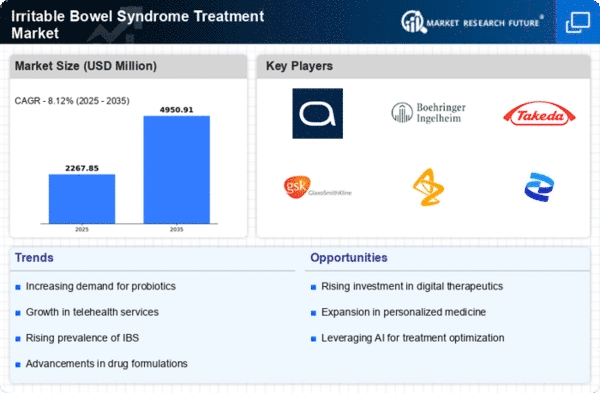

Top Industry Leaders in the Irritable Bowel Syndrome Treatment Market

Irritable Bowel Syndrome Treatment Key Companies" width="600" height="300">Disclaimer: List of key companies in no particular orderLatest Irritable Bowel Syndrome Companies Update

Irritable Bowel Syndrome Treatment Key Companies" width="600" height="300">Disclaimer: List of key companies in no particular orderLatest Irritable Bowel Syndrome Companies Update

-

October 2023: The U.S. subsidiary of Teva Pharmaceutical Industries Ltd., Teva Pharmaceuticals, and Sanofi announced a partnership to co-develop and co-commercialize asset TEV’574, which is presently undergoing Phase 2b clinical trials for the treatment of Crohn’s disease and ulcerative colitis, two forms of inflammatory bowel disease. Sanofi will spearhead the development of the Phase 3 program, and all companies will equally split the development expenses worldwide as well as net earnings and losses in important countries. Other markets will be subject to a royalty agreement. Teva will spearhead product commercialization in Europe, Israel, and a few other countries; Sanofi will handle North American, Japanese, other Asian, and global commercialization.

-

June 2023: The U.S. FDA authorized LINZESS® (linaclotide) as a once-daily therapy for children’s patients with functional constipation ages 6-17. This announcement was made by Ironwood Pharmaceuticals, Inc., a GI-focused healthcare firm. For this patient population, LINZESS is the first and only FDA-approved prescription medication for functional constipation. Our supplementary New Drug Application (sNDA) was given a 6-month priority review by the FDA early this year, which is four months ahead of the regular review schedule. In the US, AbbVie and Ironwood Pharmaceuticals are responsible for the development and marketing of LINZESS. Linacetide demonstrated a statistically significant and clinically relevant improvement in the primary endpoint of 12-week spontaneous bowel movement (SBM) frequency rate (SBMs/week) as compared to placebo in this crucial trial. Building on the class-leading formulary coverage currently in place for the brand, LINZESS 72mcg is now accessible for the treatment of functional constipation in pediatric patients aged 6 to 17 years old, based on FDA clearance.

List of Irritable Bowel Syndrome Key companies in the market

-

Valeant Pharmaceuticals International

-

Allergan Inc

-

Astellas Pharma

-

Lexicon Pharmaceuticals

-

Nestle Health Science

-

Synergy Pharmaceuticals Inc

-

Ironwood Pharmaceuticals

-

Ardelyx

-

Mallinckrodt

-

Abbott