaging, such as Amcor, West Pharmaceutical Services and Sealed Air, are actively investing in the development of new products and the establishment of strategic alliances to strengthen their market positions. Amcor, for example, is investing in sustainable packaging, while West is enhancing its product portfolio through technological innovations. These strategic activities not only show the companies' commitment to meeting the needs of the market, but also highlight the competitive landscape in the field of medical packaging, which is increasingly characterized by innovation and the pursuit of sustainable development.

Regional Market Size

Regional Deep Dive

The Medical Devices and Diagnostics Market is growing significantly in different regions, driven by increasing health care needs, technological developments and strict regulations. In North America, the market is characterized by a high demand for new and improved packaging solutions that ensure product safety and regulatory compliance. In Europe, there is a strong focus on sustainable and eco-friendly packaging. The Asia-Pacific region is experiencing rapid growth, driven by the rising expenditures on health care and the growing population. The Middle East and Africa are also seeing a positive development in health care and in turn in medical device and diagnostics packaging. Latin America is also becoming a key player in the field, with increasing investments in health care and medical device manufacturing.

Europe

- The European Union's push for sustainable packaging has led to increased demand for biodegradable and recyclable materials in medical packaging, prompting companies like Schott AG to innovate in this area.

- Regulatory changes, such as the Medical Device Regulation (MDR), are requiring stricter compliance and documentation, which is influencing packaging design and materials used by manufacturers across the region.

Asia Pacific

- The rapid growth of the healthcare sector in countries like China and India is leading to a surge in demand for medical packaging solutions, with local companies like Huhtamaki and Sealed Air expanding their operations to meet this need.

- Innovations in sterilization techniques and packaging materials are being driven by the increasing prevalence of chronic diseases, prompting companies to develop more effective and safer packaging solutions.

Latin America

- The Brazilian government has launched initiatives to boost local medical device manufacturing, which is driving demand for high-quality medical packaging solutions from both local and international suppliers.

- There is a growing trend towards the adoption of tamper-evident and child-resistant packaging in the region, influenced by increasing regulatory requirements and consumer safety concerns.

North America

- The U.S. Food and Drug Administration (FDA) has recently updated its guidelines on medical device packaging, emphasizing the need for enhanced traceability and safety, which is driving innovation among packaging manufacturers.

- Companies like Amcor and West Pharmaceutical Services are investing heavily in R&D to develop smart packaging solutions that incorporate IoT technology, enhancing the monitoring of medical products throughout their lifecycle.

Middle East And Africa

- The World Health Organization (WHO) has initiated programs to improve healthcare access in the region, which is increasing the demand for reliable medical packaging solutions to ensure product integrity.

- Local manufacturers are collaborating with international companies to enhance their packaging capabilities, with firms like Al Haramain Packaging investing in advanced technologies to meet global standards.

Did You Know?

“Approximately 30% of all medical packaging is designed to be tamper-evident, ensuring the safety and integrity of medical products.” — International Journal of Medical Packaging

Segmental Market Size

The Medical Packages market is booming, driven by the growing demand for safe and effective medical packaging. In particular, the increasing need for tamper-evident and sterile packages, a result of the increased awareness of the dangers of contamination, is driving the market. The development of new materials and processes that improve the product’s shelf life is also driving the market. The current stage of development of the medical packages market is the stage of deployment. Amcor and West Pharmaceutical Services are leading the development of new packaging solutions. The principal applications are in pharmaceutical packages, medical device packages, and packages for biologicals. In these applications, companies are deploying advanced materials to meet specific regulatory requirements. Moreover, developments such as the COVID-19 pandemic have accelerated the development of sustainable packaging solutions and the use of eco-friendly materials. Smart packaging and RFID are also driving the market’s evolution, enabling better supply chain management and product traceability.

Future Outlook

The Medical Packaging Market is estimated to grow at a CAGR of 3.19% from 2024 to 2035. The market is expected to be driven by the increasing demand for advanced medical devices and pharmaceuticals, which require innovative packaging solutions that ensure product integrity and compliance with stringent regulatory standards. As the medical systems continue to evolve, the need for safe, effective, and easy-to-use packaging solutions is expected to increase the demand for medical packaging, especially for sterile packaging and tamper-evident solutions. The integration of smart packaging and sustainable materials is expected to reshape the medical packaging landscape. RFID and QR codes, for instance, can enhance the traceability and efficiency of the supply chain, which will help manufacturers meet the growing demand for transparency and safety. The growing focus on sustainable materials and practices, driven by regulations and consumer preferences, is also expected to drive the demand for eco-friendly packaging. In the coming years, companies that invest in R & D to develop these new products and services are expected to gain a larger share of the market and become the leaders in the rapidly changing market.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 25.9 Billion |

| Market Size Value In 2023 | USD 27.89 Billion |

| Growth Rate | 7.55% (2023-2032) |

Medical Packaging Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.