Rising Cyber Threats

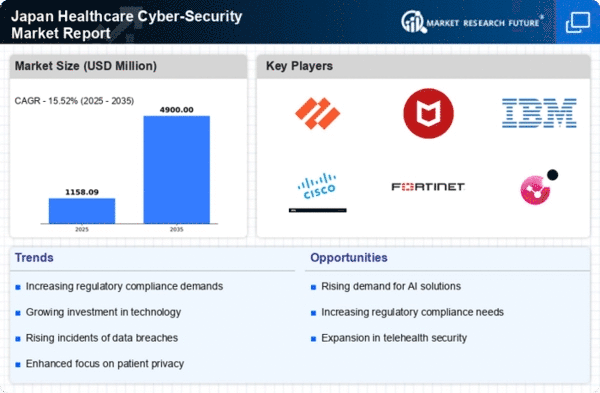

The The healthcare cyber-security market in Japan is experiencing heightened demand. in Japan is experiencing heightened demand due to the increasing frequency and sophistication of cyber threats. Recent reports indicate that healthcare organizations are prime targets for cybercriminals, with ransomware attacks rising by over 30% in the last year alone. This alarming trend compels healthcare providers to invest significantly in robust cyber-security measures. The potential financial losses from data breaches, which can exceed $3 million per incident, further underscore the urgency for enhanced security protocols. As a result, the healthcare cyber-security market is likely to see substantial growth as organizations prioritize safeguarding sensitive patient data and maintaining operational integrity.

Integration of IoT Devices

The integration of Internet of Things (IoT) devices in healthcare settings is transforming patient care but also poses new security challenges. The The integration of Internet of Things (IoT) devices in healthcare settings is transforming patient care. is responding to the vulnerabilities associated with connected medical devices, which can be exploited by cybercriminals. As the number of IoT devices in healthcare is projected to reach 50 million by 2026, the need for robust security measures becomes increasingly critical. Organizations are compelled to invest in specialized cyber-security solutions to safeguard these devices and the data they transmit. This trend indicates a growing market for healthcare cyber-security solutions tailored to protect IoT ecosystems.

Growing Patient Data Volume

The exponential increase in patient data generated by healthcare providers in Japan is a significant driver for the The exponential increase in patient data generated by healthcare providers is a significant driver.. As electronic health records (EHRs) and telemedicine services become more prevalent, the volume of sensitive information requiring protection continues to rise. Reports suggest that the amount of healthcare data is expected to grow by 36% annually, creating a pressing need for effective cyber-security measures. This surge in data necessitates advanced security technologies to prevent unauthorized access and data breaches. Therefore, the healthcare cyber-security market is poised for growth as organizations seek to implement comprehensive solutions to protect vast amounts of patient information.

Government Initiatives and Funding

The Japanese government is actively promoting initiatives aimed at strengthening the The Japanese government is actively promoting initiatives aimed at strengthening cyber-security.. With the increasing recognition of cyber threats, government funding for cyber-security infrastructure has surged, with allocations reaching approximately ¥10 billion in the last fiscal year. These initiatives not only provide financial support but also establish frameworks for best practices in cyber-security. The collaboration between public and private sectors is expected to enhance the overall resilience of healthcare systems against cyber threats. Consequently, this government backing is likely to stimulate growth in the healthcare cyber-security market, encouraging more organizations to adopt advanced security solutions.

Increased Awareness of Cyber Risks

There is a growing awareness among healthcare organizations in Japan regarding the risks associated with cyber threats. This heightened consciousness is driving investments in the There is a growing awareness among healthcare organizations in Japan regarding the risks. as organizations recognize the potential repercussions of data breaches, including reputational damage and regulatory penalties. Surveys indicate that over 70% of healthcare executives now prioritize cyber-security as a critical component of their operational strategy. This shift in mindset is likely to lead to increased spending on cyber-security solutions, as organizations seek to mitigate risks and ensure compliance with evolving regulations. Consequently, the healthcare cyber-security market is expected to expand as awareness translates into action.