Advancements in 5G Technology

The rollout of 5G technology is significantly impacting the IP Multimedia Subsystem Market. With its promise of higher speeds, lower latency, and enhanced connectivity, 5G is expected to facilitate the deployment of advanced multimedia services. This technology enables richer user experiences, such as high-definition video conferencing and real-time collaboration tools. As 5G networks become more widespread, the demand for IP Multimedia Subsystem Market solutions that can leverage these capabilities is anticipated to increase. Analysts suggest that the integration of 5G with IP Multimedia Subsystem Market technologies could lead to a substantial increase in service adoption rates, potentially doubling the market size by 2030.

Emergence of Remote Work Culture

The rise of remote work culture is reshaping the IP Multimedia Subsystem Market. As organizations adapt to flexible work arrangements, the demand for reliable communication tools has surged. Employees require access to multimedia services that facilitate collaboration, regardless of their location. This shift has led to increased investments in IP Multimedia Subsystem Market technologies that support remote communication, such as video conferencing and virtual collaboration platforms. Market analysts indicate that this trend is likely to persist, with remote work becoming a permanent fixture in many industries, thereby sustaining the demand for innovative multimedia communication solutions.

Increased Focus on Security and Compliance

As organizations become more reliant on digital communication, the emphasis on security and compliance within the IP Multimedia Subsystem Market is intensifying. Businesses are increasingly aware of the risks associated with data breaches and are seeking solutions that offer enhanced security features. Regulatory requirements, such as GDPR and HIPAA, are driving the demand for secure communication systems. Companies are investing in IP Multimedia Subsystem Market technologies that provide encryption, authentication, and secure access controls. This focus on security is expected to shape the market landscape, as organizations prioritize solutions that not only enhance communication but also protect sensitive information.

Growing Adoption of Internet of Things (IoT)

The proliferation of Internet of Things (IoT) devices is emerging as a significant driver for the IP Multimedia Subsystem Market. As more devices become interconnected, the need for robust communication frameworks that can support multimedia services is becoming increasingly apparent. IoT applications, ranging from smart homes to industrial automation, require reliable and efficient communication protocols. The market for IoT is expected to reach trillions of dollars in the coming years, which will likely create substantial opportunities for IP Multimedia Subsystem Market solutions. This trend indicates a shift towards more integrated communication systems that can handle diverse multimedia traffic.

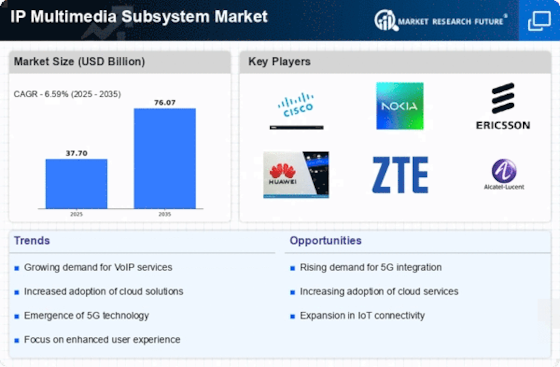

Rising Demand for Unified Communication Solutions

The increasing need for unified communication solutions is a primary driver in the IP Multimedia Subsystem Market. Organizations are seeking to integrate various communication channels, such as voice, video, and messaging, into a single platform. This trend is fueled by the desire for improved collaboration and productivity among employees. According to recent data, the market for unified communication is projected to grow at a compound annual growth rate of approximately 15% over the next five years. As businesses recognize the value of seamless communication, investments in IP Multimedia Subsystem Market technologies are likely to rise, further propelling the market forward.