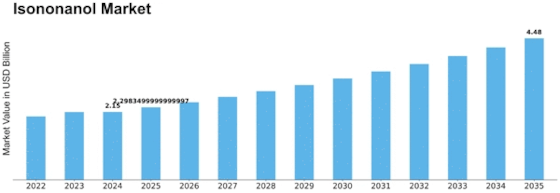

Isononanol Size

Isononanol Market Growth Projections and Opportunities

Many market factors affect the isononanol market. An important chemical intermediary, isononanol, is used to make plasticizers. Isononanol demand rises as these sectors expand globally. The construction and automotive industries, which use plasticizers, are growing, driving Isononanol demand.

Regulatory factors shape the Isononanol market. Environmentally friendly Isononanol-based plasticizers have replaced phthalate-based ones due to strict regulations. Isononanol is becoming a popular plasticizer raw ingredient as regulatory organizations globally ban the usage of hazardous compounds.

The Isononanol market is also affected by global energy and crude oil prices. The oxo-alcohol process, essential to the petrochemical sector, produces isononanol. Crude oil price fluctuations effect production costs and Isononanol pricing. To stay competitive and maintain a stable supply chain, market actors actively monitor and adapt to energy market developments.

Technological advances and industrial breakthroughs affect Isononanol's market. Isononanol quality, production efficiency, and environmental effect are constantly improved through research and development. Manufacturers' competitiveness depends on their capacity to adopt and execute these technical advances.

Global economic and trade policies affect the isononanol market. Trade disputes, tariff laws, and economic stability affect the worldwide supply chain, affecting Isononanol availability and pricing. Market players must negotiate these macroeconomic dynamics to stay competitive.

Consumer and business environmental and sustainability concerns affect market dynamics. Industries are exploring bio-based Isononanol as sustainable practices and eco-friendly products become more popular. As environmentally conscious consumers demand eco-friendly chemical solutions, manufacturers that link their production methods with sustainability goals may gain a competitive edge.

Isononanol market dynamics are also affected by competition and consolidation. Key player mergers, acquisitions, and strategic partnerships are traditional ways to boost market presence and competitiveness. Companies must build robust distribution networks and serve varied end-use sectors to succeed in the market.

Leave a Comment