Rising Incidence of Cancer

The increasing incidence of cancer in Italy is a primary driver for the circulating tumor-cell market. According to recent statistics, cancer cases in Italy have been on the rise, with estimates suggesting that approximately 3.5 million individuals are living with cancer. This growing patient population necessitates advanced diagnostic and monitoring solutions, such as those offered by the circulating tumor-cell market. As healthcare providers seek to improve patient outcomes, the demand for innovative technologies that can detect and monitor cancer progression is likely to increase. This trend is expected to propel the market forward, as more healthcare facilities adopt circulating tumor-cell technologies to enhance their cancer management strategies.

Supportive Regulatory Framework

A supportive regulatory framework in Italy is fostering growth in the circulating tumor-cell market. Regulatory bodies are increasingly recognizing the importance of innovative diagnostic tools in cancer care, leading to streamlined approval processes for new technologies. This environment encourages companies to invest in the development of circulating tumor-cell solutions, as they can navigate the regulatory landscape more efficiently. The presence of clear guidelines and supportive policies is likely to enhance market entry for new products, thereby expanding the range of available options for healthcare providers. As a result, the circulating tumor-cell market is poised for growth, driven by the favorable regulatory climate.

Growing Awareness of Early Detection

There is a growing awareness among the Italian population regarding the importance of early cancer detection, which is positively impacting the circulating tumor-cell market. Educational campaigns and initiatives by healthcare organizations have emphasized the benefits of early diagnosis in improving treatment outcomes. As a result, patients are increasingly seeking advanced diagnostic options, including those provided by the circulating tumor-cell market. This heightened awareness is likely to lead to increased adoption of circulating tumor-cell technologies in clinical settings, as healthcare providers aim to meet the rising demand for effective cancer screening and monitoring solutions.

Investment in Research and Development

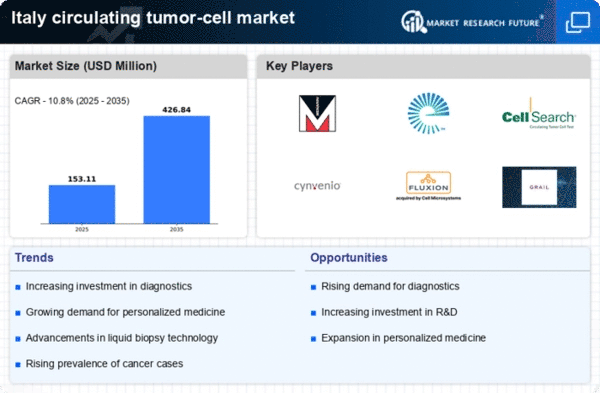

Investment in research and development (R&D) within the healthcare sector is significantly influencing the circulating tumor-cell market. In Italy, public and private funding for cancer research has seen a notable increase, with the government allocating substantial resources to support innovative cancer therapies and diagnostics. This financial backing fosters the development of advanced circulating tumor-cell technologies, which are crucial for early detection and personalized treatment approaches. As R&D efforts continue to expand, the market is likely to benefit from the introduction of novel products and solutions that enhance the accuracy and efficiency of cancer diagnostics, thereby driving growth in the circulating tumor-cell market.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is a significant driver for the circulating tumor-cell market. This integration is transforming the way cancer care is delivered. In Italy, the adoption of digital health solutions, such as telemedicine and electronic health records, is transforming the way cancer care is delivered. This technological shift facilitates the incorporation of circulating tumor-cell testing into routine clinical practice, enabling healthcare providers to offer more comprehensive cancer management. As hospitals and clinics increasingly embrace these innovations, the demand for circulating tumor-cell technologies is expected to rise, further propelling market growth. The synergy between technology and healthcare is likely to enhance patient outcomes and streamline cancer treatment processes.