Increased Focus on Quality Control

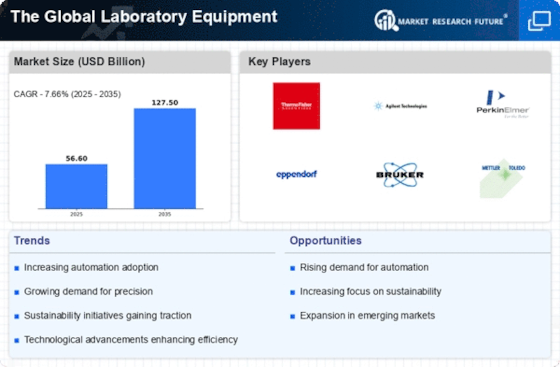

Quality control remains a critical aspect of manufacturing and production processes, particularly in sectors such as food and beverage, pharmaceuticals, and chemicals. The Global Laboratory Equipment Industry is experiencing growth due to the heightened focus on quality assurance and compliance with stringent regulations. In 2025, the market for laboratory quality control equipment is anticipated to grow at a compound annual growth rate of around 6.5%. This growth is driven by the need for accurate testing and validation of products to ensure safety and efficacy. As companies strive to meet regulatory standards, the demand for laboratory equipment that facilitates quality control processes is likely to increase. Consequently, The Global Laboratory Equipment Industry is positioned to expand as organizations invest in advanced testing and monitoring technologies to uphold quality standards.

Rising Demand for Research and Development

The increasing emphasis on research and development across various sectors is a primary driver for The Global Laboratory Equipment Industry. As industries such as pharmaceuticals, biotechnology, and environmental science expand, the need for advanced laboratory equipment becomes more pronounced. In 2025, the global R&D spending is projected to reach approximately 2.4 trillion USD, indicating a robust growth trajectory. This surge in investment is likely to stimulate demand for sophisticated laboratory instruments, including analytical and diagnostic equipment. Furthermore, the trend towards personalized medicine and innovative drug development necessitates the use of high-precision laboratory tools, thereby propelling the market forward. The Global Laboratory Equipment Industry is expected to benefit significantly from this heightened focus on R&D, as organizations seek to enhance their capabilities and improve outcomes.

Emergence of Advanced Analytical Techniques

The advent of advanced analytical techniques is reshaping the landscape of The Global Laboratory Equipment Industry. Techniques such as mass spectrometry, chromatography, and molecular imaging are gaining traction due to their ability to provide precise and comprehensive data. The market for analytical laboratory equipment is projected to grow significantly, with estimates suggesting a value of over 20 billion USD by 2026. This growth is attributed to the increasing complexity of research and the need for detailed analysis in various fields, including environmental monitoring and clinical diagnostics. As researchers and laboratories adopt these sophisticated techniques, the demand for high-performance analytical instruments is expected to rise. Thus, The Global Laboratory Equipment Industry stands to benefit from the integration of cutting-edge analytical technologies that enhance research capabilities.

Growing Importance of Environmental Testing

Environmental testing has become increasingly vital in the context of sustainability and regulatory compliance. The Global Laboratory Equipment Industry is witnessing growth driven by the rising need for environmental monitoring and assessment. With governments and organizations prioritizing environmental protection, the demand for laboratory equipment that facilitates testing of air, water, and soil quality is on the rise. The market for environmental testing equipment is projected to grow at a CAGR of approximately 7% through 2025. This growth is fueled by the need for accurate data to inform policy decisions and ensure compliance with environmental regulations. As a result, laboratories are investing in advanced testing technologies, thereby propelling The Global Laboratory Equipment Industry forward as it adapts to the evolving landscape of environmental concerns.

Expansion of Educational and Research Institutions

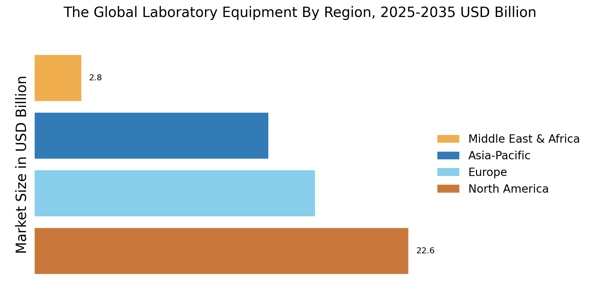

The expansion of educational and research institutions is a significant driver for The Global Laboratory Equipment Industry. As universities and research centers proliferate, the demand for laboratory equipment to support educational programs and research initiatives is likely to increase. In 2025, the global education sector is expected to see substantial investments, with a focus on enhancing laboratory facilities. This trend is particularly evident in emerging economies, where the establishment of new institutions is on the rise. The need for modern laboratory equipment to facilitate hands-on learning and research is paramount. Consequently, The Global Laboratory Equipment Industry is poised for growth as educational institutions seek to equip their laboratories with state-of-the-art tools that foster innovation and scientific inquiry.