Ketones Size

Ketones Market Growth Projections and Opportunities

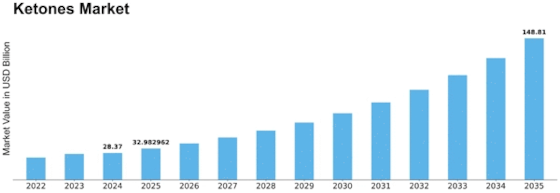

Ketones Market Size was valued at USD 23.5 billion in 2022. The ketones market is projected to grow from USD 24.4 billion in 2023 to USD 32.9 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 16.26%

The ketones market, which is subject to fluctuation due to various factors affecting the health and wellness industry generally, thrives on market factors that directly shape its direction and speed of growth: an example of these factors include keto-diet awareness as one of the key drivers that push the ketones further into the marketplace; with this concern about personal care on health and fitness, many people are adopting ketogenic diets for purposes controlling weight gain, enhancing mental focus and being more energized in life generally; resulting in high demand for ketogenic products that force companies to expand their portfolios in order to meet diverse consumer needs.

In addition, growing cases of lifestyle related diseases such as obesity and diabetes has further served as leverage for ketones. This is because scientific evidence exists pointing out that ketones could have positive effects towards metabolic health alongside insulin sensitivity thus making it attractive to the market.While others are looking for products that will help them achieve their fitness goals through healthy eating habits especially given the prevalence of chronic diseases like obesity and diabetes in some areas.Moreover,this trend predominantly affects regions experiencing increased incidence rates of lifestyle-related illnesses thereby spurring growth within the corresponding field known as ketone business.

Furthermore, research advancement you are making notable progress toward conducting a study aimed at exploring potential health benefits regarding ketone properties on certain conditions related with human medical.This has led into positive results from such studies which build confidence among consumers and therefore induces higher demand particularly towards keto based goods.There are also advancements concerning production processes and formulation techniques which have made supplements containing exogenous ketones better quality hence improving their yield levels.

Further, the ketones market is heavily influenced by regulations. The marketing and selling of ketone supplements is affected by strict guidelines that relate to it. Manufacturers therefore have to comply with these restrictive policies in order for them to gain customers’ trust. However, health authorities approvals and endorsements can spur rapid market expansion as they assure the public about the safety and efficacy of ketone products when consumed.

In addition, the competitive landscape among key market players shapes the trajectory of the ketones market. This includes new entries into the markets as well as strategic partnerships between different firms or aggressive marketing campaigns being launched in said industry. In many cases, big companies also invest in research and development (R& D) activities so as to be ahead of their rivals causing innovation and diversification within this sector.

Leave a Comment