Innovations in Packaging

Innovations in packaging are emerging as a key driver in the Mayonnaise Market, as manufacturers seek to enhance product shelf life and consumer convenience. New packaging technologies, such as resealable pouches and eco-friendly materials, are gaining traction among consumers who prioritize sustainability. Recent surveys indicate that nearly 70% of consumers are more likely to purchase products with environmentally friendly packaging. This trend not only aligns with the growing demand for sustainable practices but also encourages manufacturers to rethink their packaging strategies. As the industry evolves, innovative packaging solutions are likely to play a crucial role in attracting environmentally conscious consumers and differentiating brands within the competitive landscape of the Mayonnaise Market.

Health and Wellness Trends

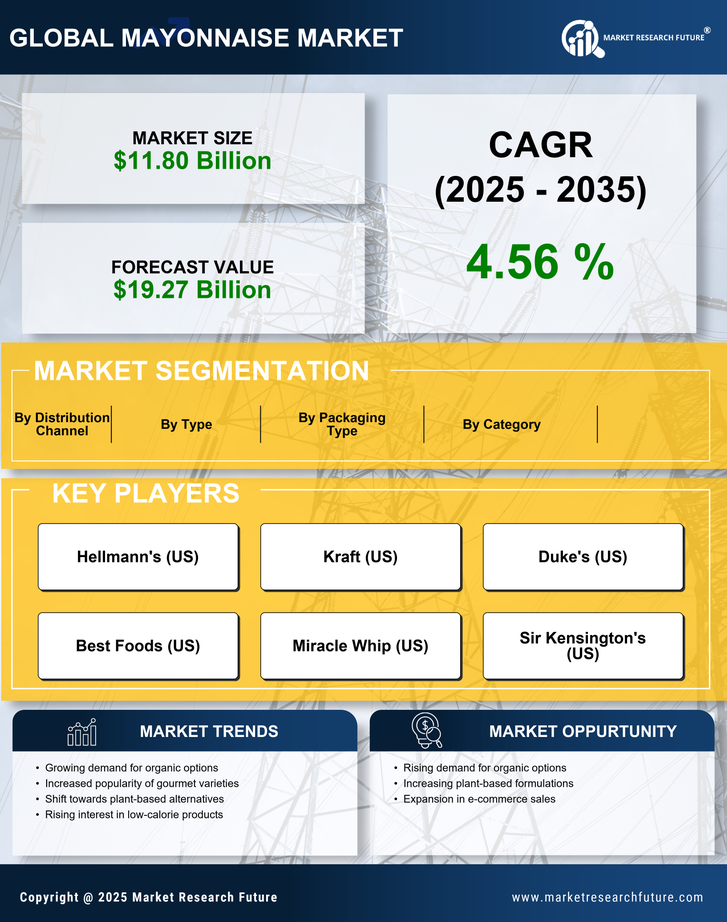

The growing emphasis on health and wellness is influencing the Mayonnaise Market, as consumers become more conscious of their dietary choices. There is a rising demand for mayonnaise products that are lower in calories, fat, and preservatives, leading to the introduction of healthier alternatives such as avocado mayonnaise and reduced-fat options. Market data indicates that the health-conscious segment is expanding, with sales of these alternative products increasing by approximately 10% annually. This trend reflects a broader shift towards clean-label products, where consumers seek transparency in ingredient sourcing and nutritional content. As health trends continue to evolve, the Mayonnaise Market must adapt to meet the changing preferences of consumers.

Expansion of Retail Channels

The Mayonnaise Market is witnessing an expansion of retail channels, which is significantly enhancing product accessibility for consumers. Supermarkets, hypermarkets, and online platforms are increasingly stocking a diverse range of mayonnaise products, catering to various consumer preferences. Recent statistics reveal that online sales of mayonnaise have surged by over 15% in the past year, reflecting a shift in shopping habits. This expansion not only facilitates greater consumer access to different brands and flavors but also encourages competition among manufacturers. As retailers continue to diversify their offerings, the Mayonnaise Market is likely to benefit from increased visibility and availability, ultimately driving sales growth.

Rising Demand for Gourmet Products

The Mayonnaise Market is experiencing a notable shift towards gourmet and artisanal mayonnaise products. Consumers are increasingly seeking unique flavors and high-quality ingredients, which has led to a proliferation of premium brands. This trend is supported by data indicating that the gourmet segment of the mayonnaise market has seen a growth rate of approximately 8% annually. As consumers become more adventurous in their culinary choices, they are willing to pay a premium for gourmet mayonnaise options, which often feature organic or locally sourced ingredients. This shift not only enhances the product offerings within the Mayonnaise Market but also encourages manufacturers to innovate and diversify their product lines to meet evolving consumer preferences.

Increased Use in Food Service Sector

The food service sector plays a pivotal role in the Mayonnaise Market, as mayonnaise is a staple ingredient in many dishes served in restaurants, cafes, and catering services. Recent data suggests that the food service segment accounts for nearly 60% of total mayonnaise consumption. The growing trend of dining out and the rise of fast-casual restaurants have further propelled the demand for mayonnaise-based sauces and dressings. As chefs and food service operators experiment with new recipes and flavor combinations, the versatility of mayonnaise continues to be a key driver in the industry. This trend indicates a robust future for mayonnaise products within the food service sector, as operators seek to enhance their menus with innovative offerings.