Diverse Flavor Profiles

The Kid Snack Market is witnessing a notable shift towards diverse and innovative flavor profiles. Children are becoming more adventurous in their taste preferences, prompting manufacturers to experiment with unique flavors that go beyond traditional offerings. This trend is reflected in the increasing popularity of snacks infused with exotic ingredients and bold flavors. Market data indicates that snacks featuring flavors such as spicy, tangy, and even savory are gaining traction among young consumers. This diversification not only enhances the appeal of snacks but also encourages children to explore new tastes, thereby contributing to the dynamic evolution of the Kid Snack Market.

Health and Wellness Trends

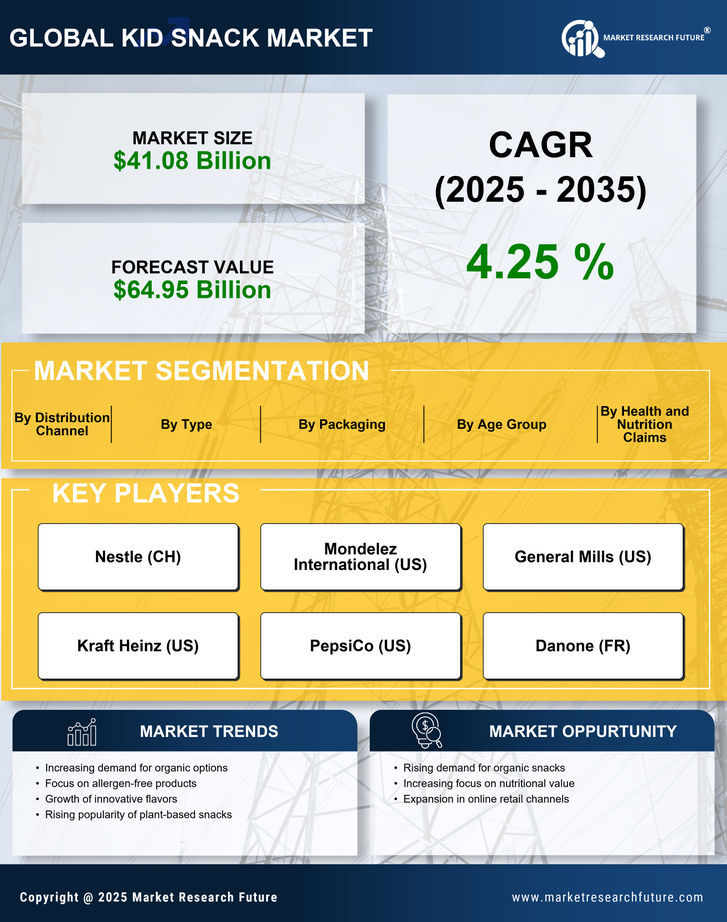

The Kid Snack Market is increasingly influenced by the rising health and wellness trends among parents. As awareness of nutrition grows, parents are more inclined to seek snacks that are not only tasty but also nutritious. This shift has led to a surge in demand for snacks that are low in sugar, high in fiber, and enriched with vitamins and minerals. According to recent data, the market for healthy snacks for children is projected to grow at a compound annual growth rate of approximately 5.5% over the next five years. This trend indicates that manufacturers are likely to innovate and reformulate existing products to meet these health-conscious demands, thereby reshaping the Kid Snack Market.

Convenience and On-the-Go Options

In the fast-paced lifestyles of modern families, convenience plays a pivotal role in the Kid Snack Market. Parents are increasingly looking for snacks that are easy to pack and consume, particularly for busy days filled with activities. This demand has led to the proliferation of single-serve packaging and portable snack options. Data suggests that the market for on-the-go snacks is expanding, with a notable increase in sales of pre-packaged snacks that require minimal preparation. This trend not only caters to the needs of parents but also aligns with children's preferences for fun and accessible snack options, thereby driving growth in the Kid Snack Market.

Digital Engagement and E-Commerce Growth

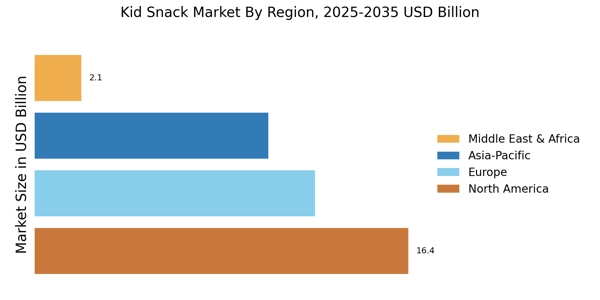

The rise of digital engagement is significantly impacting the Kid Snack Market. With the increasing use of smartphones and online platforms, parents are turning to e-commerce for their shopping needs, including snacks for their children. This trend has led to a surge in online sales, with many brands enhancing their digital presence to reach consumers effectively. Market data indicates that e-commerce sales in the snack sector are expected to grow substantially, driven by convenience and the ability to access a wider variety of products. This shift not only changes how snacks are marketed but also influences purchasing behaviors, thereby transforming the landscape of the Kid Snack Market.

Sustainability and Eco-Friendly Packaging

Sustainability is becoming a crucial consideration in the Kid Snack Market, as both parents and children express growing concern for the environment. Manufacturers are increasingly adopting eco-friendly practices, including the use of biodegradable packaging and sustainable sourcing of ingredients. This shift is not merely a trend but appears to be a response to consumer demand for products that align with their values. Data suggests that brands that prioritize sustainability are likely to capture a larger share of the market, as environmentally conscious parents seek out snacks that reflect their commitment to a healthier planet. This focus on sustainability is reshaping the Kid Snack Market.