Market Analysis

In-depth Analysis of Lactose Free Butter Market Industry Landscape

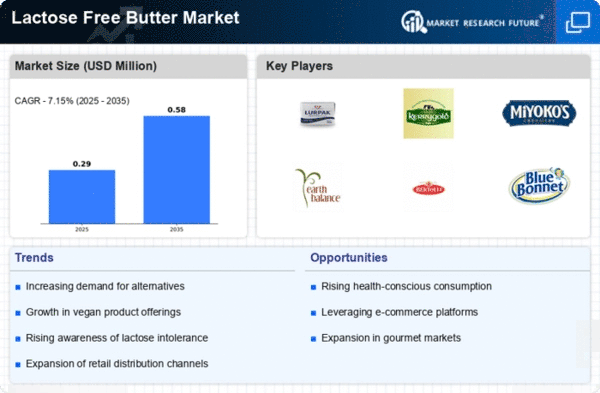

The lactose-free butter market is subject to a dynamic interplay of various factors that collectively influence its trajectory and growth. A key driver of this market is the increasing prevalence of lactose intolerance and the growing awareness of this condition among consumers As the awareness develops about lactose levels in milk, other alternatives like butter free of this substance are becoming more and more popular. This is not only about those suffering from lactose intolerance, but also people who make dairy-free choices based on their health and lifestyle.

Market forces are also rather significant and largely depend on consumer preferences, dietary trends for lactose-free butter. It increases interest in dairy substitutes like lactose free butter due to the growing popularity of veganism and plant-based diets. It has prompted manufacturers to come up with new plant-based formulas that emulate the taste and feel of common butter, which attracts more people.

Moreover, the regulatory framework of this market is another significant factor impacting its development. In this regulatory framework, clear and precise communication about the product being lactose free along with appropriate nutritional information becomes very important.

The dynamics of the market for lactose-free butter is also influenced by its competitive environment. there are various products from the price issue for both established dairy companies and newcomers when they fight against each other in order to grab space of markets.

Consumer education plays a crucial role in development of the lactose-free butter market. ⁃ Consumers become more selective in the buying products as awareness of lactose intolerance grows. Manufacturers would be wise to invest their funds into public education programs in an attempt to help consumers understand the possible benefits of getting lactose free butter and have some myths about other types of dairy substitutes dispelled. This education approach fosters the ability to influence consumer perceptions and choices.

Economic factors also influence the development of market forces. In addition, changes in prices of raw materials used for production such as plant-based products that are being processed to make lactose free butter can also influence the cost involved. Variations in consumer spending habits due to their disposable income and purchasing power significantly impact overall demand for lactose-free butter. Manufacturers are doing their best to develop the taste and texture of their products, which will be attractive for consumers. Lactose-free butter market is a global scale and as such influenced by the international trend and cultural factors. The demand for dairy alternatives may differ regionally and market players should adjust their strategies to respond to the local preferences. Cultural attitudes towards plant-based diets and lactose intolerance also impact the acceptance and growth of the lactose-free butter market in different parts of the world.

Leave a Comment