Rising Vehicle Ownership

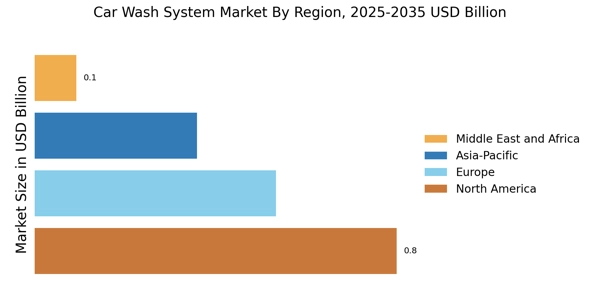

The Car Wash System Market is experiencing growth due to the rising vehicle ownership rates across various regions. As more individuals acquire vehicles, the demand for car maintenance services, including washing, is likely to increase. This trend is particularly evident in urban areas, where convenience and time-saving services are prioritized. Market data suggests that the number of registered vehicles is projected to rise by approximately 5% annually, leading to a corresponding increase in the need for efficient car wash systems. Consequently, businesses are investing in advanced car wash technologies to cater to this growing customer base, thereby enhancing their service offerings and operational capabilities.

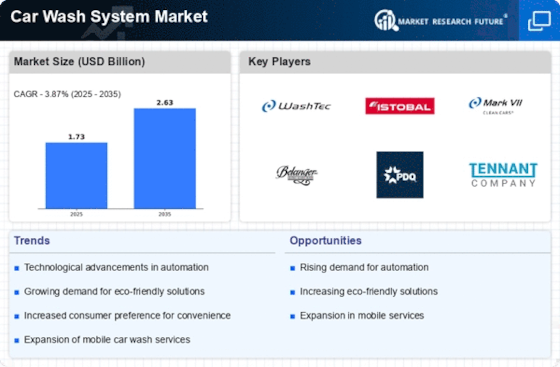

Environmental Regulations

The Car Wash System Market is increasingly influenced by stringent environmental regulations aimed at reducing water usage and chemical runoff. Governments are implementing policies that encourage the adoption of eco-friendly car wash systems, which utilize less water and biodegradable cleaning agents. This regulatory landscape is driving innovation within the industry, as companies seek to comply with these standards while maintaining operational efficiency. As a result, the market is witnessing a shift towards waterless and water-efficient car wash technologies. The demand for sustainable practices is expected to grow, with projections indicating that eco-friendly car wash systems could capture a significant share of the market by 2026, reflecting a broader trend towards sustainability in consumer services.

Technological Innovations

Technological innovations are a key driver in the Car Wash System Market, as advancements in automation and digital solutions transform traditional car wash operations. The integration of smart technologies, such as automated payment systems and mobile applications, enhances customer experience and operational efficiency. Moreover, the introduction of advanced washing equipment, which utilizes less water and energy, is becoming increasingly popular. Market analysis indicates that the adoption of such technologies could lead to a reduction in operational costs by up to 20%, making businesses more competitive. As technology continues to evolve, the industry is likely to see further enhancements in service delivery and customer engagement.

Expansion of Franchise Models

The Car Wash System Market is witnessing a notable expansion of franchise models, which are becoming a popular business strategy for new entrants. Franchising allows for rapid market penetration and brand recognition, enabling operators to leverage established business models and support systems. This trend is particularly advantageous in regions with high vehicle ownership and a growing demand for car wash services. Data suggests that franchise-operated car washes are projected to account for over 30% of the market share by 2026, driven by the appeal of brand consistency and operational support. As more entrepreneurs enter the market through franchising, the competitive landscape is likely to evolve, fostering innovation and service diversification.

Consumer Demand for Convenience

The Car Wash System Market is significantly shaped by consumer demand for convenience and time efficiency. Modern consumers are increasingly seeking quick and hassle-free car wash solutions that fit into their busy lifestyles. This trend has led to the rise of express car wash services and mobile car wash units, which cater to the need for on-the-go services. Market Research Future indicates that express car wash services are expected to grow at a rate of 7% annually, reflecting a shift in consumer preferences towards faster service options. Businesses that adapt to these changing demands by offering convenient solutions are likely to gain a competitive edge in the market.