Legal Process Outsourcing Size

Legal Process Outsourcing Market Growth Projections and Opportunities

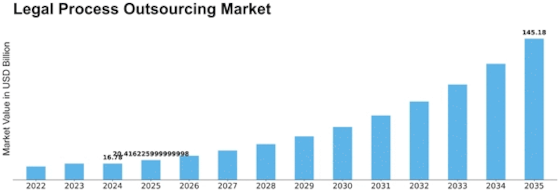

According to MRFR, the Legal Process Outsourcing market industry is projected to grow USD 80.6 Bn by 2032, exhibiting a CAGR of 21.6% during the forecast period (2023 - 2032). The market is intricately segmented based on components, organization size, service location, end-users, and regions. The component category is divided into software and services, with the services segment further categorized into various offerings such as bookkeeping & billing, e-discovery, IP technical support outsourcing, legal research outsourcing, litigation support outsourcing, contract drafting, compliance assistance, patent support, data analysis & management, and review & management.

Organization size is segmented into Small and Medium-sized Enterprises (SMEs) and large enterprises, while service location is categorized into On-Shore Outsourcing and Offshore Outsourcing. The end-users section comprises segments like BFSI, Government, Healthcare, Automotive, and Others. Geographically, the market is divided into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. The study conducted by MRFR has thoroughly analyzed major players who have significantly contributed to the global legal process outsourcing market's growth.

Among these players are industry leaders like UnitedLex, Clarivate, Integreon, Inc., Axiom Law, Elevate Services, Inc., Litigation Services, Infosys Limited, Lexplosion Solutions Private Limited, Mindcrest, COBRA LEGAL SOLUTIONS, QuisLex, Exigent, WNS (Holdings) Ltd., Vee Technologies, SunLexis, and more. These key players are strategically focused on innovating their product offerings in the legal process outsourcing sector. They invest significantly in research and development to introduce cost-effective software and services that save time and ensure quick turnaround time. The industry leaders aim to expand their practice areas to cater to a broader client base, offering flexible and reliable product and service solutions. To enhance their market share, these players are actively involved in strategic initiatives such as partnerships, mergers & acquisitions, product developments & enhancements, global expansion, and the consolidation of their client base.

Leave a Comment