Top Industry Leaders in the Magnetoresistance Sensor Market

The Competitive Landscape of the Magnetoresistance Sensor Market

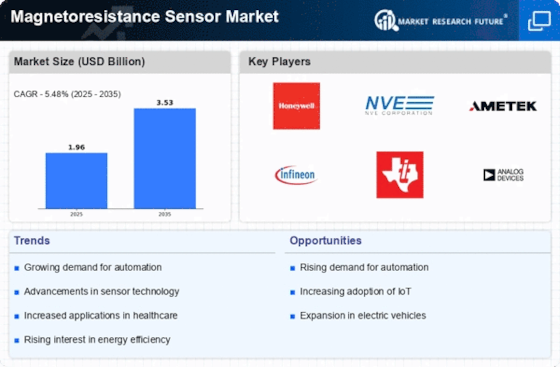

Magnetoresistance sensors, capable of detecting and measuring magnetic fields, are quietly revolutionizing industries from automotive to consumer electronics. This market, pulsating with technological advancements and diverse applications, is fiercely competitive. Understanding the strategies, factors influencing market share, and the emergence of new players is crucial for navigating this dynamic terrain.

Key Player:

- AMS

- TE Connectivity

- Murata

- Honeywell International Inc.

- Analog Devices

- Asahi Kasei Micro Devices Corporation

- NXP Semiconductor N.V.

- Infineon Technologies AG

- NXP Semiconductor N.V.

- Robert Bosch GmbH

- Memsic Inc.

Strategies Adopted by Leaders:

- Product Diversification: Leading players like TDK Corporation and NXP Semiconductors are expanding beyond traditional GMR (Giant Magnetoresistance) sensors, offering AMR (Anisotropic Magnetoresistance) and TMR (Tunneling Magnetoresistance) sensors for specific applications requiring higher sensitivity or smaller size. This caters to varied needs and strengthens market presence.

- Focus on Miniaturization and Low Power Consumption: Smaller and more energy-efficient sensors are key for integration into portable devices and battery-powered applications. Infineon Technologies' low-power TMR sensors and Honeywell's miniature AMR sensors exemplify this focus on compact efficiency.

- Collaboration and Partnerships: Strategic partnerships accelerate technology development and market access. Bosch collaborates with Samsung on micro-fabricated TMR sensors, while TE Connectivity partners with DENSO for automotive sensor solutions, leveraging expertise and expanding reach.

- Vertical Integration and In-house Manufacturing: Controlling the entire production chain, from materials to sensors, offers cost advantages and quality control. Asahi Kasei Micro Devices Corporation's in-house TMR chip production exemplifies this strategy, ensuring high-quality components for their sensor systems.

- Focus on Quality and Reliability: Magnetoresistance sensors are often employed in critical applications. Established players like Honeywell and Texas Instruments prioritize rigorous quality control and reliability testing, building trust and reputation for dependable performance.

Factors for Market Share Analysis:

- Brand Reputation and Installed Base: Established players like NXP and Infineon Technologies hold an advantage with proven track records and extensive deployments in various industries. Their established reputation attracts repeat business and partnerships.

- Technology Portfolio and Breadth: Offering a diverse range of sensor types with varying sensitivity, size, and power consumption levels, like magnetoresistive position sensors and angle encoders, caters to a wider range of applications. This breadth attracts a larger client base.

- Compliance and Regulatory Certifications: Meeting industry standards and safety regulations is crucial for certain applications. STMicroelectronics' automotive-grade TMR sensors, compliant with AEC-Q100 standards, open doors to the automotive market, while certain medical devices require sensors adhering to strict biocompatibility regulations.

- Software Development Kits and Support: Comprehensive support and development tools are invaluable for integrating sensors into complex systems. Allegro MicroSystems' comprehensive software development kits simplify sensor integration for engineers.

- Cost-Effectiveness and Affordability: Making magnetoresistance sensors accessible is crucial for wider adoption, especially in consumer electronics. Rohm Semiconductor's cost-competitive AMR sensors cater to price-sensitive applications, expanding market reach.

New and Emerging Companies:

- Magnano: Pioneering advanced GMR sensors with ultra-high sensitivity for biomagnetic imaging and security applications.

- SenesTech: Developing miniature TMR sensors specifically designed for wearable devices and healthcare applications.

- Magnonic Instruments: Focusing on high-performance AMR sensors for industrial automation and robotics applications requiring precise positioning and control.

- Spin Torque Devices: Leading the way in emerging spin-torque magnetoelectric RAM (STT-MRAM) technology, combining memory and sensing capabilities in a single chip.

Latest Company Updates:

AMS:

- October 20, 2023: AMS announces the launch of the AS5214 high-precision AMR angle sensor specifically designed for use in industrial robots and automated guided vehicles (AGVs), offering enhanced accuracy and reliability for positioning and navigation tasks

- June 7, 2023: AMS unveils the TMR3230, a low-power and high-sensitivity TMR sensor ideal for portable medical devices and wearables, enabling advanced monitoring and diagnostics at minimal power consumption

TE Connectivity:

- October 13, 2023: TE Connectivity introduces the CTLS Series current sensors featuring TMR technology, offering high accuracy and low noise for battery management systems in electric vehicles and hybrid vehicles

- July 5, 2023: TE Connectivity partners with DENSO on a comprehensive sensor solution for automotive applications, combining TE's AMR and TMR sensors with DENSO's expertise in automotive systems, aiming to improve vehicle safety and performance