Insulin Syringes Size

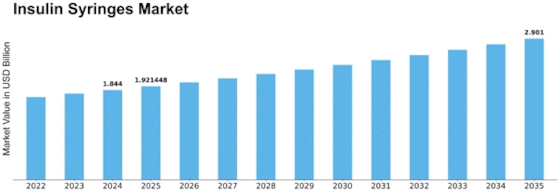

Insulin Syringes Market Growth Projections and Opportunities

The Pharmaceutical Insulin Syringes Market is not complete without it, as the market serves individuals with diabetes that require insulin. This growth is due to advancements in insulin delivery technology and an increasing number of diabetics worldwide. Managing diabetes requires pharmaceutical syringes for administering insulin accurately and safely.

One major factor contributing to the development of the Pharmaceutical Insulin Syringes Market is a rise in diabetes instances across the globe. Consequently, the bulging population of diabetic patients has led to increased demand for insulin devices such as syringes. This implies that diabetic persons can opt for pharmaceutical insulin syringes so as to self-administer them, thus enhancing glycemic control and proper control over diseases.

Pharmaceutical Insulin Syringes Market addresses different needs among diabetic populations through availability of various specifications and feature-rich syringe options. These companies are investing on ultra-thin needles, ergonomic designs and user-friendly features so that patient’s comfort improves as well as adherence. Their objective is thus met when they keep making better improvements in technology aimed at making administration more convenient so that fear among the patient reduces.

Pharmaceutical Insulin Syringe markets have grown in many geographical areas including North America, Europe, Asia Pacific etcetera. These regions have high incidents of diabetes; therefore, they have established health facilities related to diabetics control measures hence advanced care strategies towards this disease. On the other hand, there is rapid urbanization increasing prevalence rates of Diabetes Mellitus (DM) besides gaining self-awareness about DM treatment process leading to significant rise within Asia-Pacific.

A popular trend within this market involves switch from vial-and-syringe methods towards prefilled insulin injection syringe systems. These offer convenience, accuracy and safety against possible overdose or underdose thus becoming preferable over others by both patients and doctors alike who consider them effective tools for managing diabetes mellitus. Therefore, such changes have been witnessed which include shifting from vials and syringes for prefilled insulin syringes which are designed in such a way that; they make the administration of insulin injections easier and also promote patients’ adherence to their daily doses of insulin.

Competition among manufacturers of pharmaceutical insulin syringes is evidenced by numerous players involved. They concentrate on research and development so as to come up with new designs and include features that are able to meet changing customer needs. In addition, these people have partnered with health providers as well as diabetes educators who have been instrumental in teaching these patients about new technologies used in delivering insulin.

Leave a Comment