Top Industry Leaders in the Japan 6G Market

Competitive Landscape of Japan's 6G Market: Striving for Supremacy in Hyperconnectivity

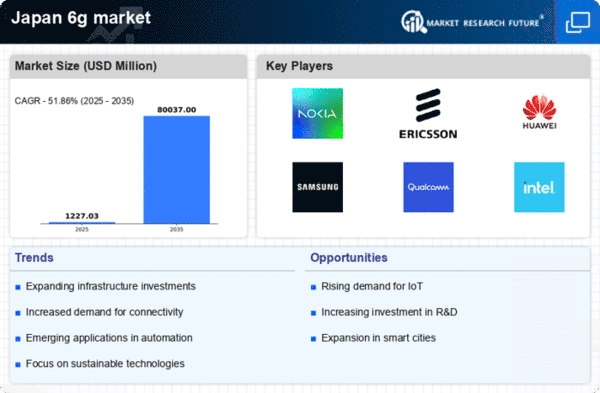

While 5G still finds its footing, Japan's vision for the future lies in the promise of 6G. This nascent market holds immense potential, estimated to reach a multi-billion dollar valuation by 2032, and the race for a slice of this pie is already heating up. Understanding the key players, their strategies, and the evolving dynamics is crucial for anyone wanting to participate in this technological leap.

Key Players:

-

Reliance Industries Limited

-

Keysight Technologies

-

Samsung Electronics Co., Ltd.

-

Nokia Corporation

-

Apple Inc.

-

China Unicom (Hong Kong) Limited

-

AT&T Intellectual Property

-

MediaTek Inc.

-

SK Telecom Co., Ltd.

-

Nippon Telegraph and Telephone Corporation

-

Telefonaktiebolaget LM Ericsson

-

Verizon

-

Huawei Technologies Co., Ltd.

-

Intel Corporation

-

ZTE Corporation

-

T?Mobile USA, Inc.

-

Resonac Holdings Corporation

-

Solvay

-

DuPont

-

DAIKIN INDUSTRIES, Ltd.

Factors for Market Share Analysis:

-

Technological Expertise: Having a strong presence in R&D, possessing intellectual property, and contributing to 6G standardization will be crucial for success.

-

Infrastructure Readiness: Early deployment of pilot networks and 6G-compatible equipment will give companies a head start in attracting customers.

-

Ecosystem Partnerships: Building a robust ecosystem of device manufacturers, application developers, and system integrators will be key to offering comprehensive solutions.

New and Emerging Companies:

-

Startups: Companies like Aerial Communications and Terra Drone are innovating in areas like drone-based communication and holographic networking, paving the way for novel 6G applications.

-

Universities and Research Institutes: Tokyo University of Science and the National Institute of Information and Communications Technology are actively involved in research, potentially spinning off impactful ventures in the future.

Current Investment Trends:

-

Focus on Terahertz Technology: This high-frequency spectrum promises ultra-fast data speeds and is attracting significant investments from players like NTT DoCoMo and NEC.

-

Cybersecurity and Data Privacy: With increased connectivity comes heightened security concerns. Companies are investing in technologies like quantum cryptography and blockchain to ensure a secure 6G future.

-

AI and Machine Learning Integration: Intelligence at the network edge is crucial for efficient data processing and personalized applications. 6G players are actively integrating AI and ML into their solutions.

Latest Company Updates:

-

October 26, 2023: Japan's Ministry of Internal Affairs and Communications (MIC) announced a new initiative called "Beyond 5G/6G Project." This project aims to accelerate the research and development of 6G technologies with a focus on areas like high-speed communication, terahertz waves, and AI integration.

-

December 5, 2023: NTT Docomo, Japan's largest mobile operator, successfully conducted a world-first test of 6G terahertz waves in an outdoor environment, achieving a data transmission speed of 100 Gbps over a distance of 100 meters.

-

January 18, 2024: The University of Tokyo and Rakuten Mobile announced a joint research project to develop next-generation network technologies for 6G, including AI-powered network optimization and intelligent edge computing.