E-commerce Growth

The surge in e-commerce activities is significantly impacting the Marine Cargo Insurance Market. With more businesses engaging in online sales and international shipping, the volume of goods transported by sea has increased dramatically. Data indicates that e-commerce sales are expected to reach trillions of dollars, leading to a corresponding rise in the need for marine cargo insurance. This trend highlights the necessity for tailored insurance products that address the unique risks associated with e-commerce logistics. As such, insurers are likely to innovate and expand their offerings to meet the demands of this burgeoning market.

Regulatory Compliance

Regulatory frameworks governing international trade and shipping practices are becoming increasingly stringent. The Marine Cargo Insurance Market is influenced by these regulations, as businesses must comply with various legal requirements to ensure the safe transport of goods. Compliance with international standards, such as the International Maritime Organization's guidelines, necessitates adequate insurance coverage. This regulatory landscape compels companies to invest in marine cargo insurance to avoid penalties and ensure smooth operations. As a result, the demand for comprehensive insurance solutions is likely to rise, further propelling the Marine Cargo Insurance Market.

Increasing Trade Volumes

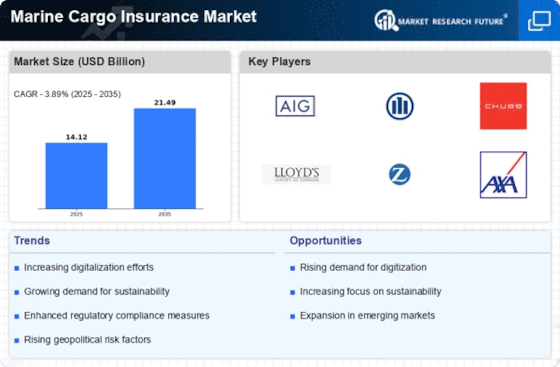

The Marine Cargo Insurance Market is experiencing growth due to rising trade volumes across various sectors. As international trade expands, the need for insurance coverage for cargo in transit becomes more pronounced. According to recent data, global merchandise trade is projected to grow by approximately 4% annually, which directly correlates with the demand for marine cargo insurance. This increase in trade activities necessitates robust insurance solutions to mitigate risks associated with loss or damage during transportation. Consequently, insurers are adapting their offerings to cater to the evolving needs of businesses engaged in cross-border trade, thereby driving the Marine Cargo Insurance Market.

Technological Advancements

Technological advancements are reshaping the Marine Cargo Insurance Market by enhancing risk assessment and management processes. Innovations such as blockchain, IoT, and big data analytics are being integrated into insurance practices, allowing for more accurate tracking of shipments and real-time risk evaluation. These technologies enable insurers to offer more competitive premiums and customized coverage options, thereby attracting a broader client base. As businesses increasingly adopt these technologies, the demand for marine cargo insurance is expected to grow, reflecting the industry's adaptation to modern logistics challenges.

Rising Awareness of Risk Management

There is a growing awareness among businesses regarding the importance of risk management in supply chain operations. The Marine Cargo Insurance Market is benefiting from this trend, as companies recognize the potential financial repercussions of cargo loss or damage. This heightened awareness drives businesses to seek comprehensive insurance solutions to safeguard their assets during transit. As organizations prioritize risk management strategies, the demand for marine cargo insurance is likely to increase, prompting insurers to enhance their product offerings and customer service to meet evolving market needs.