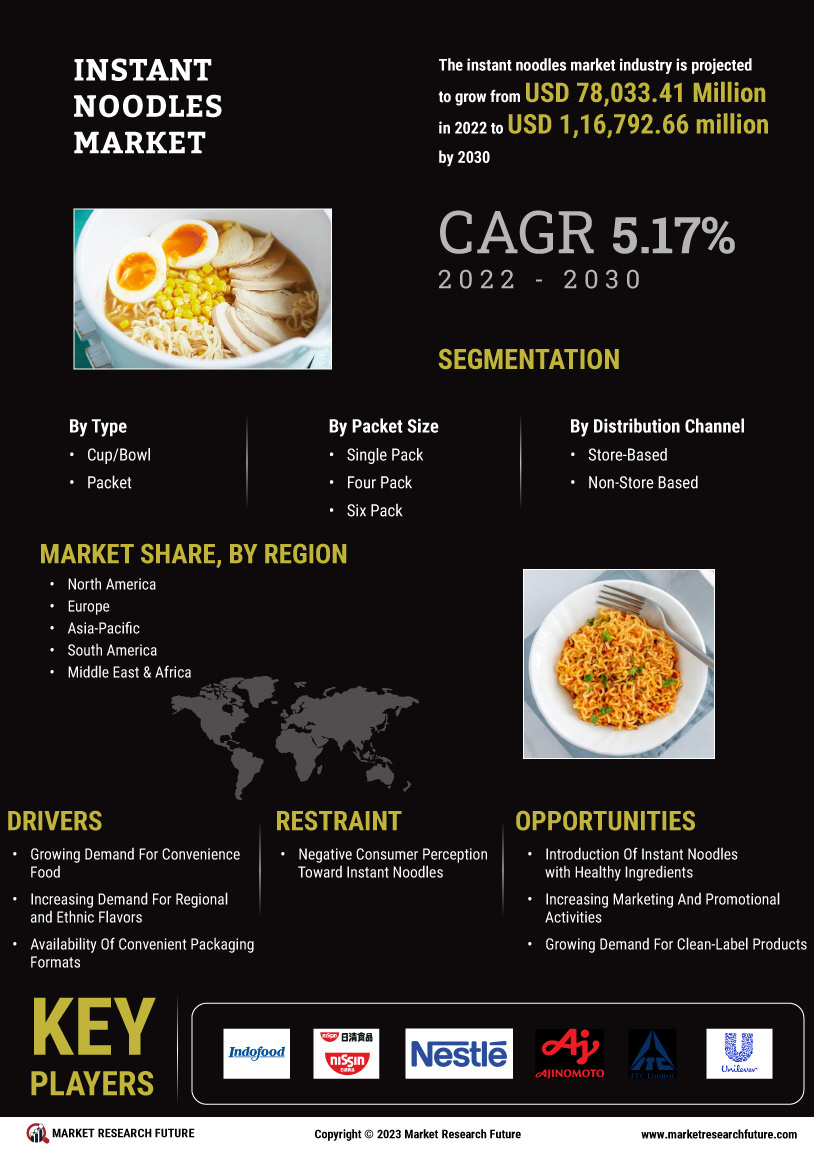

Rising Snack Culture

The rising snack culture significantly influences the Instant Noodles Market, as consumers increasingly view instant noodles as a convenient snack rather than just a meal. This shift in perception has led to the development of smaller, snack-sized packaging that caters to on-the-go consumption. Market Research Future suggests that the snacking trend is particularly popular among younger demographics, who often seek quick and portable food options. As instant noodles are versatile and can be consumed at any time of the day, this trend is expected to bolster the Instant Noodles Market, encouraging manufacturers to innovate and market their products as suitable for snacking.

Health and Wellness Trends

Health and wellness trends are becoming increasingly relevant in the Instant Noodles Market, as consumers become more conscious of their dietary choices. There is a growing demand for healthier instant noodle options, including those that are low in sodium, fortified with vitamins, or made from whole grains. This shift is prompting manufacturers to reformulate their products to align with health-conscious consumer preferences. Market data indicates that the segment of health-oriented instant noodles is expanding, reflecting a broader trend towards nutritious convenience foods. The Instant Noodles Market is likely to continue evolving as brands respond to these health trends, offering products that cater to the needs of health-aware consumers.

Flavor Innovation and Variety

Flavor innovation is a key driver in the Instant Noodles Market, as manufacturers continuously seek to attract consumers with diverse and exciting options. The introduction of unique flavors and regional specialties has become a strategy to differentiate products in a competitive landscape. Recent trends show that consumers are increasingly adventurous in their culinary choices, leading to a demand for gourmet and ethnic flavors in instant noodles. This innovation not only caters to traditional tastes but also introduces new experiences for consumers. The Instant Noodles Market is likely to see sustained growth as brands expand their flavor profiles to meet evolving consumer preferences.

Convenience and Time Efficiency

The Instant Noodles Market thrives on the growing demand for convenience and time efficiency among consumers. As lifestyles become increasingly fast-paced, individuals seek quick meal solutions that require minimal preparation. Instant noodles offer a ready-to-eat option that can be prepared in mere minutes, appealing to busy professionals, students, and families alike. This trend is particularly pronounced in urban areas, where time constraints are more prevalent. According to recent data, the instant noodles segment has seen a steady increase in sales, with a notable rise in single-serve packaging. This convenience factor is likely to continue driving growth in the Instant Noodles Market, as consumers prioritize speed and ease in their meal choices.

Affordability and Economic Factors

Affordability plays a crucial role in the Instant Noodles Market, particularly in regions where economic conditions may limit consumer spending. Instant noodles are often perceived as a cost-effective meal option, providing a filling and satisfying choice at a low price point. This affordability appeals to a wide demographic, including students and low-income families. Market data indicates that during economic downturns, sales of instant noodles tend to increase as consumers seek budget-friendly alternatives. The Instant Noodles Market is likely to benefit from this trend, as economic fluctuations may lead consumers to prioritize value for money in their food purchases.