- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

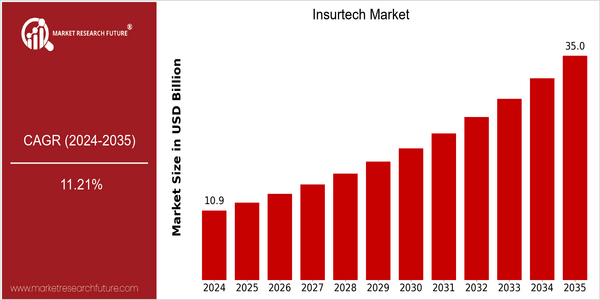

| Year | Value |

|---|---|

| 2024 | USD 10.88 Billion |

| 2035 | USD 35.0 Billion |

| CAGR (2025-2035) | 11.21 % |

Note – Market size depicts the revenue generated over the financial year

The market for InsurTech is expected to reach $34 billion by 2035. This growth rate, which is a compound annual growth rate (CAGR) of 11.21%, reflects a strong demand for new insurance solutions. Artificial intelligence, big data, and the blockchain are driving this growth, as insurance companies seek to improve customer service, optimize operations, and improve risk assessment. Leading InsurTech companies such as Lemonade, Root Insurance, and MetroMile are transforming the insurance industry with their business models and strategic initiatives. Lemonade’s use of artificial intelligence for underwriting and claims processing is an example of the way that technology is disrupting the insurance industry. InsurTechs are also increasingly collaborating with traditional insurance companies, enabling them to adopt new technology while maintaining their market presence. These trends are expected to continue to drive growth in the InsurTech industry.

Regional Market Size

Regional Deep Dive

The insurtech market is undergoing significant transformation in various regions, driven by technological developments, changing consumer expectations and evolving regulatory landscapes. In North America, the market is characterised by high investment in digital solutions and a strong presence of established insurance companies collaborating with insurtechs. In Europe, the regulatory framework varies between countries, which influences innovation. In Asia-Pacific, the rapid growth of the mobile and digital penetration is accelerating the adoption of insurtech solutions. The Middle East and Africa region is seeing an increasing number of insurtechs, driven by the growing demand for insurance. Latin America is emerging as a promising market, focusing on financial inclusion and digital transformation of the insurance sector.

Europe

- The European Union's InsurTech Regulation is set to standardize practices across member states, promoting innovation while ensuring consumer protection and market stability.

- Notable developments include the partnership between Allianz and the insurtech startup, Wefox, which aims to streamline the insurance purchasing process through advanced technology.

Asia Pacific

- The region is witnessing a boom in microinsurance products, with companies like PolicyBazaar in India offering affordable insurance solutions tailored to low-income consumers.

- Government initiatives, such as Singapore's Financial Services Regulatory Authority's support for fintech and insurtech innovation, are creating a conducive environment for startups to thrive.

Latin America

- The growth of digital payment systems in Latin America is facilitating the rise of insurtech companies like Clara, which offers insurance solutions tailored to the needs of small businesses.

- Regulatory changes in countries like Brazil are promoting the entry of new players into the insurance market, fostering competition and innovation.

North America

- The rise of embedded insurance solutions is reshaping the market, with companies like Lemonade and Metromile leading the charge in integrating insurance into everyday transactions.

- Regulatory changes, such as the introduction of the Insurance Data Security Model Law by the National Association of Insurance Commissioners (NAIC), are enhancing data protection and cybersecurity measures, fostering consumer trust.

Middle East And Africa

- The emergence of digital insurance platforms like YAPILI in Kenya is addressing the insurance gap by providing accessible and affordable insurance products to underserved populations.

- Regulatory bodies in countries like South Africa are increasingly adopting sandbox models to encourage innovation in the insurtech space, allowing startups to test their solutions in a controlled environment.

Did You Know?

“In 2022, insurtech investments reached a record high of over $15 billion globally, highlighting the growing interest in technology-driven insurance solutions.” — Insurtech Global Investment Report 2022

Segmental Market Size

The InsurTech market is growing rapidly, as digital solutions for the insurance industry become increasingly important. In this market, the development is driven by a number of factors, including changing customer expectations, regulatory changes, and advances in data analysis and artificial intelligence. These factors are changing the way insurance products are developed, marketed and distributed, making the sector more responsive to the customer. In the United States, Lemonade and Root Insurance are leading the way. Europe and Asia-Pacific are also experiencing rapid growth. The European InsurTech Hub is promoting innovation. There are a number of different applications, such as claims automation, bespoke insurance offers and risk assessment using data. A pandemic like COVID-like COV19 has made digital platforms even more important. Insurers are being forced to go green by the current demands for greater sustainability. The blockchain and machine learning are key to greater transparency and efficiency in the sector.

Future Outlook

The insurtech market is expected to grow at a CAGR of 11.21% from 2024 to 2035. The growth will be based on the increased use of digital technology, such as artificial intelligence, machine learning, and blockchain, which will revolutionize the underwriting process, the management of claims, and the customer relationship. The expected improvements in operational efficiency and customer satisfaction will increase the penetration of the market. By 2035, it is estimated that more than 60% of insurance transactions will be digital, greatly increasing the convenience and access to consumers. Regulators will encourage innovation and competition. There will be a growing demand for bespoke insurance solutions. The emergence of on-demand insurance products and usage-based insurance will reshape the insurance industry and meet the changing needs of digital consumers. Moreover, the growing frequency of natural disasters and cyber risks will lead to a need for more comprehensive and flexible insurance solutions. The most successful companies will be those that can be agile and customer-focused, and they will be able to take market share and achieve sustainable growth in this dynamic industry.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 5.6 Billion |

| Market Size Value In 2023 | USD 8.6 Billion |

| Growth Rate | 53.50% (2023-2032) |

Insurtech Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.